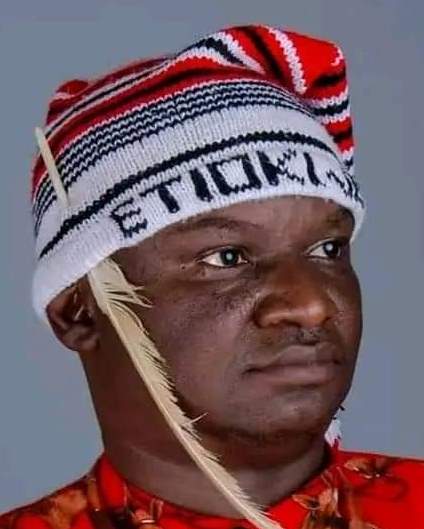

A financial expert, Irom Emmanuel James has urged Nigerian banks to focus on simplifying and standardising products, processes, and technology to increase productivity and efficiency.

James, a professional in banking with experience cutting across all facets of management, and banking, disclosed this in an interview. He also said that simplifying and standardising products will help the banks reduce operating costs and allow more investment in innovative technologies.

He commended the Nigerian Banks for doing great within the African Market but much is still required adding that the current Central Bank of Nigeria’s new Capital Regime for the Banks if achieved will better place our Banks.

Speaking about the microfinance banks in the country, he enumerated the challenges confronting them.

He said, “The challenges facing Nigerian banks are majorly categorised under three broad categories which are: Lack of Corporate Governance; unfavourable regulations; and High Cost of doing business.

“Some operators in the industry have not come to terms with the importance of corporate governance and the impact it has on the performance of the institution they own or operate, as simple as it sounds, the success and failure of every microfinance bank are tied to either proper corporate governance or lack of appropriate Corporate Governance. A study of all failed microfinance banks that got their licences revoked by the Central Bank of Nigeria showed weak corporate governance. There are instances where some microfinance banks don’t have a functional board of directors, there are some that have boards but the board has no say as one-man seats somewhere to decide what happens, the directors appointed are just for regulatory compliance, in instances such as this, the management of the bank has no direction and the bank is headed towards losses and possible closure.’’

He urged the government to increase support for the banks. He said, “Yearly we hear and read on pages of papers of numerous government funds on poverty reduction being channelled through other sources to beneficiaries which has not yielded the much-desired results. The government is very aware of the role microfinance plays in the economy. Microfinance Banks are a veritable tool the government can use to boost the microeconomy.”

4 months ago

20

4 months ago

20

English (US) ·

English (US) ·