Foreign exchange inflows from International Money Transfer Operators increased by 38.86 per cent to $1.07bn in the first quarter of 2024, from $770.23m recorded in the same period in the previous year.

This was revealed in the Central Bank of Nigeria’s quarterly statistical bulletin for the first quarter of 2024, which was recently published on its website.

According to the data, in January, the IMTOs recorded inflows worth $383.04m, it dropped in February to $322.83m and returned upward in March to $363.70m.

When compared with the last quarter of 2023, the inflows from IMTOs grew by 10.74 per cent.

Recently, the apex bank revealed that it had granted approvals-in-principle to 14 new IMTOs, to help increase the sustained supply of foreign exchange in the official market.

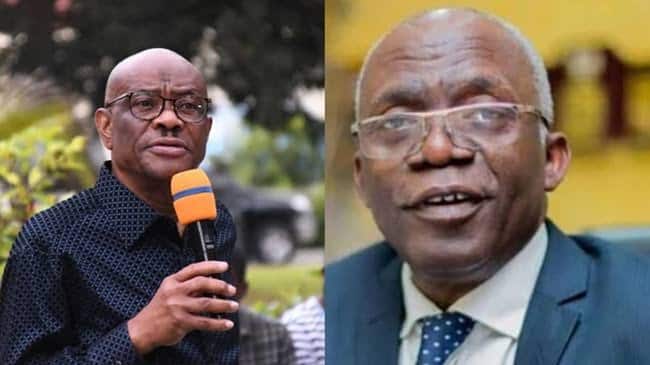

The CBN Governor, Dr Olayemi Cardoso, said that the recent approval of licenses for 14 IMTOs was expected to improve competition and lower the cost of transactions, thus attracting more remittances through formal channels.

“Let me give some context to this. I’m sure over the years; many of you would have read from the World Bank that Nigeria has significant remittances from the diaspora. We have identified that this is a critical element of inflows coming into the country. It is estimated to represent about six per cent of our GDP. We felt from the Central Bank’s perspective that to have a strategy to engage this sector, the entities that seem to play the biggest role in that sector are the IMTOs and so for us, it was important for us to meet them,” he said at the end of the Monetary Policy Committee meeting in May.

Also, the CBN has announced that eligible international money transfer operators will now have access to the official window to sell foreign exchange.

In a circular signed by the acting Director of the Trade and Exchange Department, Dr W.J. Kanya, the apex bank said that the measure, which was effective immediately, would enable IMTOs to access naira liquidity at the official window, thus, enabling the timely settlement of diaspora remittances.

The apex noted, “The bank has implemented measures that will enable eligible International Money Transfer Operators to access NGN liquidity at the CBN window. These measures are aimed at widening access to local currency liquidity for the settlement of diaspora remittances.

“Therefore, eligible IMTO operators will be able to access the CBN window directly or through their authorised dealer banks to execute transactions for the sale of foreign exchange in the market.”

3 months ago

59

3 months ago

59

English (US) ·

English (US) ·