Worried over the mass exit of multinational firms from the country, the Chartered Institute of Directors (CIoD, Nigeria, has warned against the economic repercussions.

The Institute said by addressing the underlying issues and cautiously implementing measures to reverse the trend, Nigeria could create a more attractive business environment.

The institute said a stable and predictable operating environment with access to foreign exchange (FX), reliable power, efficient infrastructure and improved security would not only help in mitigating the trend but would also attract new businesses.

This, in turn, it said, would lead to increased investment, job creation and economic growth, ensuring the “Giant of Africa” retains its position as a leading destination for foreign investments in Africa.

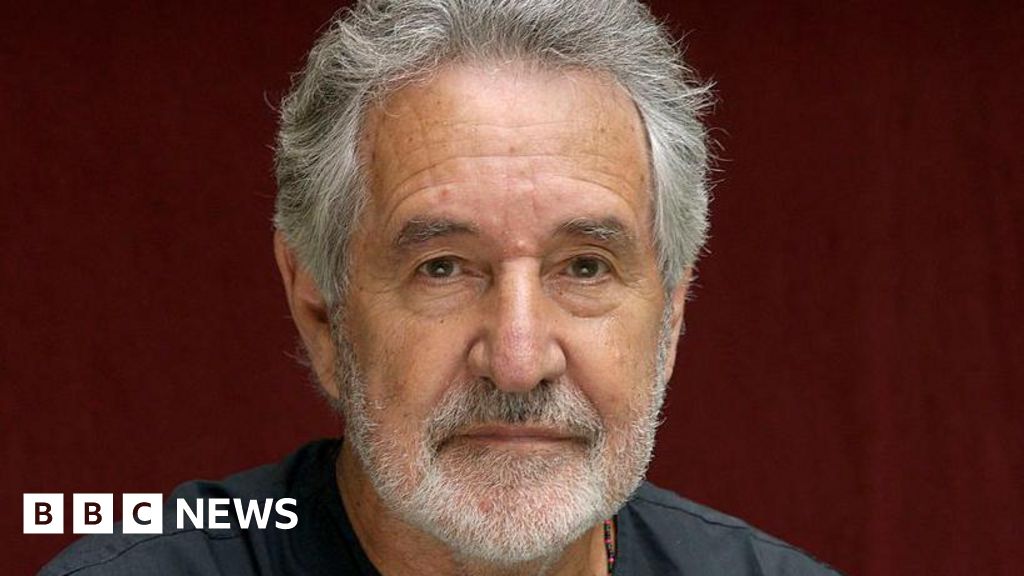

Director General/Chief Executive Officer, CIoD Nigeria, Bamidele Alimi, in a position paper ‘On the Exodus of Multinationals from Nigeria’, said the exit of businesses has raised concerns about the business climate in the country and the ability to attract and retain foreign investment.

He said with the country experiencing a significant exodus of multinational companies over the past decade, there is a need to understand the reasons behind the trend and explore solutions to achieve economic stability.

Mentioning some household names like Procter & Gamble (P&G), GlaxoSmithKline (GSK) and Kimberly-Clark that left the Nigerian market, he said even though some opted to transform to third-party model, they have left behind a trail of lost jobs, investments and economic uncertainty.

Alimi said: “Obtaining foreign exchange (forex) is a significant hurdle for multinationals.

The volatility in the exchange rate creates untold hardship for businesses. The lack of an easily accessible liquid forex market, where companies can easily buy and sell foreign currency at market rates, significantly hinders their operations. This makes it hard for them to repatriate profits in dollars or euros, impacting their global bottom line.”

4 months ago

27

4 months ago

27

English (US) ·

English (US) ·