Regrettably, despite 14 years of its existence, AMCON still carries massive loans in its portfolio put at circa N5 trillion, with a significant portion of the AMCON debt due to the Central Bank of Nigeria (CBN). So, I expect that we should come up with more effective options for dealing with the outstanding loans beyond the strategies already adopted, just like the Korea Asset Management Company (KAMCO).

I am delighted to welcome you at this retreat, themed “Transitioning Beyond AMCON: Navigating the Path to Sustainable Financial Stability,” which provides an invaluable opportunity for us to reflect on the critical role that AMCON has played in stabilising our financial sector and to chart the path forward in view of its sunset clause.

You will recall that following the signing into law of the AMCON Bill in July 2010, the Corporation was established as an intervention agency to halt the drift caused by Non-Performing Loans (NPLs) in the banking industry, with its adverse impact on savers and the entire economy. From available records, the Corporation had acquired, at inception, over 12,000 NPLs worth about N3.7 trillion from 22 commercial banks and injected a colossal amount as financial accommodation to 10 banks. Admittedly, the setting up of AMCON has succeeded, to a large extent, in not only stabilising the banking industry, given that the purchase of Eligible Banks Assets (EBA) re-injected the much-needed liquidity into the Banking System, but also helped in restoring confidence in the financial sector.

Without any doubt, AMCON was established at a time of considerable turmoil, in the wake of the global financial crisis of 2008, to clean up the books of many ailing banks. It can be said that as a result of AMCON’s interventions, thousands of jobs were saved as a number of banks were rescued from the brink of collapse.

However, even as we acknowledge AMCON’s successes, we must also accept the reality that AMCON was not designed to be a permanent fixture in our financial landscape. I am aware that the AMCON Amendment Act of 2021 extended the life of AMCON for another five years, although it provides that the current tenor may be extended by a resolution of the National Assembly. So, we now stand at a pivotal moment where we must transition beyond AMCON as it is near impossible for the Corporation to recover substantial loans by 2026 when it is expected to wind down.

Regrettably, despite 14 years of its existence, AMCON still carries massive loans in its portfolio put at circa N5 trillion, with a significant portion of the AMCON debt due to the Central Bank of Nigeria (CBN). So, I expect that we should come up with more effective options for dealing with the outstanding loans beyond the strategies already adopted, just like the Korea Asset Management Company (KAMCO).

It goes without saying that a major challenge remains how to recover the tax payers’ money used to purchase the EBAs, so they can be channeled to critical areas such as education, health and provision of infrastructure. This is against the backdrop of the fact that many businesses in Nigeria are currently battling economic headwinds, which make debt recovery efforts more difficult now than ever before.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

I look forward to the insightful discussions that will shape the future of the Nigerian banking system beyond AMCON.

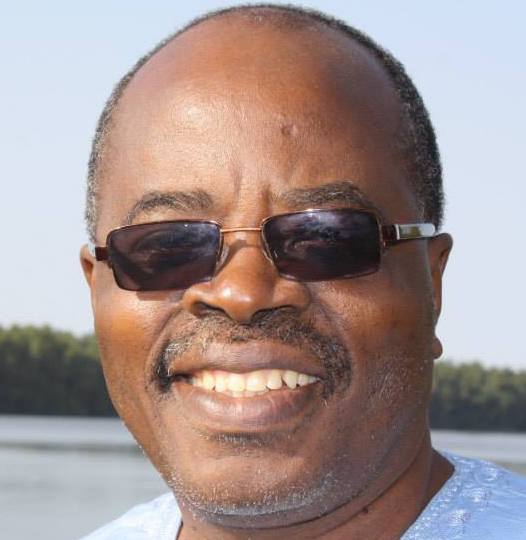

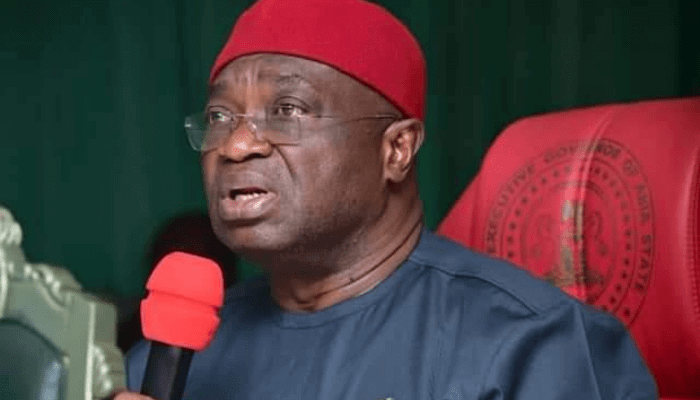

Mukhail Adetokunbo Abiru is chairman Senate Committee on Banking, Insurance and Other Financial Institutions.

This is the text of the speech by Senator Mukhail Adetokunbo Abiru at the 2024 Stakeholders Retreat with the Asset Management Corporation of Nigeria (AMCON).

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·