Banks’ credits to the private sector rose by 34 per cent to N75.48tn in July, from N56.46tn in the prior year.

This is according to the latest data on credit to the private sector obtained from the Central Bank of Nigeria.

On a month-on-month basis, banks’ credit to the private sector rose by about N2.29tn between June and July.

CPS includes loans, trade credits and other account receivables and supports provided by banks to the private sector within a period.

The CPS is a global measure of the banking sector’s balance sheet resilience and contribution to the national economic agenda.

According to experts, increased private sector credit implies a major boost for the economy, as there is a link between credit to the private sector and economic growth.

Analysts at Cordros Capital projected that credit to the private sector may continue in the period ahead.

“We believe the re-enforcement of the CBN’s limit on Deposit Money Bank’s loans-to-deposits macro-prudential ratio will continue to drive the willingness of commercial banks to create risky assets over the short to medium term,” Cordros Capital stated.

Analysts, however, noted that the apex bank’s intensified monetary policy tightening measures could impact the magnitude of growth going forward.

A study published by the CBN noted, “Credit is growth-enhancing, even when trade openness, monetary policy, investment climate and infrastructure are low.”

The study found that private-sector credit increased economic growth.

The balance sheet strength of banks also determines the flow of credits, with the continuing increase in lending amidst macroeconomic headwinds underpinning Nigerian banks’ resilience and stability.

In a study on ‘Balance Sheet Strength and Bank Lending During the Global Financial Crisis’, researchers at the International Monetary Fund examined the role of bank balance sheet strength in the transmission of financial sector shocks to the real economy.

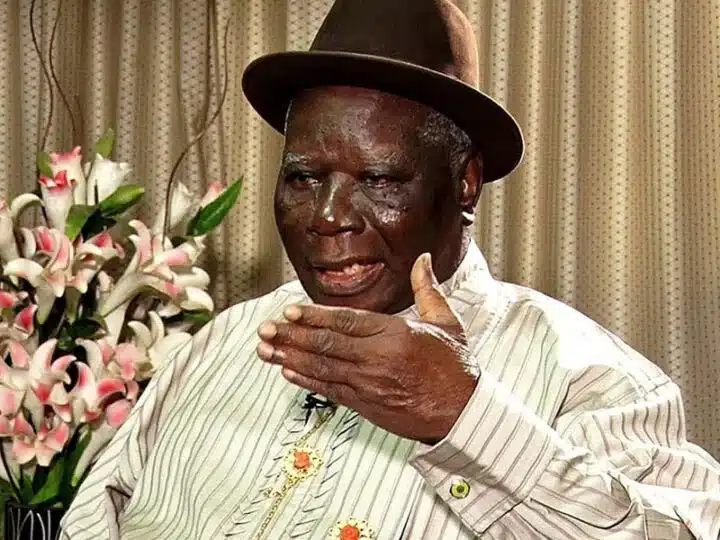

The Chief Executive Officer of the Centre for the Promotion of Private Enterprise, Dr Muda Yusuf, said the credit outlook remained cautious, calling for an expansive distribution of credits across all tiers of companies and sectors.

According to Yusuf, there are major concerns in terms of the distribution of credits across sectors and companies with small businesses, which contribute more to job creation and economic inclusion, not likely to benefit much.

He noted that banks tend to be wary of credit risk concerns associated with lending to small businesses and certain sectors, adding that efforts should be made to drive inclusive and stable credit access to all sectors, including growth and employment elastic sectors such as agriculture, manufacturing, real estate, mining and construction.

Meanwhile, a report by the CBN showed that Nigerian banks had seen a significant increase in deposits during the first half of this year.

The report indicated that banks’ demand deposits rose from N26.7tn recorded at the end of December 2023 to N33tn by June 2024.

Banks sustained steady growth in deposits across the quarters.

Total demand deposits in the first quarter ended rose by 8.1 per cent to N28.9tn and went further up by 14.3 per cent to N33tn in Q2 2024.

Most banks saw a significant increase in deposits in recent periods, providing the headroom for most banks to create new loans and advances.

Financial analysts said banks were in a position to continue to create more loans, citing aggressive growth strategies by banks and enabling regulatory environment.

3 months ago

8

3 months ago

8

English (US) ·

English (US) ·