The Independent Petroleum Marketers Association of Nigeria (IPMAN) has urged the Dangote Petroleum Refinery to reduce the price of Premium Motor Spirit (PMS), insisting that the current rate of ₦825 per litre is too high for Nigerian consumers.

Speaking to The PUNCH, IPMAN’s National Publicity Secretary, Chinedu Ukadike, argued that with the favourable conditions granted to the refinery—especially the naira-for-crude supply arrangement—the price of petrol should not exceed ₦750 per litre.

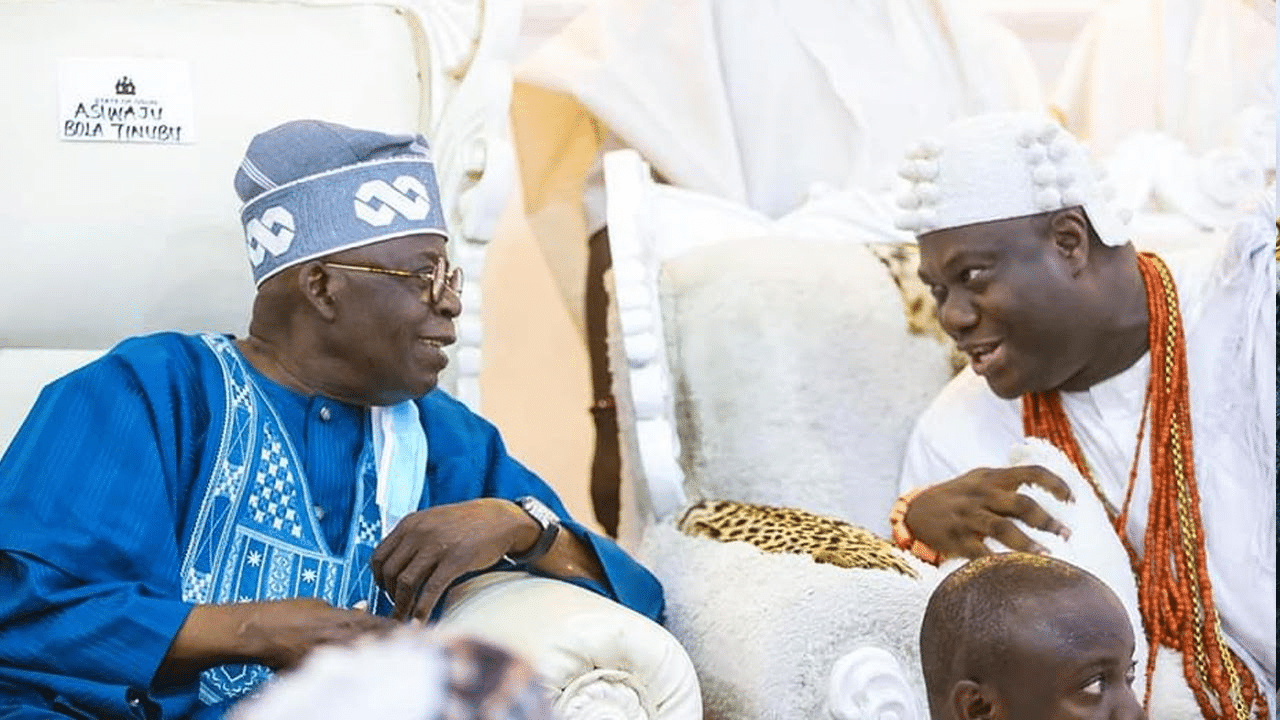

Ukadike’s reaction followed comments by the President of Dangote Group, Aliko Dangote, who recently told ECOWAS officials and President Bola Tinubu that Nigerians are paying about 55 per cent of what citizens in other West African nations pay for petrol.

Although Ukadike agreed that petrol is relatively cheaper in Nigeria, he insisted it ought to be significantly lower due to the country’s crude production capacity and the federal government’s decision to sell crude to Dangote in naira.

“I agree that petrol is cheaper in Nigeria than in other West African countries. Notwithstanding, those African countries Dangote was comparing us with are not crude oil-producing countries,” Ukadike said.

“We’re a crude oil-producing state. PMS should be far lower, as the President has also decided to give him crude in naira. So, most of the foreign exchange brouhaha and the exchange costs are no more there; we should also enjoy it as Nigerians.”

Availability Solved, But Price Still High

Ukadike acknowledged that Dangote’s major contribution has been solving the issue of petrol scarcity but maintained that affordability remains a concern.

He said: “What I believe he (Dangote) has conquered for Nigerians is availability. On price, we’ll still get there. Once the government works very hard to ensure that the rate of naira to the dollar is reduced and the strength of our naira is stable, you’ll find out that the price will go down.”

Asked if the current price was acceptable, he replied: “For me, I don’t feel it’s cheap. I think the petrol will go as low as around ₦770. That’s my own permutation. I’m not an expert in oil refining. But with what I have gathered—the refinery production costs and the landing at the depot cost—petrol should not be more than ₦780, ₦750, in line with the dollar rate.”

The IPMAN official stressed that the continued depreciation of the naira is a major factor keeping petrol prices high. He projected that if the exchange rate drops to ₦1,200 or lower, pump prices would fall significantly.

“The dollar is around ₦1,600 now. So, if the dollar can come down to ₦1,200, I want to tell you that the price of PMS at the pumps will go below ₦750,” he added.

Dangote Defends Pricing Structure

Meanwhile, Aliko Dangote defended the pricing of his refinery’s output, noting that his plant currently sells petrol between ₦815 and ₦820 per litre.

He reiterated that local refining has helped slash fuel prices across Nigeria compared to other West African countries.

“In neighbouring countries, the average price of petrol is around $1 per litre, which is ₦1,600. But here at our refinery, we’re selling at between ₦815 and ₦820,” Dangote said during a recent visit by ECOWAS Commission President Dr Omar Touray and his team.

He also cited the naira-for-crude policy as a game-changer.

“Many Nigerians don’t realise that they are currently paying just 55 per cent of what others in the region are paying for petrol,” he added.

Diesel Impact and Sector Benefits

Dangote highlighted how diesel prices had also seen dramatic reductions since his refinery began operations last year.

He said: “Last year, when we began diesel production, we were able to reduce the price from ₦1,700 to ₦1,100 at a go, and as of today, the price has crashed further. This reduction has made a significant impact across various sectors—industries, mining, agriculture.”

Despite the refinery’s contributions, a recent report by S&P Global observed that fuel prices from the facility remained high in comparison to the drop in global crude prices.

As of press time, Dangote Refinery’s spokesperson, Mr Tony Chiejina, had yet to respond to IPMAN’s remarks.

3 hours ago

2

3 hours ago

2

English (US) ·

English (US) ·