The Central Bank of Nigeria (CBN) has issued a stern warning to Deposit Money Banks (DMBs) regarding the rejection of dirty or mutilated Naira notes.

According to the bank, the directive comes in response to numerous reports received by the CBN about some banks refusing to accept dirty and damaged currency from the public.

In a circular dated 28 June 2024, signed by Solaja Olayemi, the acting director of the currency operations department, the CBN reiterated that the guidelines outlined in its previous circular from 2 July 2019, remain in full effect.

The 2019 directive specified penalties for banks that reject Naira banknotes.

“The Central Bank of Nigeria shall not hesitate to apply strict sanctions on DMBs who are reported to have rejected deposits of Naira banknotes from the public, under any guise,” the circular stated.

The issue of mutilated banknotes has long been a concern in Nigeria, amid efforts to ensure that notes are better handled by the public.

Section 21 of the CBN Act specifically prohibits the abuse of Naira notes, prescribing penalties for offenders that include fines and imprisonment. According to Section 21 (1) – (3) of the CBN Act, a person who tampers with a coin or note issued by the Bank is guilty of an offence and shall on conviction be liable to imprisonment for a term not less than six months or to a fine not less than N50,000 or to both such fine and imprisonment.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

“A coin or note shall be deemed to have been tampered with if the coin or note has been impaired, diminished or lightened otherwise than by fair wear and tear or has been defaced by stumping, engraving, mutilating, piercing, stapling, writing, tearing, soiling, squeezing or any other form of deliberate and willful abuse whether the coin or note has or has not been thereby diminished or lightened.

READ ALSO: CBN to sanction banks, BDCs, others over rejection of old dollar notes

“For the avoidance of doubt, spraying of, dancing or matching on the Naira or any note issued by the Bank during social occasions or otherwise howsoever shall constitute an abuse and defacing of the Naira or such note and shall be punishable under Sub-section (1) of this section.”

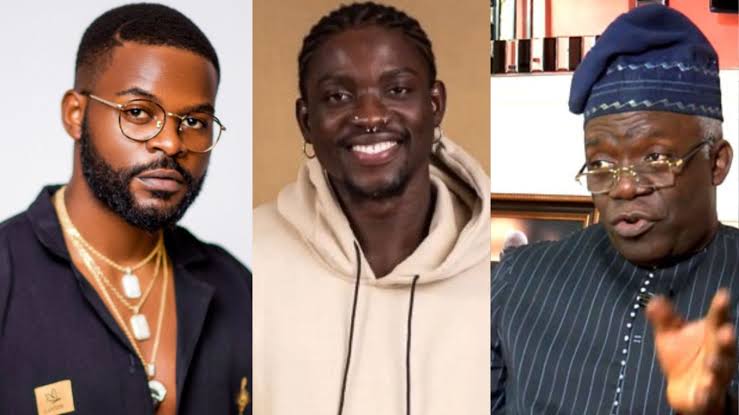

In recent times, the Economic and Financial Crimes Commission (EFCC) has intensified its enforcement of the CBN act, while some Nigerians suspected of mishandling the Naira have been arrested and prosecuted.

Notable figures among those arrested include Nollywood actress Oluwadarasimi Omoseyin, popular crossdresser Bobrisky, and socialite Cubana Chief Priest.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·