BY TEMITOPE ADEBAYO

In a landmark move following the closure of Heritage Bank, the Nigeria Deposit Insurance Corporation (NDIC) has announced that it has successfully disbursed 82.36 per cent of insured deposits to affected customers.

This significant progress comes in the wake of the Central Bank of Nigeria (CBN) revoking Heritage Bank’s banking license on June 3, 2024.

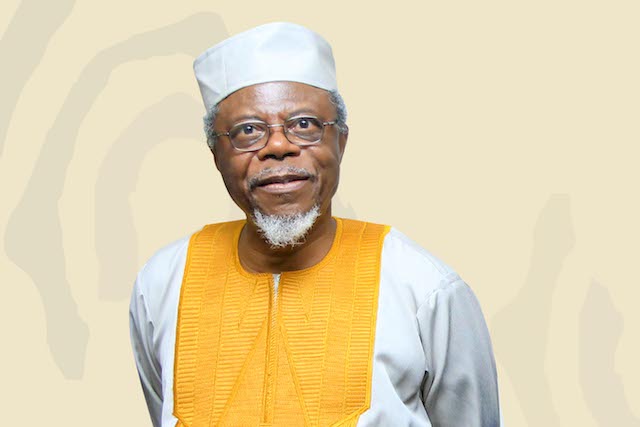

The NDIC, in a statement signed by its Director, Communication & Public Affairs, Bashir A. Nuhu, and obtained by The Daily Times yesterday, explained that the Corporation appointed as the bank’s liquidator, has executed a swift and efficient reimbursement process under the provisions of Section 12(2) of the BOFIA 2020 and Section 55 subsections 1 & 2 of the NDIC Act 2023.

According to the Corporation, within just four days of the bank’s closure, the NDIC began distributing insured deposits up to Five Million Naira (N5,000,000) per depositor. This unprecedented move was facilitated through the use of Bank Verification Numbers (BVN), allowing for direct payments to depositors’ alternate accounts at other banks.

READ ALSO: Nigeria’s bid to upscale the war against human slavery

“This new method has eliminated the need for depositors to visit NDIC offices or complete additional paperwork, representing a historic shift in the efficiency of deposit reimbursement.

“Despite this progress, 17.64 per cent of insured deposits remain pending. This outstanding percentage primarily involves depositors with accounts flagged with post-no-debits (PND) instructions, those lacking BVNs, or those with limitations on daily transactions.

“The NDIC is actively reaching out to these individuals via telephone and text messages to facilitate their verification process. Depositors are encouraged to visit NDIC offices or access the verification portal online at www.ndic.gov.ng/claims to complete their claims”, it stated.

In addition to the insured deposits, the NDIC, pointed out that it is working diligently to address uninsured deposits, which constitute a larger portion of the total deposits at the defunct bank.

“The process includes the recovery of debts and the realization of the bank’s investments and physical assets. Payments to uninsured depositors will be made through liquidation dividends as the bank’s assets are liquidated.”

Following the settlement of both insured and uninsured deposits, the NDIC, noted that it will proceed with payments to creditors in line with legal priorities.

The Corporation, therefore, reassures the public of its commitment to the security of depositors’ funds and the stability of all licensed banks. Customers are encouraged to continue their banking activities with confidence, knowing that all other financial institutions remain robust and secure.

For further assistance, depositors and the public can contact the NDIC Claims Resolution Department by email at claimscomplaints@ndic.gov.ng or by phone on weekdays from 9:00 a.m. to 5:00 p.m. at 810 422 0807, 0810 931 3326, 0903 819 7064, 0906 465 7140, or 0903 727 3810.

English (US) ·

English (US) ·