The Federal Government has increased the maximum amount available for small businesses to access through single-digit loans to ₦5 million, aiming to promote inclusive economic growth across the nation.

This announcement was made by Dr Olasupo Olusi, the Managing Director and Chief Executive Officer of the Bank of Industry (BOI), during a town hall meeting held in Lagos on Friday, which focused on the Federal Government Grant and Loan Scheme.

The Federal Ministry of Finance organized the event in partnership with the Federal Ministry of Industry, Trade and Investments, the Presidency, the Bank of Industry, and various other stakeholders.

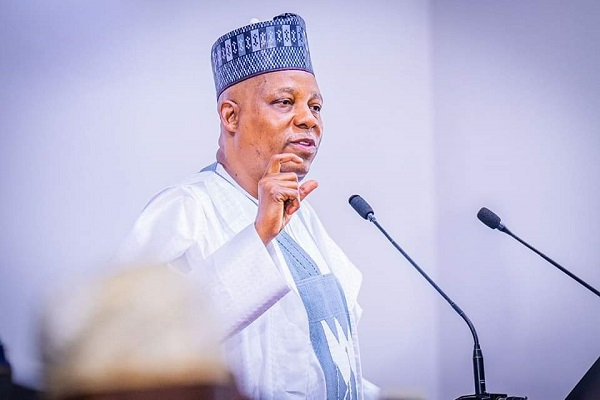

Olusi, represented by Umar Shekarau, Executive Director of MSMEs at the Bank of Industry, commended President Bola Tinubu for establishing a ₦200 billion Presidential Intervention Fund to support Micro, Small, and Medium Enterprises.

He noted that ₦75 billion from the presidential conditional grant and loan scheme is allocated explicitly for MSMEs, with the initiative anticipated to generate thousands of direct and indirect job opportunities throughout the country.

The head of the Bank of Industry stated that the fund, readily available for disbursement at a competitive interest rate of nine per cent, is being managed through the Bank of Industry’s nationwide network.

He encouraged business owners to either visit the Bank of Industry directly or register online to access loans and grants, emphasizing that they should avoid intermediaries in the process.

According to his remarks, over 800,000 Nigerians have already benefited from this initiative, with opportunities still available for the inclusion of youth, women, individuals with disabilities, and all Nigerians.

“We maintain our integrity as BoI and disburse the funds,” he said.

It is worth noting that the town hall meetings are being conducted simultaneously across six states within the federation.

Temitola Adekunle-Johnson, the Senior Special Assistant to the President on Job Creation and Micro, Small, and Medium Enterprises, announced that successful applicants will now be eligible for an increased loan amount of ₦5 million.

This represents a significant increase from the previous benchmark of ₦1 million, designated to enhance their business operations.

He noted that President Tinubu allocated these funds to alleviate the challenges businesses face, including issues related to access to finance and infrastructure.

The loan is offered at a nine per cent interest rate with a three-year tenure, allowing a single MSME to borrow up to ₦5 million at a single-digit interest rate.

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, outlined the various interventions initiated by the presidency to support small businesses and the manufacturing sector, highlighting the successes achieved thus far.

Edun, who Ahmed Gazalli represented, emphasized that the event signifies a crucial step in our collective pursuit of economic empowerment and sustainable growth.

He stated that the purpose of the gathering was to promote a unified vision for communal prosperity within a flourishing and inclusive economy where every Nigerian is equipped with the necessary tools and resources to thrive.

Edun reiterated the government’s strong commitment to fostering the growth of MSMEs and ensuring the success of the manufacturing sector to reposition Nigeria’s economy effectively.

“It is common knowledge that MSMEs are the backbone of the Nigerian economy, and if we do not support our MSMEs’ prosperity, the Nigerian economy suffers,” he said.

He thanked the MSMEs and beneficiaries in attendance for their hard work, sacrifice, and contributions to the development and stability of Nigeria.

Minister of State for Industry, Trade and Investment, Sen. John Eno, said the government was eager to support programmes and initiatives that promote the welfare of Nigerians.

Eno pledged the government’s commitment to help all the agencies to deliver on their mandates.

He called for collaboration to remove barriers to the growth of MSMEs.

“It is such collaboration that can make it work,” he said.

In his remark, Special Adviser, Industry, Trade and Investment, Mr John Uwajumogu, explained the gains of supporting industries with finance for inclusive growth.

Some beneficiaries included Mr Akor Goddy, a vegetable farmer and vendor from Badagry; Angela Christopher, a nanny; and Mr William Asuquo, a food vendor from Isolo in Lagos.

2 hours ago

1

2 hours ago

1

English (US) ·

English (US) ·