• Apex bank trades quick fixes for long-term confidence building

• Gwadabe: Lack of clarity in new guidelines fueling fresh panic

• Naira on edge ahead of summer activities

• Moody’s: Govt to spend 36 per cent revenue on interest

• MPC commits to 21.4% long-term inflation target, says member

Barely two weeks into the new Bureau de Change (BDC) regulatory regime, the Central Bank of Nigeria (CBN) may have finally stopped the funding of the sub-sector, and, in extension, the retail foreign exchange (FX) market, The Guardian learnt at the weekend.

The decision, according to sources, comes on the back of the CBN’s resolve to re-chart its way back to the market liberalisation template and minimise quick fixes, that is, applying mechanical approaches to what should have been an institutionalised process in managing the FX market.

On a broader scale, The Guardian has learnt, the monetary authority is currently reviewing major policies to firm up the implementation or tweak them.

Whereas the bank is worried about the recent renewed pressure on the local currency, those familiar with its plan said its focus is on sustainable plans that would unlock liquidity in the medium to long term with confidence-building central to the new agenda.

Much of the FX policy options were handed down to the current governor, Yemi Cardoso, who will complete his first anniversary in office in October. For instance, the pro-market reform was announced by Folashodun Shonubi, during his stint as acting CBN governor following the suspension of the former governor, Godwin Emefiele.

Cardoso, who was said to have expressed reservation about the integrity of the process, reluctantly continued with the reform template to prevent the negative consequences of policy reversal.

With close to nine months in office, Cardoso seems to believe it is time to roll out his agenda core mandates of the bank fully.

Last month, the apex bank released the new regulatory framework of the BDC operation with a proviso for fresh licensing. The new regime took effect on June 3 but existing and prospective operators have six months grace.

The guideline is not explicit on CBN’s liquidity support for the BDC but lists funding sources to include the Nigerian Foreign Exchange Market (NFEM) subject to meeting the requirements for authorised dealership licence, International Money Transfer Operators (IMTOs) and diplomatic missions in Nigeria.

Currently, BDCs do not have clearly defined business relationships with IMTOs and NAFEM, whose operations are regulated by the CBN. The new template is lacking in detail on how the BDC could begin to leverage the different opportunities to access liquidity, a possibility many said would need additional regulatory intervention.

A source in the CBN said the apex banks assumed the new regime had commenced and that BDCs would adjust over time to the new market reality. But BDC operators told The Guardian the regulator would need to do more in terms of further clarification as “everybody is in the dark” on how to transit.

The leadership of the Association of Bureau de Change of Nigeria (ABCON) is said to have written the Central Bank on the “way forward” several times in recent times but has yet to get any response.

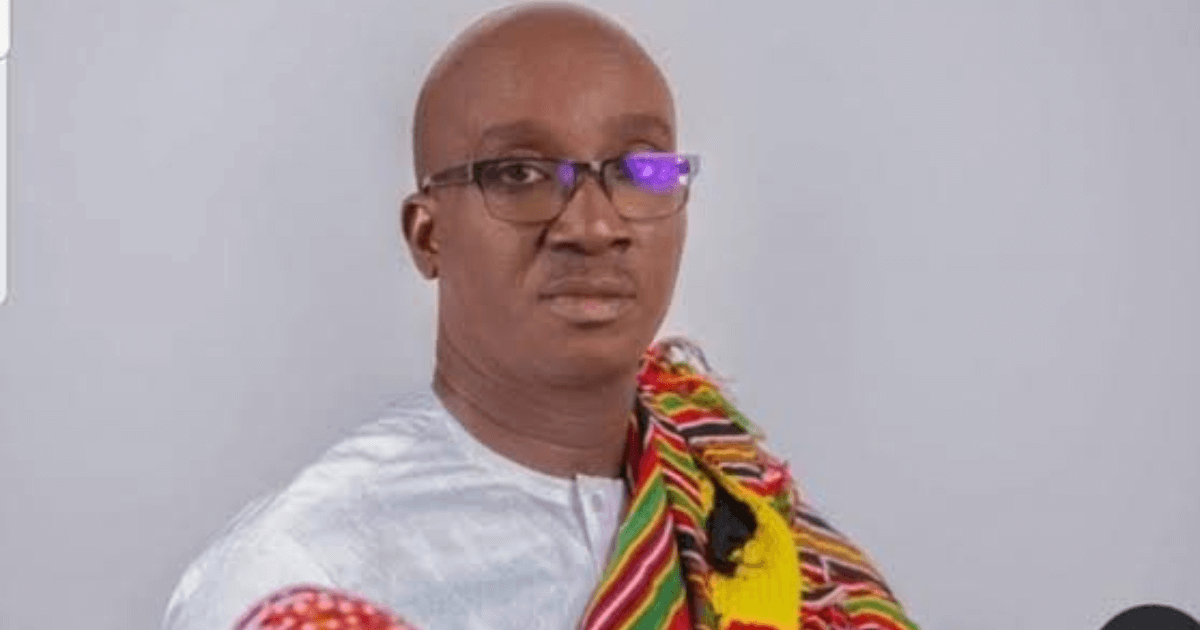

President of the Association, Dr Aminu Gwadabe, during a telephone conversation, yesterday, said the last correspondence was delivered about a month ago, after the latest guideline was released.

