- The United Bank for Africa (UBA) reports a 39.6% increase in gross earnings for the first half of 2024

- This is in spite of the challenging macroeconomic conditions and the geopolitical environment in the country

- Head of UBA's media and external relations revealed double-digit rise in the bank's operating incomes

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

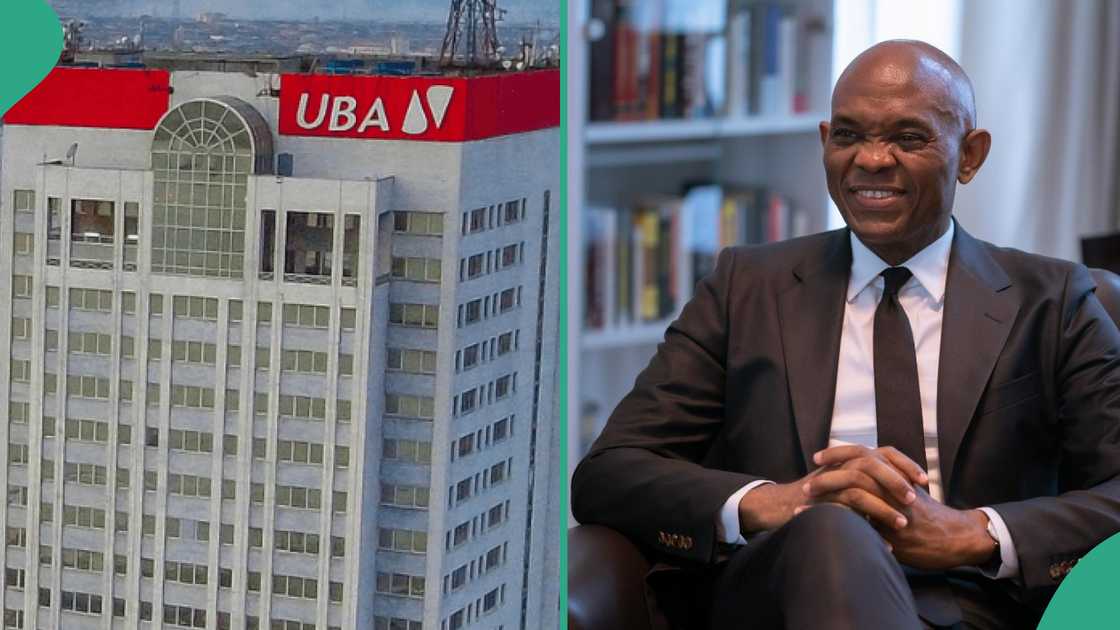

For the first half (H1) of 2024, the United Bank for Africa (UBA) reports a 39.6% increase in gross earnings.

Source: UGC

UBA stated that its gross earnings climbed from N981.77 billion in 2023 to N1.37 trillion by June 2024 in a statement released on Monday, discussing its audited financial performance for the half year ended June 30, 2024.

The bank claimed this accomplishment. despite Nigeria's challenging macroeconomic conditions and the geopolitical environment in which it works.

The audited financials provided to the Nigerian Exchange Limited (NGX) revealed double-digit rise in the bank's operating incomes, according to Ramon Nasir, head of UBA's media and external relations.

According to him, total assets increased by 37.2%, from N20.6 trillion in December 2023 to N28.3 trillion, while interest income increased by 134.3% to N1 trillion, from N428.2 billion in June of last year.

According to Nasir, customer deposits rose by 33.7% in the same time frame, from N17.3 trillion at the end of 2023 to N23.2 trillion.

“The results filed showed that profit before tax (PBT) which stood at N403 billion in June 2023, closed the half year at N402 billion, while profit after tax (PAT) dropped slightly from N378 billion to N316 billion in the year under consideration,” he said.“However, the banks’ shareholders funds increased by 47 percent from N2.03 trillion in December 2023, to N2.99 trillion.”According to him, total assets increased by 37.2 percent, from N20.6 trillion in December 2023 to N28.3 trillion, while interest income increased by 134.3 percent, to N1 trillion, from N428.2 billion in June of last year.

According to Nasir, customer deposits rose by 33.7 percent in the same time frame, from N17.3 trillion at the end of 2023 to N23.2 trillion.

Oliver Alawuba, the group managing director (MD) and CEO of UBA, remarked on the outcomes and emphasized the bank's dedication to continuously providing value to its investors.

“UBA Group has continued to deliver strong double-digit growth in high quality and sustainable banking revenue streams, driven by a focused growth in balance sheet, transaction and digital banking businesses across geographies in line with our strategic goals,” Alawuba said.“The Group’s performance has been buoyed by consistent strong growth in all core and sustainable banking income lines. Our intermediation business showed strong growth with net interest income expanding by 143% YoY to N675billion.“As the Group intensifies its customer acquisition drive, we are making significant investments in technology, data analytics, product research and innovation to enhance our value proposition and customer experience.”List of five largest commercial banks

Legit.ng reported that the combined total asset value of Nigeria's tier-one largest banks increased to N116.80 trillion as of the end of the first quarter of 2024.

This figure represents a 23.81% or N22.46 trillion increase compared to N94.33 trillion as of December 2023.

Nigeria's Tier 1 banks: FBN Holdings (First Bank), Access Holdings (Access Bank), GTCO (GTBank), UBA, and Zenith Bank

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

English (US) ·

English (US) ·