Acting Managing Director/Chief Executive Officer of Infinity Trust Mortgage Bank (ITMB), Ngozi Chukwu, said the bank’s N50 billion capital raising would transform the bank into a digital commercial bank with a focus on providing finance to essential sectors as well as tackle challenges facing micro, small and medium-sized enterprises (MSMEs) and the unbanked in Nigeria.

At the ‘Facts behind the Figure’ held in Lagos at the weekend, Chukwu said over 39 million MSMEs are faced with the problem of limited access to finance to grow their businesses, just as only 0.3 per cent of commercial banking credit is available to this group of business owners.

According to her, the 2022 sectoral allocation of bank credit report indicated that over 75 per cent of MSMEs rely on internal capital to grow, which is considered largely inadequate and inefficient.

Hence, Chukwu said ITMB will leverage technology and digital tools to effectively reach their target customers, especially the MSMEs by offering lower interest rates and higher returns through increased transaction volumes.

“Technology is, therefore, a critical component of our strategy. Our target customers will be MSMEs, unserved and underserved by microfinance banks and commercial banks,” he said. She listed the firm’s six strategic focuses as financial inclusion, deep industry knowledge, data and technology, product innovation and customisation, partnerships as well as cost efficiency.

On financial inclusion, she explained that the company would provide financial services to underserved and underbanked individuals to align with CBN’s strategic goals of increasing the financial inclusion rate to 80 per cent.

Chukwu added that the ITMB intends to create digital banking, transportation/logistics, asset management, healthcare and pharmaceutical, real estate/green finance, agriculture, foreign exchange, women and youth empowerment and real sector financing with sources of value creation with the additional capital.

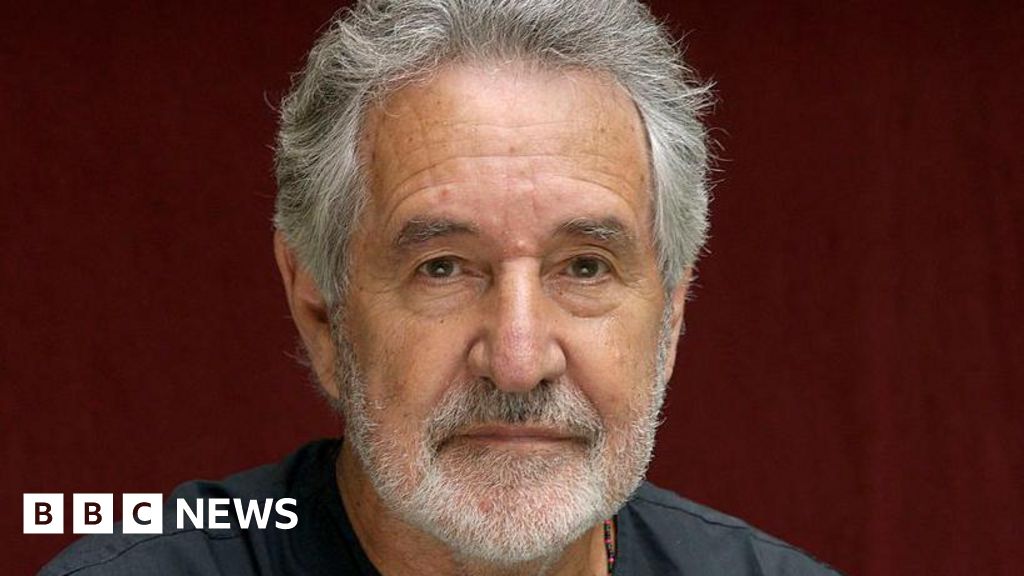

The chairman of the bank, Okwa Ene Iyana, stated that the capital raising exercise is the management’s strategic move to capitalise on new opportunities, expand its reach as a catalyst for financial inclusiveness and further entrench its position as a leader in the sector.

“As we navigate through the complexities of its dynamic industry, we remain steadfast in our mission to provide innovative, customer-centred solutions, to foster sustainable growth and create long-term value for all our stakeholders.

“Our unwavering commitment to excellence, integrity, and transparency has been the compass of our success to date and we will continue to uphold these values”, Okwa added.

2 months ago

53

2 months ago

53

English (US) ·

English (US) ·