“After the consolidation, the BDCs are expected to play in the NAFEM window. However, the business model that has worked for BDCs is a situation where the CBN provides liquidity to keep them in business.

“Unfortunately, there is no clarity on whether the CBN funding will stop completely and how the BDCs can begin to play in NAFEM. CBN has not provided any clarity. They will tell you that the regulations are there. But there are a lot of frequently asked questions like how they go about the new regulation,” Gwadabe said.

The CBN resumed funding of the retail outlets earlier in the year and has since then extended weekly liquidity support to the operators three times – the last being in March. Before the resumption, the operators were compelled to embrace new guidelines, including allowable margins and detailed reporting of their activities.

BDC operators, who have also earned a reputation for non-compliance with regulatory requirements, expected that the weekly liquidity support would continue pending when they are integrated with the official FX management structure.

Within the CBN itself, not many know exactly the official position of the CBN-BDC funding approach and whether the weekly funding has been terminated with finality. Efforts to get an official position failed as the Acting Director of Corporate Communications of the Bank, Hakama Sidi Ali, did not respond to SMS and WhatsApp messages.

But insider sources said the CBN must have closed the liquidity window and expect BDCs to begin to test the viability of the funding sources outlined in the new guideline, adding that supports granted earlier in the year were “obviously not sustainable” – a reason funding was not extended every week.

The Guardian is aware that the BDC funding blockage is one of the several firm decisions the CBN is taking to transition to a more sustainable demand management approach. From both the demand and supply side, The Guardian learnt, the CBN is prioritising long-term confidence building over quick fixes, suggesting the authoritising may tolerate the current squeeze.

The naira has lost about one-third of its value to the dollar since the April breather, which saw the local currency emerging as the best-performing currency in the world. As the naira formed up, the international financial community, led by the International Monetary Fund (IMF) expressed worry that the country was drifting from the commendable pro-market reform that started mid-last year.

At the weekend, the naira continued to trade at about N1500/$ at the parallel market where liquidity has dropped to a record low. With NAFEM closing at ₦1485.53/$ last week, the market arbitrage has narrowed remarkably.

With summer activities ahead, there are growing fears in the market that prolonged illiquidity could trigger a fresh crisis in the retail FX market in the coming months. Traders who spoke with our correspondent this week, said retail suppliers have started hoarding hard currencies for a better bargain in the coming months when demand is expected to hit the roof .

Perhaps, summer demand would provide the market an opportunity to stress-test the apex bank’s resolve to stick to its long-term stability plan, calling for proactive policy action to prevent the March crisis when the naira almost touched N2000/$ and tip the economy into disaster.

Meanwhile, the broad economic crisis may not ease soon even as Moody’s Ratings has suggested there would be a significant increase in Nigeria’s interest spending this year, estimating a rise of one per cent of the gross domestic product (GDP). The projection comes on the back of continued restrictions on the local financial market, which is the primary source of funding for the government.

According to Moody’s latest outlook on Nigeria, the increase in interest rates, from an average of 12.8 per cent in 2023 to 19.7 per cent in the first five months of 2024 will drive interest spending to consume 36 per cent of government revenue.

“As the government is predominantly borrowing in domestic markets, this will have a significant impact on interest spending, which we expect will increase by 1 percentage of GDP in 2024 and consume 36 per cent of government revenue. We expect that the fiscal deficit will widen significantly in 2024 to around seven per cent of gross domestic product (GDP) amid multiple obstacles to the government’s fiscal consolidation plans .

“Moreover, institutional weaknesses and heightened social risks as inflation affects the population with high poverty rates and restrained access to basic services are key credit constraints. While the new administration is working at raising the very low levels of tax compliance, higher revenue intake is unlikely to fully offset the ongoing spending pressure,” it noted.

The outlook may even be worse than Moody’s projection as the Monetary Policy Committee (MPC) seems not ready to start easing the monetary space. According to the personal statements of members, the Committee does not seem to believe the inflation rate has reached its peak.

“The rise in Nigeria’s headline inflation from 33.20 per cent in March 2024 to 33.69 per cent in April 2024 supports my resolve to vote for a sustained tight policy stance to effectively anchor inflation expectation,” Aku Odinkemelu, argued.

Some of the members argued that the consecutive month-on-month decline in the inflation rate has not translated to sufficient easing in the headline inflation and that the MPC was committed to achieving its long-term inflation target, which Cardoso pegged at 21.4 per cent earlier in the year.

5 months ago

25

5 months ago

25

English (US) ·

English (US) ·