- FBN Holdings, the parent company of First Bank, has reported gross earnings of N2.2 trillion in the first nine months of 2024

- The banking group recorded a 134% rise in its earnings relative to the N962.40 billion it recorded in 2024

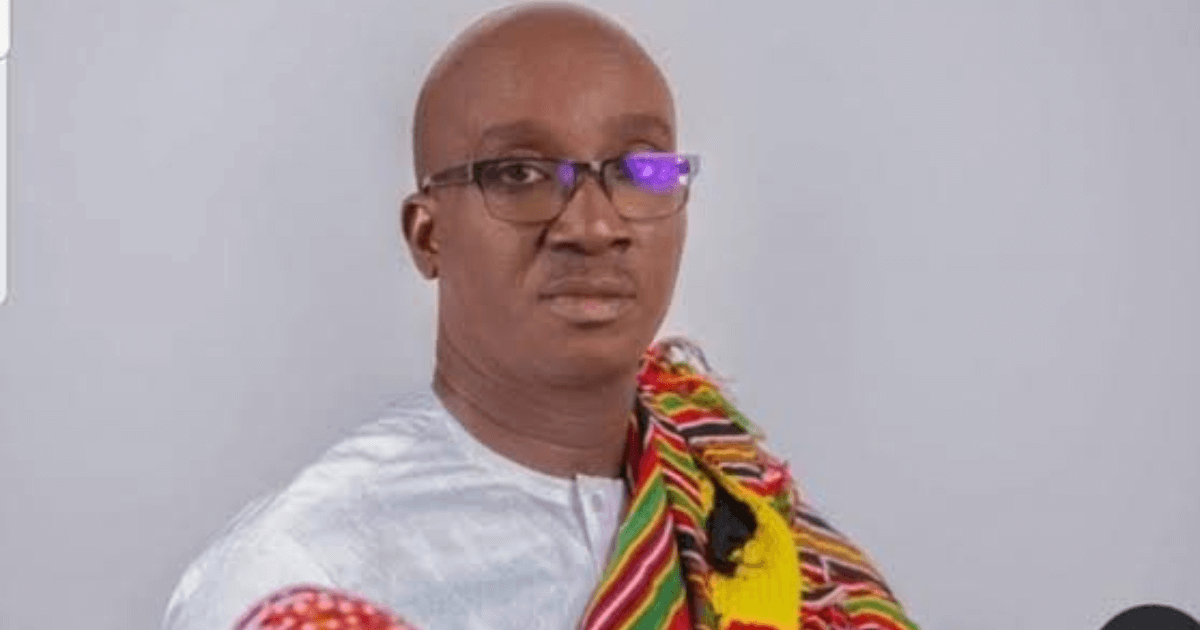

- The company’s group managing director, Nnamdi Okonkwo, attributed the bank’s earnings to operational efficiency

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

FBN Holdings Plc's gross earnings increased 134% to N2.2 trillion at the end of September 2024 relative to N962.40bn recorded for the same period in 2023.

The earnings were disclosed in the bank’s unaudited result in the first nine months of 2024, filed with the Nigerian Exchange Limited on Wednesday, October 30, 2024.

Source: Getty Images

First Bank’s revenue jumps 164%

The holding company’s revenue improved due to the 164.6% growth in interest income, which was N1,63 trillion from N617.1 billion as of September 2023.

Despite operating expenses rising by 94.8% to N676.8 billion from N347.5 billion, the company’s profit before tax rose by 128% yearly to N610.9 billion, and profit for the period grew by 125.8% to N533.9 billion from N236.4 billion.

The financial institution’s assets stood at N27.5 trillion, showing a 62.3% yearly growth. Customer deposits increased by 56.8% to N16.7 trillion, and net loan advances stood at N9.4 trillion.

First Bank’s GMD reveals reasons for growth

According to a Punch report, Nnamdi Okonkwo, the Group Managing Director of FBN Holdings Plc, disclosed that the banking group delivered a robust performance in the first nine months of the year, achieving significant growth driven by the effective execution of its strategic priorities.

He said that despite a challenging operating environment, the bank has focused on operational efficiency, customer-centric innovations, and prudent risk management to generate sustainable value for its stakeholders.

He disclosed that the bank’s gross earnings increased 134% to N2.3 trillion. In comparison, profit before tax rose by 128% to N610.9 billion, showing its ability to drive customer relationships, boost revenue streams, and deliver solid returns.

Okonkwo said:

“We remain focused on executing our digital transformation strategy, enhancing customer experience, and driving long-term growth.”FBN Holdings moves to change name

Legit.ng reported that the banking group proposed changing its name at the forthcoming Annual General Meeting (AGM).

FBN Holdings Plc has announced plans to change its legal and brand name to First HoldCo Plc at its upcoming 12 Annual General Meeting (AGM) on November 14, 2024.

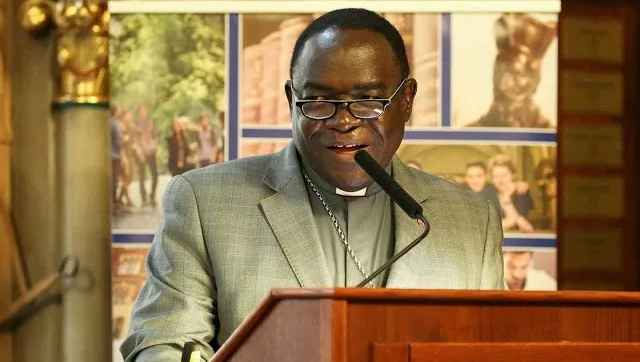

The bank announced this in a notice signed by the company's acting secretary, Adewale Arogundade.

The New Telegraph reports that the name change is one of the several notable decisions the bank’s shareholders will consider at the AGM.

FBN Holdings announces N150bn right issue

Legit.ng earlier reported that FBN Holdings Plc (FBNH) had started a significant capital raise through a rights issue offering around 6 billion new shares to strengthen First Bank of Nigeria Limited, its flagship company.

A signing ceremony was performed at the company's headquarters in Marina, Lagos, to formally announce the rights issue, which has a value of over N149.6 billion..

BuisnessDay reported that current shareholders may subscribe for one new share, valued at N25.00 per share, for every six already held.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

English (US) ·

English (US) ·