- Nigeria's foreign reserves, which were $33.30 billion on June 13, 2024, rose by 10.7% over the previous three months

- The $3.57 billion increase is attributed to several key factors, including the successful sales of domestic dollar bonds

- On September 3, 2024, the reserves saw their first significant increase, going from $36.24 billion to $36.27 billion

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

Nigeria's external reserves increased by 10.7% in the last three months, from $33.30 billion on June 13, 2024, to $36.87 billion on September 12, 2024, a trend that bodes well for the country's economic stability.

Source: Getty Images

The noteworthy rise of $3.57 billion has been ascribed to multiple pivotal elements, such as the successful sales of domestic dollar bonds and advantageous macroeconomic circumstances.

Following the successful issuance of a domestic dollar bond, the Central Bank of Nigeria (CBN) recently released data showing that the country's foreign exchange (FX) reserves increased by a noteworthy $621.2 million in just 10 days.

In order to draw foreign exchange inflows and increase liquidity in the financial system, the bond issuance was essential between September 2, when reserves were $36.24 billion, and September 12, when they were $36.87 billion.

ThisDay reported that the reserves had their first notable increase on September 3, 2024, rising from $36.24 billion to $36.27 billion, an increase of almost $30 million. Over the next three days, reserves increased gradually, reaching $36.33 billion on September 5 and $36.30 billion on September 4.

The reserves increased to $36.39 billion on September 6, 2024, and then to $36.64 billion by September 9 of that same year, marking the true acceleration. Strong investor interest for Nigeria's dollar bonds and the enhanced foreign exchange inflows associated with the sale were demonstrated by this $250 million spike in just one weekend.

On June 13, Nigeria's external reserves were $33.30 billion, and by June 28, they had risen to $34.19 billion. This increase of about $889 million is the result of consistent accumulation, bolstered by remittance inflows and preliminary indications of a trade balance improvement.reign exchange sales-related inflows.

Reserves increased significantly in July, reaching $36.79 billion by July 31 from $34.34 billion on July 1. Strong foreign direct investment, growing export revenue, and positive global economic circumstances drove the $2.45 billion gain. The month of July signalled a shift in the nation's reserve position, boosting trust in Nigeria's economic strategies.

Reserves peaked in August, starting the month at $36.83 billion on August 1 and rising to $36.87 billion by August 7. By the end of the month, they had stabilised at $36.30 billion. The general stability of reserves around the $36 billion mark, despite regular portfolio outflows, demonstrated steady foreign exchange inflows from non-oil exports and remittances, notwithstanding slight changes.

A good trade balance, strong remittance inflows from the Nigerian diaspora, and increased foreign direct investment are some of the other reasons that have contributed to the total growth in reserves, in addition to the bond sales. Stabilising the reserves has been largely attributed to the CBN's strategic management of the foreign exchange market, which reflects successful monetary policy initiatives that boost confidence in the Nigerian economy.

Investors over subscribes domestic bond

Legit.ng reported that subscriptions for Nigeria's first-ever domestic bond denominated in a foreign currency totalled $900 million.

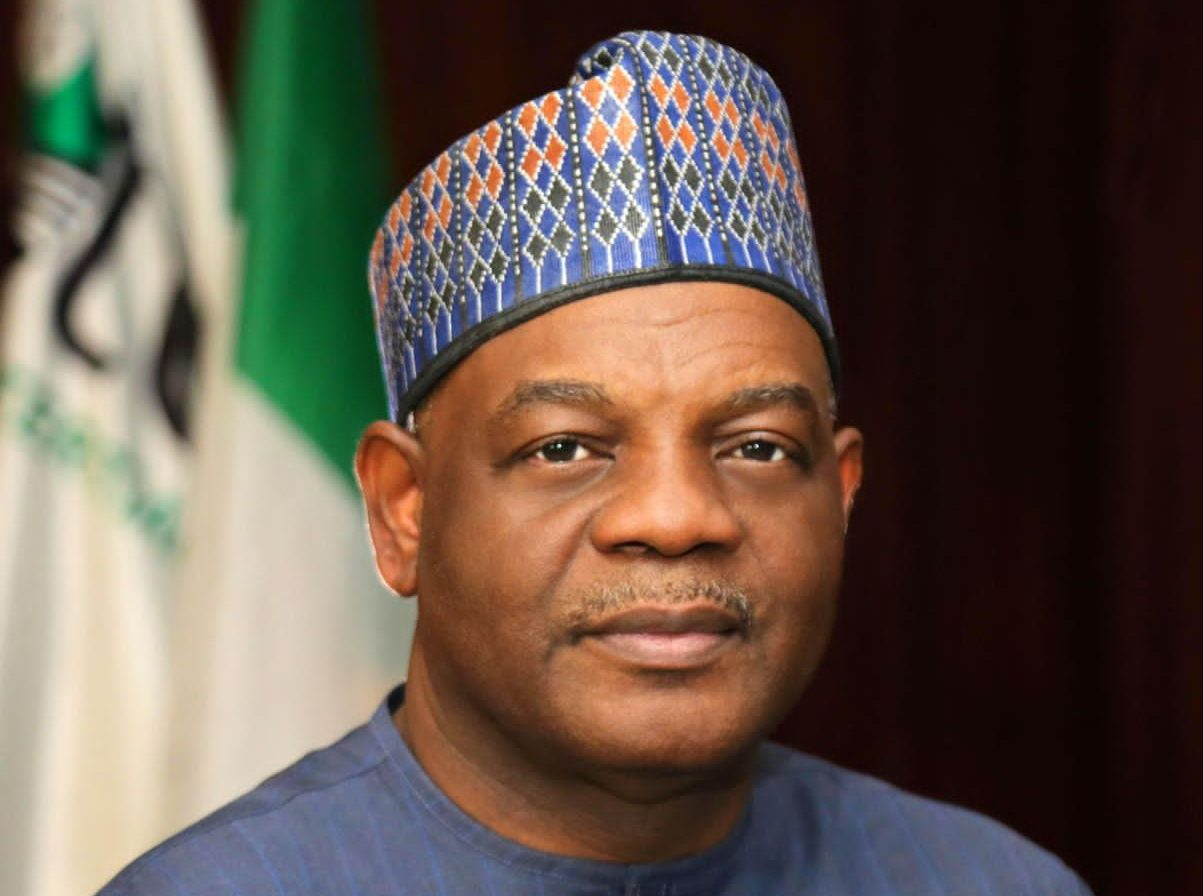

This was disclosed by Wale Edun, the Coordinating Minister of the Economy and Minister of Finance, on Tuesday during a discussion on the outcomes of the historic bond offering.

He pointed out that investor trust in Nigeria's economic stability and growth potential is reflected in the oversubscription.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

English (US) ·

English (US) ·