The Central Bank of Nigeria (CBN) has clarified that its recent exit programme, which resulted in the voluntary resignation of 1,000 employees, was initiated in response to requests from staff members who expressed a desire to leave the organisation.

Bala Bello, a deputy director at the bank, stated this on Friday when he appeared before an ad hoc committee of the House probing the scheme.

Mr Bello, who represented the Governor of the bank, Yemi Cardoso, said the initiative was not the bank’s idea; rather, it adopted a popular demand from staff members who wanted to leave.

“In this particular case, based on popular request—and I came with the union leader of the bank—the staff requested that a similar opportunity should be extended to other categories of staff,” Mr Bello said.

“But for the first time in the over 60-year history of the bank, the early exit programme is being extended to everybody who is willing to take it. And this came at the instance of the staff. So, it’s not mandatory, it’s not compulsory, there’s no coercion, no forceful exit, and no intimidation for anybody to take it,” he added.

He noted that this current layoff is not the first of its kind, as the bank periodically reviews its workforce needs.

The House had, on 3 December, resolved to investigate the planned mass retirement of over 1,000 staff members and the payment of ₦50 billion as compensation.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

The resolution followed a motion of urgent public importance moved by Kama Nkemkamma (LP, Ebonyi).

The House subsequently set up an ad hoc committee, chaired by the Majority Whip, Bello Kumo, to probe the scheme.

Technology created redundancy

Speaking on the initiative, Mr Bello said the bank, like other organisations, is deploying technology in its operations, which creates both opportunities and redundancies, depending on the situation.

“You are very much aware, chairman, that the entire world is going through a process of digitising its operations. And when that happens, a lot of opportunities are created, just as a lot of redundancies are equally created,” he said.

He further explained that the lack of vacancies at the managerial level also created redundancies and stagnation, leaving some staff stuck at a particular level for years without promotion.

“It gets to the level where you have, for example, 30 departments in the Central Bank. You cannot have 60 directors manning 30 departments. It’s not going to work. So, once those vacancies are filled, some people—despite being highly qualified, very able, and very willing—find there are no vacancies. Then they get to a level where they are stagnated for a period of time,” he said.

Mr Bello also explained that some of the staff who exited plan to establish their own banks and have received assurances from the CBN to support them.

“A lot of opportunities are out there. For example, among the people who have left, there are three or four who are going to set up a bank.

“The approach we told them is that, literally, anything you want to do, if you need the support of the Central Bank, we will give it to you,” he said.

Earlier in his remarks, Mr Kumo, assured the bank of a fair hearing in the probe.

He stated that the House is on a fact-finding mission regarding the process of restructuring and reorganising the bank.

READ ALSO: 2024: Nigerian economy battles multiple headwinds amid sweeping reforms

Restructuring by Cardoso

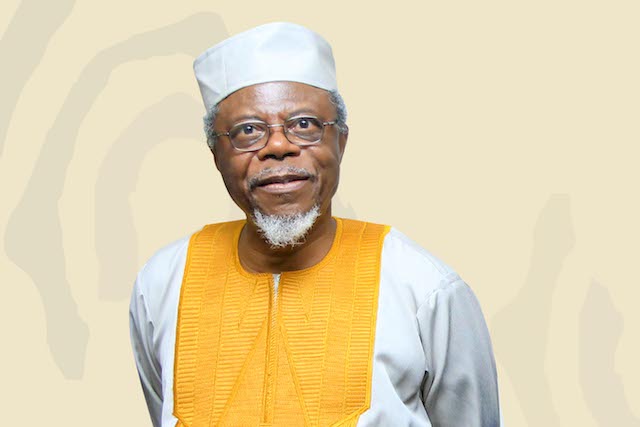

Mr Cardoso was appointed by President Bola Tinubu in September 2023 following the suspension of Godwin Emefiele.

The CBN governor, a former Citigroup executive, promised a radical departure from his predecessor and return to orthodox banking regulations.

In the past 15 months, the CBN has been praised for clearing of some outstanding obligations. Also lauded for the eradication of the multiple exchange rates but the lack of stability in the FX market remains a concern.

In terms of the organisation of the bank, ongoing restructuring within the bank has been generating concerns.

Meanwhile, the continuous rise in inflation despite the high interest rate adopted by the CBN has been a blight on the reforms embarked by Mr Cardoso.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·