A total of N1.354 trillion in revenue from the June 2024 federation account has been allocated to the federal government, states, and local government areas across Nigeria.

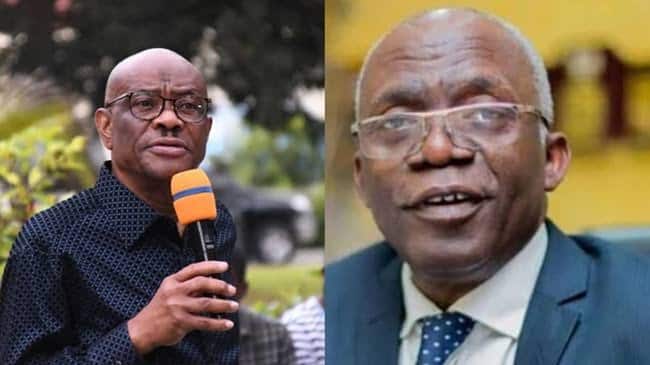

The distribution occurred during the July 2024 Federation Accounts Allocation Committee (FAAC) meeting in Abuja, presided over by the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun.

According to a communiqué from FAAC, the N1.354 trillion total distributable revenue includes N142.514 billion from statutory revenue, N523.973 billion from Value Added Tax (VAT), N15.692 billion from electronic money transfer levy, N472.192 billion from exchange differences, and an augmentation of N200 billion.

In June 2024, the total revenue available was N2,483.890 billion.

After deducting N92.112 billion for collection costs and N1.1 billion for transfers, interventions, and refunds, “the remaining gross statutory revenue for June 2024 was N1,432.667 billion. This figure shows an increase of N208.773 billion from the N1,223.894 billion received in May 2024,” a statement from the Office of the Accountant General of the Federation said.

The VAT gross revenue for June 2024 amounted to N562.685 billion, an increase of N65.020 billion from the N497.665 billion available in May 2024.

From the total distributable revenue, the federal government received N459.776 billion, the states got N461.979 billion, and the LGAs received N337.019 billion. Additionally, N95.598 billion, representing 13 percent of mineral revenue, was allocated to the states benefiting from derivation revenue.

Regarding the N142.514 billion in distributable statutory revenue, the federal government received N48.952 billion, the states received N24.829 billion, and the LGAs received N19.142 billion.

Another N49.591 billion, representing 13 percent of mineral revenue, was allocated to the benefiting states.

Out of the N523.973 billion in distributable VAT revenue, the federal government received N78.596 billion, states received N261.987 billion, and the local government areas received N183.391 billion.

In terms of the N15.692 billion money transfer levy, the federal government received N2.354 billion, states: N7.846 billion, and the LGAs N5.492 billion.

For the N472.192 billion from exchange differences, the federal government was allocated N224.514 billion, the states received N113.877 billion, and the LGAs received N87.794 billion. Additionally, N46.007 billion, representing 13% of mineral revenue, was given to the benefiting states.

Similarly, from the N200.000 billion augmentation, the federal government received N105.360 billion, the states received N53.440 billion, and the LGAs received N41.200 billion.

The communiqué further noted that in June 2024, there were significant increases in companies’ income and VAT, with marginal increases in Import and Excise Duties and EMTL.

However, there were notable decreases in royalty crude, petroleum profit tax, rentals, and CET levies.

The balance in the Excess Crude Account (ECA) stood at $473,754.57.

4 months ago

49

4 months ago

49

![Just In: Tinubu Departs Aso Villa For Late COAS Lagbaja’s Burial [Video]](https://www.naijanews.com/wp-content/uploads/2023/06/20230622_180721.jpg)

English (US) ·

English (US) ·