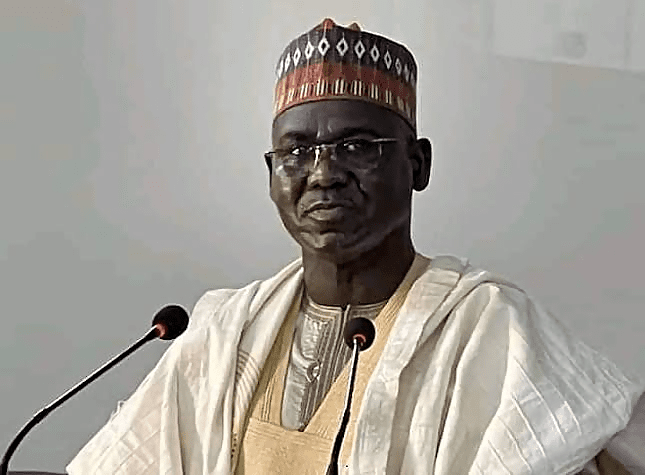

Olayemi Cardoso, governor of the Central Bank of Nigeria, on Wednesday, said Nigerians in the diaspora no longer send money back home via unorthodox means.

Mr Cardoso attributed the development to the reforms carried out by the apex bank in recent months.

The CBN governor made this known at an investors’ forum held on the sidelines of the World Bank/IMF annual meetings in Washington DC.

The event tagged Global Investors’ Forum, had in attendance policy experts, market analysts, investors, and fund managers.

Mr Cardoso noted that when there is a rate increase, there will be an increase in appetite for instruments in the local currency.

He added that due to the reforms put in place by the apex bank, many Nigerians no longer go through the hassle of sending money back home through unorthodox means.

The recent uptick in the flow of diaspora remittances, he said, was recorded against the background of the new development.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

In August, the Central Bank of Nigeria said diaspora remittances increased year-on-year by 130 per cent to $553 million in July 2024 from the corresponding period of 2023.

According to the apex bank, the continuous rise in remittances was due to its recent policies geared towards improving liquidity in the country’s foreign exchange market.

In July, a World Bank report said Nigeria was a major recipient of diaspora remittances in Sub-Saharan Africa, capturing approximately 35% of the region’s total inflows in 2023.

The report analysed global remittances in 2023 and projected inflows for 2024.

However, there have been concerns that nearly half of the inflows come in via unorthodox means.

The CBN has made efforts to bridge the gap by licensing International Money Transfer Operators (IMTOs) to ease diaspora inflows. In May, the CBN granted Approval-in-Principle (AIP) to 14 new International Money Transfer Operators (IMTOs) to enhance remittances.

READ ALSO: Interest rate hike in September done in anticipation of fuel price increase — Cardoso

Non-resident Bank Verification Number on the way

Mr Cardoso said the Nigerian Inter-Bank Settlement System (NIBSS) will launch a non-resident Bank Verification Number (BVN) platform to enable Nigerians in the diaspora to operate their local bank accounts by December.

He explained that the initiative is part of efforts to ensure that Nigerians, irrespective of their location anywhere in the world, can participate in the Nigerian economy without any hassles.

“As far as we are concerned it is totally unacceptable that you should be out here and be having hassles in operating your accounts or doing your business in your original country. I want to tell you that starting in December 2024 Nigerians in the diaspora will no longer face the hurdle of travelling long distances for physical biometric verifications to access financial services,” Mr Cardoso said.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·