- The biggest bank in Nigeria is considering offering dollar-denominated securities for sale on the local market

- This is aimed at meeting the central bank's capital requirements and finance its expansion aspirations

- By the first quarter of 2025 or 2026 at the latest, the bank intends to open an office in the US and open one in Hong Kong on October 30

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

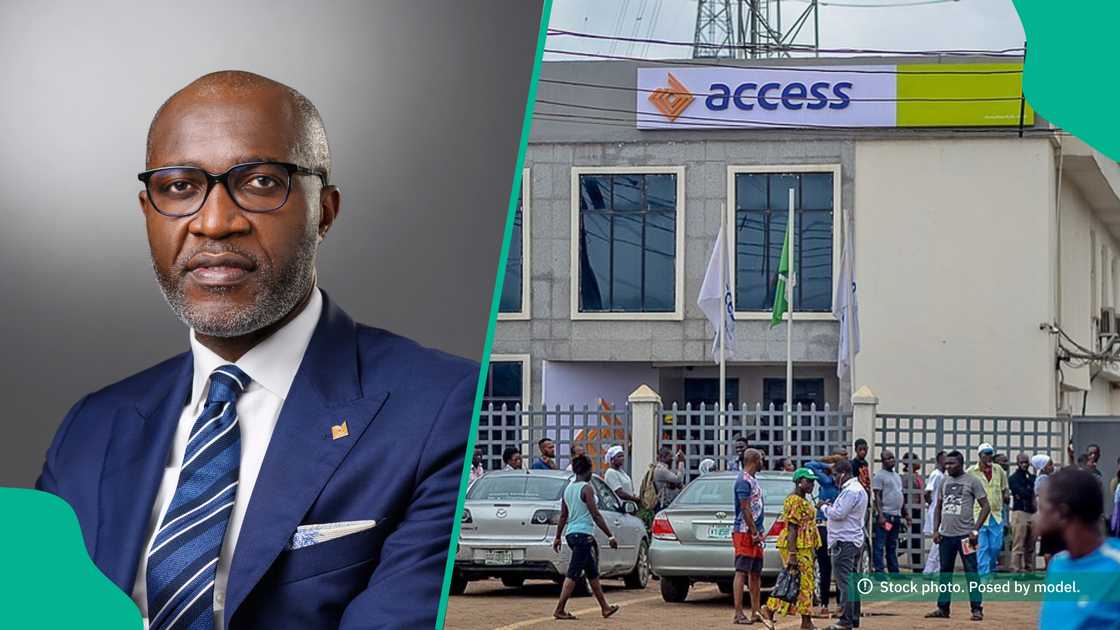

In order to meet central bank capital requirements and finance its expansion aspirations,Access Bank is thinking about selling dollar-denominated securities on the domestic market.

Source: Getty Images

Roosevelt Ogbonna, the managing director of Access Bank Plc, the largest lender in West Africa in terms of assets, stated that the bank is aiming to issue two tranches of dollar-denominated instruments, although he did not specify the amount.

One of the batches will be offered on the general market, while the other will be targeted at development financial institutions, Ogbonna said during a conference on Monday in Lagos, Nigeria's economic hub, according to a Bloomberg report.

Ogbonna stated that the tranche aimed at DFIs will be funded and finished by the first half of next year, even if the bank is still working on the instruments' structure. According to him, it will be guided by the government's first domestic offering of bonds denominated in dollars.

President Bola Tinubu’s administration sold five-year notes at a coupon of 9.75% and raised $900 million last month, almost double the targeted amount. Resident Nigerians and firms have accumulated dollar savings over the years as a hedge against a weakening naira.

Investors were attracted to the bonds as they offered very high returns and a hedge against foreign-exchange devaluation. The naira has lost more than 70% of its value since June last year after it was allowed to trade more freely against the dollar.

Plans for expansion

With operations in 24 countries, Access Bank has previously stated that it wants to double its share of assets outside of Nigeria in order to rank among the largest lenders on the continent within the next five years.

According to Ogbonna, the bank, which is controlled by Access Holdings Plc, plans to open an office in Hong Kong on October 30 and expand to the US by the first quarter of 2025 or 2026 at the latest.

CBN releases reporting channels for customers

Legit.ng reported that as Nigerian banks migrate to more secure platforms to protect depositors’ funds, customers have asked financial institutions to compensate them for losses incurred during network downtime.

A previous report by Legit.ng disclosed that about four commercial banks in Nigeria issued notices of system upgrades in the past weeks, which has caused customers to have trouble carrying out transactions.

The banks’ tech upgrades in the past few weeks caused severe concerns to customers, sending panic into bank customers in rural areas.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

English (US) ·

English (US) ·