- Beneficiaries, legal agents, or next of kin may now collect unclaimed money from dormant accounts

- A management committee will oversee the accounts under the guidance of a special office

- Account holders will visit banking establishments to complete a reclaim form, along with supporting evidencek

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

Unclaimed amounts in inactive accounts may now be claimed by beneficiaries, legal agents, or next of kin, according to the Central Bank of Nigeria (CBN).

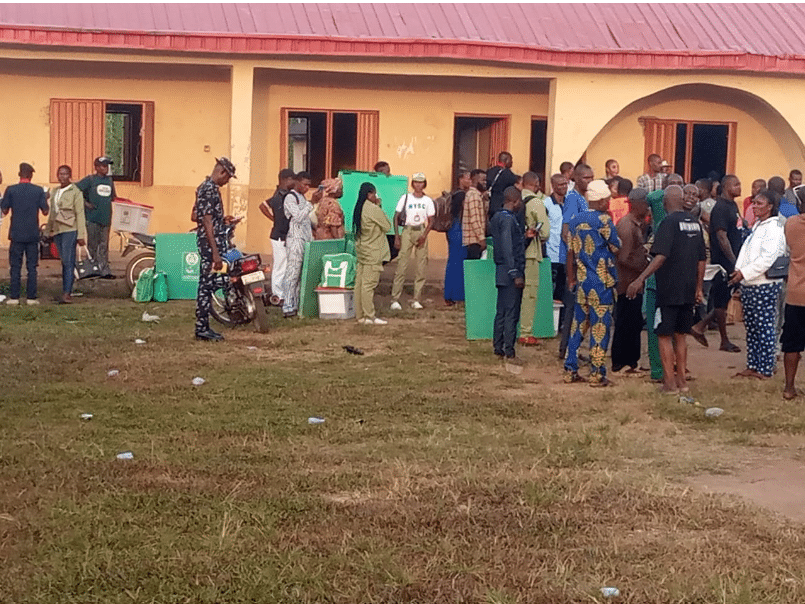

Source: UGC

Tribune reported that this was made clear in a story that the CBN published over the weekend. It said that by submitting applications to financial institutions, next-of-kin can now claim unclaimed funds.

Legal documentation of ownership and, for corporate entities, information about directors and authorized signatures must be included with these applications.

Who is in charge of dormant account?

The CBN is in charge of overseeing inactive accounts and unclaimed money and the procedure will be managed by a management committee under the direction of a dedicated office.

The CBN will invest the unclaimed money in treasury bills and other securities and lodge it in the Unclaimed Balances Trust Fund (UBTF) Pool Account. After a reclaim request, beneficiaries will get a refund of the principal plus any interest within ten business days.

Steps to claiming funds

Account holders will go to banking institutions to fill out a reclaim form and provide documentation of their identity, ownership, and a signed affidavit.

Financial institutions will verify the claim and provide it to the CBN in 10 days. The CBN will reimburse the money ten days after it receives the request.

Dormant accounts will be handled by the Nigeria Deposit Insurance Corporation (NDIC) in the event that a financial institution's license is revoked. This restriction also applies to balances in inactive domiciliary accounts; active domiciliary accounts are not affected.

No customer-initiated transactions occur on an inactive account for a period of six to twelve months. At least a year passes before a dormant account is activated again. Any sum that has lain inactive for ten years or longer is considered unclaimed.

Eligible accounts include current, savings, term deposits, domiciliary accounts, deposits for shares, prepaid card accounts, government-owned accounts, and more. Accounts that are being litigated, investigated, or burdened are considered exempt.

Banks are required by the CBN to notify account owners when an account goes dormant or inactive, as well as once a quarter after that.

The CBN only recently ordered banking institutions to move all unclaimed money to an account under the control of the top bank.

This was stated in updated instructions that were published for the administration of inactive accounts, unclaimed money, and other assets held by banks and other financial organizations.

Another Bank Set to Begin Operation in Nigeria

Legit.ng reported that Summit Bank has just received provisional licensing from the Central Bank of Nigeria (CBN) to begin operation.

The new licence brings the total number of full-fledged Islamic banks licenced in the country to six.

Non-interest banking, devoid of interest rates, operates under a robust ethical framework governing all its operations and transactions.

Source: Legit.ng

English (US) ·

English (US) ·