Following President Bola Tinubu’s directive, the Economic and Financial Crimes Commission recently disbursed N100bn to fund the Nigerian Education Loan Fund and the Consumer Credit Corp, marking a new twist to the nation’s fight against corruption, writes ’LAOLU AFOLABI

In a significant move that underscores the government’s commitment to using recovered assets for the public good, the Economic and Financial Crimes Commission recently disbursed N100bn to fund two critical initiatives aimed at uplifting the lives of Nigerians.

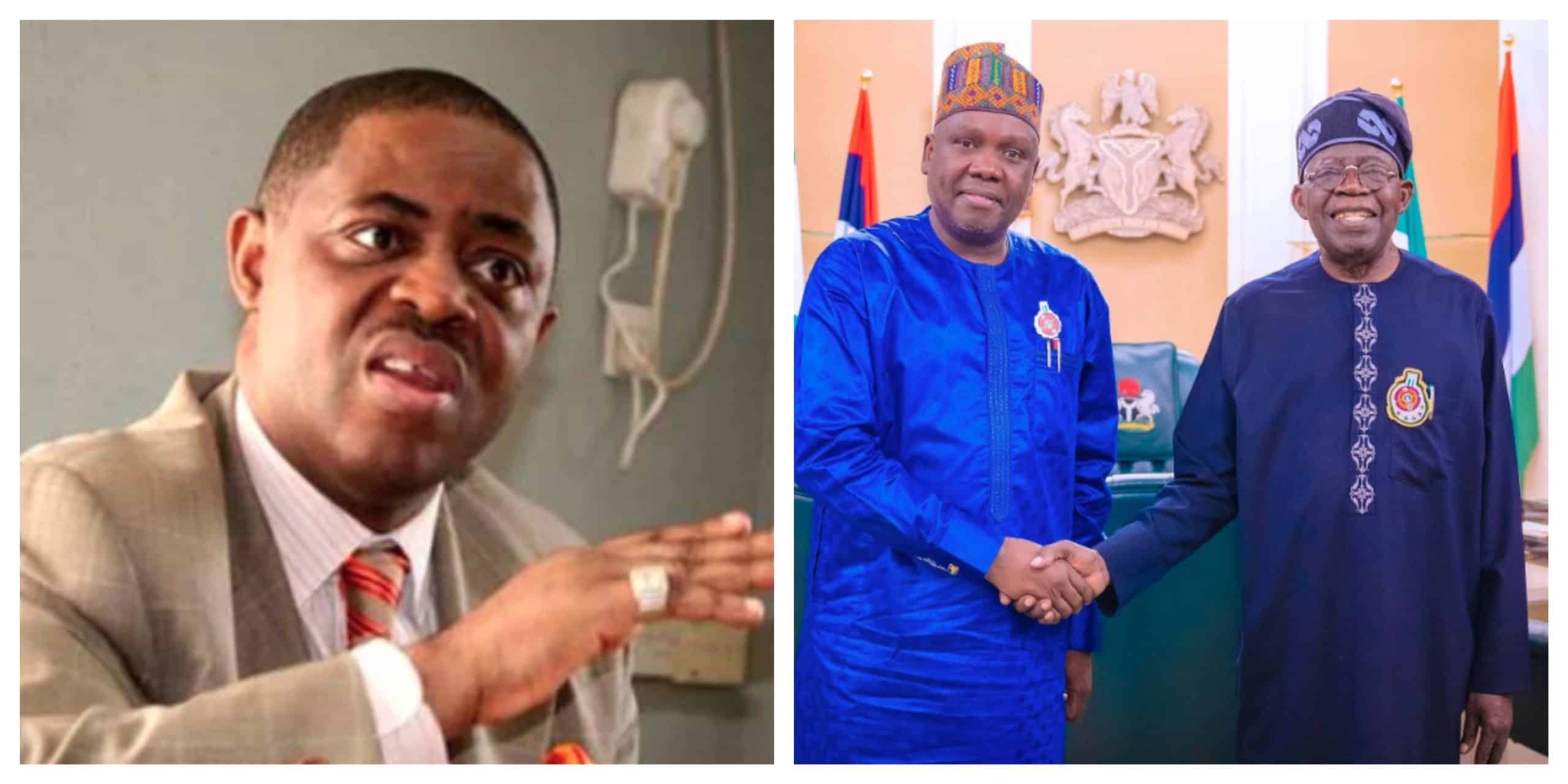

President Bola Tinubu announced in his August 4 broadcast to the nation, following the breakout of the #Endbadgovernance protest nationwide, that he had allocated N50bn each to the Nigerian Education Loan Fund and the Consumer Credit Corporation.

