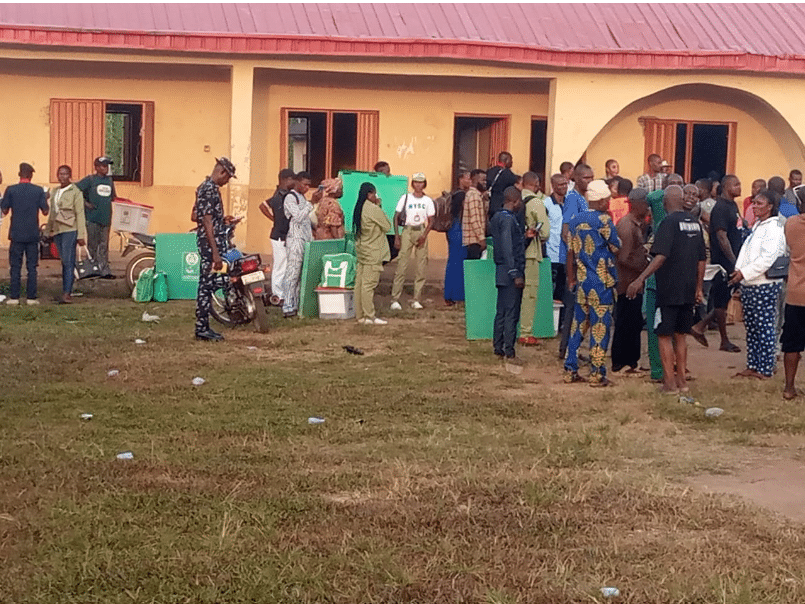

- Bank Customers trooped to their respective banks on Tuesday, July 31, 2024, to reactivate their dormant accounts

- The development comes after the CBN issued new guidelines on reclaiming bank balances in dormant accounts

- The CBN disclosed in its FAQs that next of kin to dormant account owners can fill out application forms to reclaim balances in dormant accounts

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

Bank customers affected by the Central Bank of Nigeria (CBN) guidelines on dormant accounts rushed to their respective banks on Tuesday, July 30, 2024, to reactivate their accounts.

Some customers said they had to activate their bank accounts to prevent the CBN from taking over their funds and savings.

Source: Getty Images

CBN issues new guidelines on dormant accounts

Reports say courtrooms were also swarming with those who went to swear to affidavits needed to reactivate their dormant account.

The CBN disclosed in its FAQs on dormant accounts that next-of-kin to dormant account owners can now claim unclaimed balances or funds by submitting applications for reclaims to financial institutions.

The CBN also gave customers a fresh understanding of the role of banks in resolving issues around dormant accounts and unclaimed balances.

Some customers said they had activated their bank accounts to avoid mopping up their little savings.

CBN takes over N21 trillion in dormant accounts

Legit.ng reported that the Central Bank of Nigeria (CBN) issued a new directive to Nigerian financial institutions regarding dormant accounts.

The new directives disclose that the CBN will take over the funds left in the accounts and invest them in treasury bills and other securities.

CBN to invest the funds in T-Bills

A circular issued on Friday, July 19, 2024, and signed by the bank’s Ag Director of Financial Policy and Regulation Department, John Onojah, CBN said that it shall open and maintain an account meant for warehousing unclaimed balances in banks and other financial institutions in Nigeria.

The circular reads:

Top 10 banks with highest loan amounts to customers

Legit.ng earlier reported that as the economy worsens and hardship increases, more Nigerians are turning to banks and other financial institutions for loans.

In response, banks have created various loan products, making it easier for Nigerians to access household and business loans.

Legit.ng analysis of commercial banks financial reports released on the Nigerian Exchange, ten banks, as of the end of March 2024, have disbursed N57.73 trillion to their customers.

Source: Legit.ng

English (US) ·

English (US) ·