The Ultimate Health Management Services has said it is working to ensure that the over 190 million Nigerians who lack access to a health insurance scheme are brought on board.

Specifically, the health maintenance organisation said it was working with regulatory agencies to define the clusters available both in the formal and informal sectors of the nation to bring everyone on board.

This comes as there are concerns that 26 years after the establishment of health insurance in Nigeria, not more than 10 million Nigerians have any form of health insurance. Recent data showed that over 190 million Nigerians do not have health insurance.

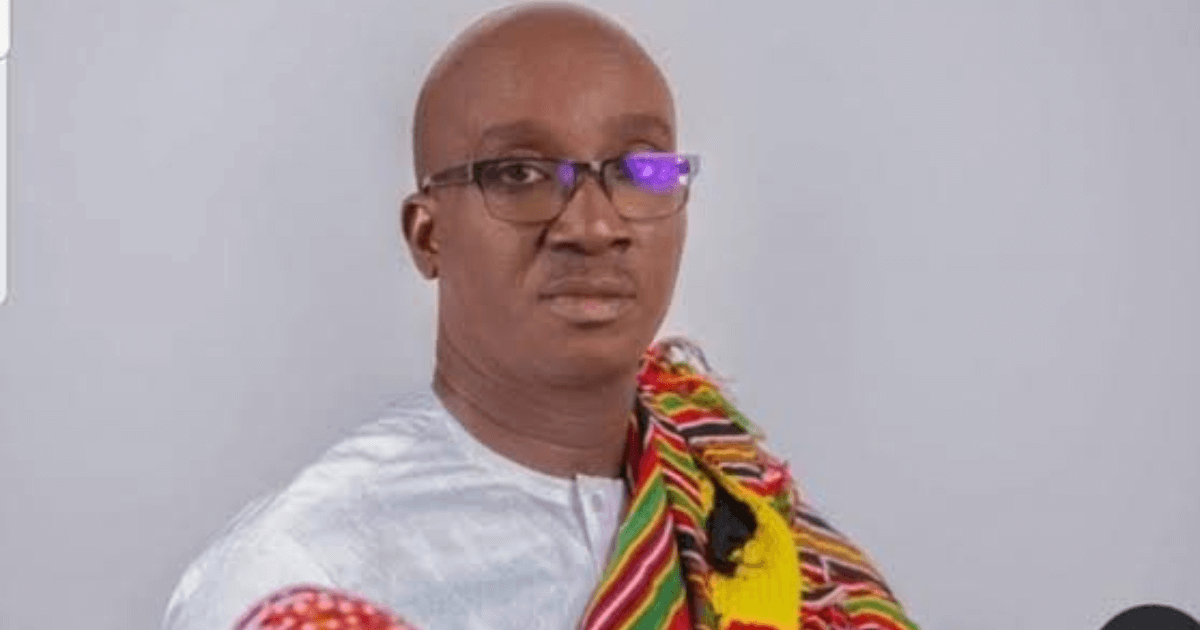

Speaking in Abuja at the 13th Annual General Meeting of Ultimate Health Management Services, Managing Director Lekan Ewenla said the HMO was working on getting all Nigerians on board the health insurance scheme.

According to the World Health Organisation (WHO), Nigeria has the highest out-of-pocket expenditure on health in West Africa.

Statistics from the global health body showed that out-of-pocket health expenditures account for more than 70 per cent of overall health spending in Nigeria and in 2020, the country’s out-of-pocket expenditure was 74.7 per cent.

In October 2023, the Coordinating Minister of Health and Social Welfare, Prof. Ali Pate, revealed that 90 per cent of Nigerians were not covered in the nation’s health insurance scheme.

But Ewenla said the organisation was working with regulatory authorities to ensure that all clusters are sensitised and brought on board.

“For example, we are looking at the youths of this country that are over 40 million that in tertiary institutions across the nation, they will be mandatorily mandated through the regulatory institutions to comply.

“We are looking at the organised private sector, they have already compiled but not totally. So we are going to see those that are still on the fringes, to bring them on board,” he said.

He underscored the need for inflationary trends to be put into consideration for upward review of premiums so that services could continue to be provided by hospitals.

He said that health insurance is volume-driven with provision for basic healthcare services to be covered.

His words: “As we speak, there are two risk managers for Nigerians. The first risk manager is the primary provider at the primary level. Services that are primary services are meant to be managed at the primary level by the risk managers.

“At commencement, it was determined to be N550 per person per month in 2005 and the actuarial reports that were submitted to the regulator indicated that a recommended percentage should upwardly review the N550 or whatever 65 per cent within 24 months.

“This was to take care of the inflationary trend which was responsible for the upward review of N550 to N750 in 2014.”

On her part, the Chairman, Board of Directors, Angela Ajala, noted that the HMO went beyond the N750 million minimum requirement stipulated by the National Health Insurance Authority.

She noted that it is the first HMO in Nigeria to diversify into the United Kingdom and the United States.

“Our major highlight is recapitalization. We have recapitalized to N1 billion, noting that the minimum from our regulatory agency is N750 million.

“We are the first HMO that has diversified into the UK and US. Which means we are standing strong enough on our local leg here and expanding and looking at what our fellow Nigerians need in the Diaspora, especially as many of them have families back home,” she said.

5 months ago

7

5 months ago

7

English (US) ·

English (US) ·