Nigeria’s battle against corruption has thus taken a new dimension, one where the proceeds of crime are being redirected to fuel national development. Based on Tinubu’s directive, the EFCC was empowered to channel N100bn from recovered funds into the government’s initiatives.

This strategic allocation is not just about recovering stolen wealth but also about ensuring that these funds serve a greater purpose – uplifting the lives of ordinary Nigerians and driving economic growth. These funds, sourced from the proceeds of crimes recovered by the EFCC over the past year, are poised to have a transformative impact on the country, particularly in the areas of education and consumer finance.

From May 2023 to May 2024, the EFCC made substantial strides in its mission to curb corruption and recover ill-gotten wealth. The agency’s efforts resulted in the recovery of over N231.6bn in the Nigerian currency alone, alongside significant amounts in other currencies, including $70.26m in United States dollars.

The commission also recovered £29,264.50, €208,297.10, 51,360.00 Indian Rupee, 3,950.00 Canadian Dollar, 740.00 Australian Dollar, 35,000 Rand, 42,390 UAE Dirhams, 247.00 Riyals and ¥74,754.00. These recoveries were the fruits of a relentless campaign against financial crimes. The commission had 15,753 petitions, investigated 12,287 cases, filed 5,376 cases in courts and secured 3,451 convictions.

With over N231bn recovered in naira alone, the commission has not only cracked down on corruption but has also laid the groundwork for the funds to be reinvested into society. The recovered assets, previously the spoils of crime, are now being repurposed to address some of Nigeria’s most pressing challenges, from education to financial inclusion.

The decision to channel a portion of these recovered funds into NELFUND is a strategic one. Established under the Tinubu administration, NELFUND is designed to provide financial support to indigent students across Nigeria, ensuring that financial hardship does not bar anyone from accessing higher education. The injection of N50bn into the fund represents a significant boost to its capacity, enabling it to expand its reach and support more students.

Already, the impact of this funding is evident. Since the launch of the NELFUND portal in May 2024, over 22,000 students have benefited from loans totalling N2.5bn. The fund has seen a surge in applications, reflecting the high demand for educational support in a country where many parents struggle to afford tuition fees. The story of NELFUND is not just about numbers; it is about the lives being changed. From the daughter of a humble gateman who aspires to become a doctor to a local mechanic who has transformed into a certified automobile engineer through vocational training, NELFUND is making dreams possible.

The other half of the N100bn allocation went to the Consumer Credit Corporation, an institution aimed at improving access to credit for everyday Nigerians. By making affordable loans available for consumer purchases, this initiative seeks to boost financial inclusion and stimulate economic growth. The corporation’s mission aligns with broader government goals of reducing poverty and fostering economic stability by empowering citizens to meet their financial needs without resorting to predatory lending practices.

Road ahead

As Nigeria continues to grapple with economic challenges, the strategic use of recovered funds could play a crucial role in driving social and economic development. The N100bn allocated to NELFUND and the Consumer Credit Corporation is just the beginning. With continued recovery efforts and prudent management, these funds have the potential to catalyse significant changes in the education sector and beyond, providing opportunities for thousands of Nigerians to rise above their circumstances and contribute to the nation’s growth.

In a recent statement, NELFUND’s Managing Director/CEO, Akintunde Sawyerr, captured the essence of this initiative, “We stand at the crossroads of possibility, ready to shape a future where every individual, regardless of state of origin, religious or political affiliation, can dream and flourish.

