Experts in the petroleum industry has suggested that with effective government intervention, petrol from the Dangote Refinery could be sold for less than ₦600 per litre.

The Crude Oil Refiners Association of Nigeria (CORAN) expressed optimism that local refineries, including Dangote’s, could reduce fuel costs if proper measures are put in place.

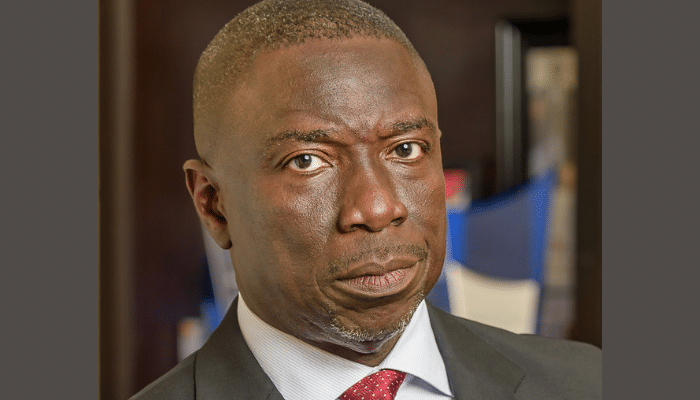

The Publicity Secretary of CORAN, Eche Idoko, shared with Sunday PUNCH that the ₦898 per litre price quoted by the Nigerian National Petroleum Company (NNPC) for petrol purchased from Dangote’s refinery was a result of the high exchange rate.

However, Idoko stated that with the exchange rate capped at ₦1,000 to the dollar for locally-produced petroleum, the price could fall to ₦550 per litre.

Idoko clarified that the petrol currently being sold by Dangote was refined from crude purchased in June, with 60% of it supplied by NNPC and the remainder imported by Dangote at international prices.

“If you remember, we did say that if we begin to refine locally and there is a naira sale, the price of PMS will drop. We still stand strongly by that position. This particular batch of product that is being sold by Dangote, the crude was purchased in June at the international price.

“NNPC supplied 60 per cent of that crude and the remaining percentage was imported by Dangote at the international price. Now, when they refine that product, they have to sell at the international price because they are a business, they have to make money,” Idoko said.

He further emphasised that even at ₦898 per litre, NNPC is purchasing the fuel at a rate ₦300 less than the landing cost of nearly ₦1,200 per litre for imported petrol.

He explained that local refining would help eliminate this ₦300/litre margin without any further intervention.

“The pricing that you are seeing now is a reflection of what the international price is, less the cost of freighting. If you look at it now, NNPC was buying the product at ₦300 less; they’re paying ₦300 more for the product they were importing than what they are buying from Dangote at ₦889.

“That ₦300/litre was what I had mentioned before that local refining would take care of, even without any intervention,” he noted.

Idoko also pointed out that selling crude in naira would reduce the nation’s dependence on foreign exchange by about 40%, as a significant portion of the country’s foreign currency goes towards importing petroleum products.

“If the financial sector is sincere, we should see an immediate climb by the naira against the dollar. And if the naira climbs against the dollar, without even the government pegging the price of the exchange rate for dollars in the pricing of that group, we will see a reduction in the price automatically,” the CORAN spokesman stated.

To significantly lower petrol prices, Idoko recommended that the Federal Government sell crude to local refineries in naira and peg the exchange rate for these transactions at ₦1,000 to the dollar. He argued that this would result in a substantial reduction in the pump price.

“But because we are not completely in touch with what happens in the financial sector, we have said to the government – two things you will do. You will sell in naira at a discount, and then at that discount, you will peg the price at a particular exchange rate to the dollar.

“For instance, you can say, you are using ₦1,000 as an exchange rate for this dollar deal, for the locally refined petroleum products. And like that, you will see a significant drop in the price,” he stated.

Additionally, Idoko reassured the public that concerns about Dangote becoming a monopoly are unfounded.

Dangote is a member of CORAN and would be subject to the association’s rules, with the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA) acting as a watchdog to prevent monopolistic practices.

“So, whatever is happening now is outside whatever is being discussed by the government. And there is a whole lot of politics here and there. Some people are afraid that this would make Dangote become a monopoly.

“Dangote now is a member of our association and will play by the rules of our association. We would also control the chances of monopoly to start with. Then the NMDPRA is there as a major gatekeeper to control any form of monopoly.

“There are two more things I will say, rather than see what is happening as a minus, NNPC should be thanking the local players for coming in to rescue them. The NNPC should see Dangote and the other private players that have come in as a partner and work with them to solve this issue. Let us all work together and not try to gaslight the public against the other person,” he said.

Idoko criticised the levies and taxes imposed on petroleum by NMDPRA, noting that about 25-30% of the pump price goes to the government.

He urged the authorities to reconsider these charges, especially during a time when Nigerians are struggling financially, suggesting that they could be reinstated once the economic situation improves.

In his final analysis, Idoko noted that a litre of petrol from Dangote’s refinery costs about $0.52, which equates to ₦842.61 at the current exchange rate of ₦1,637 to the dollar.

However, if the exchange rate were pegged at ₦1,000, the price would drop to ₦550 per litre. He suggested that with the removal of levies and taxes, the price could even fall below ₦600.

Asked if he is certain that the government can cap the dollar rate at ₦1,000, Idoko retorted, “For this intervention, yes. The crude belongs to the people now, and it’s NNPC’s crude. NNPC can give the crude for local refining at $1,000. You refine, the NNPC collects everything and stores it.

“The NNPC needs a strategic storage arrangement. We have depots in almost all the states in Nigeria. Load those depots with PMS for the rainy day.

“Right now, people don’t have the purchasing power. With the intervention, we can keep the price under ₦600, maintaining this ₦1,000 as the dollar benchmark for 36 months, after which we will review and go higher.

“What you are using to buy these things now are purely internal funds. You are not sourcing for dollars or anything; it’s Nigeria to Nigeria. The crude is your own. The currency you are receiving is your own.”

He concluded that, with this intervention, Nigeria could stabilise petrol prices at under ₦600 per litre using domestic resources without relying on foreign exchange, ensuring a more sustainable approach to fuel pricing in the long term.

2 hours ago

34

2 hours ago

34

![[LIVE UPDATES] #EdoDecides: Edo State 2024 Governorship Election LGA Results](https://www.naijanews.com/wp-content/uploads/2024/09/Edo-Election-Results-Update-1024x576.png)

English (US) ·

English (US) ·