“This vision, supported by the prudent use of recovered assets, represents a new chapter in Nigeria’s journey towards equity, opportunity, and national prosperity. The government’s strategic use of recovered assets is making this vision a reality, demonstrating that with the right policies and leadership, the proceeds of crime can indeed be turned into instruments of progress.

“This approach is a testament to the power of good governance and a reminder that the fight against corruption, when combined with a commitment to public welfare, can yield dividends far beyond the courtroom. It is a new chapter in Nigeria’s story — one where justice and development go hand in hand, and where the proceeds of crime are transformed into opportunities for growth, education, and a brighter future for all.”

The fund’s chairman, Jim Ovia, and Sawyerr are steering the initiative with a clear vision: to ensure that every deserving student has the opportunity to pursue their educational dreams, regardless of their financial background.

The stories emerging from this initiative are inspiring. Take, for example, the daughter of a gateman who, with the help of NELFUND, is now on the path to becoming a doctor. Or the young mechanic, Adamu Adebisi Ugo, who used the fund’s vocational skills programme to transition from a local apprentice to a certified automobile engineer. These are not just individual success stories; they are proof of the transformative power of targeted financial support.

The Consumer Credit Corporation, which also received N50bn from the recovered funds, is another pillar of the government’s strategy to improve the lives of Nigerians. By making credit more accessible, the corporation aims to empower citizens to meet their financial needs, whether for personal or business purposes. This initiative is particularly significant in a country where access to affordable credit has historically been limited, often forcing individuals into debt traps with predatory lenders.

The Consumer Credit Corporation is designed to bridge the gap, offering Nigerians a more reliable and transparent source of credit. This not only helps individuals manage their finances better but also stimulates the economy by increasing consumer spending and supporting small businesses. In the long run, the corporation’s work is expected to contribute to broader economic stability and growth, creating a more financially inclusive society.

The EFCC’s involvement in these initiatives goes beyond merely transferring funds. The agency, under the leadership Ola Olukoyede, stressed the importance of transparency and accountability in the management of these resources.

Olukoyede stressed that the move is part of a broader strategy to ensure that the fight against corruption has tangible benefits for the public. “One of the main incentives for cybercrimes is the inability of parents to fund the education of their children. NELFUND is a policy issue against crimes,” the EFCC boss said, underscoring the link between financial hardship, lack of education, and criminal activities. By investing in education through NELFUND, the government is tackling the root causes of crime while empowering the next generation of Nigerians.

In a recent meeting with NELFUND officials, Olukoyede reiterated the need for strict oversight to ensure that the funds are used effectively and do not fall victim to corruption. He also urged NELFUND to regularly report on its disbursements, ensuring that every naira is accounted for and used to fulfil its intended purpose.

This approach is not just about safeguarding the funds but also about reinforcing public trust in the government’s anti-corruption efforts. By demonstrating that recovered assets are being put to good use, the EFCC and the government are sending a powerful message: the fight against corruption is not just about punishing wrongdoers but also about returning stolen wealth to the people and using it to build a better future.

The commission has made it clear that it will maintain oversight of how these funds are managed and disbursed. This focus on transparency is essential for building public trust in these initiatives. By ensuring that every naira is accounted for and used effectively, the government is not only safeguarding the funds but also reinforcing the public’s confidence in its ability to manage resources responsibly. This commitment to accountability is a cornerstone of the broader anti-corruption strategy, demonstrating that the fight against corruption is about more than just recovering stolen assets — it is about using those assets to build a better Nigeria.

Setting a precedent

The allocation of N100bn from recovered funds to fund these important initiatives sets a precedent for how Nigeria can use the proceeds of crime to benefit its citizens. This approach aligns with global best practices, where recovered assets are reinvested into society to address the root causes of crime, improve public services, and support vulnerable populations.

For Nigeria, this strategy is particularly important, given the country’s ongoing challenges with poverty, inequality, and economic instability. By investing in education and financial inclusion, the government is addressing some of the most critical barriers to development.

Moreover, these initiatives are not just about immediate impact, they are about laying the foundation for long-term change, ensuring that the benefits of these investments are felt for generations to come.

2 months ago

6

2 months ago

6

English (US) ·

English (US) ·