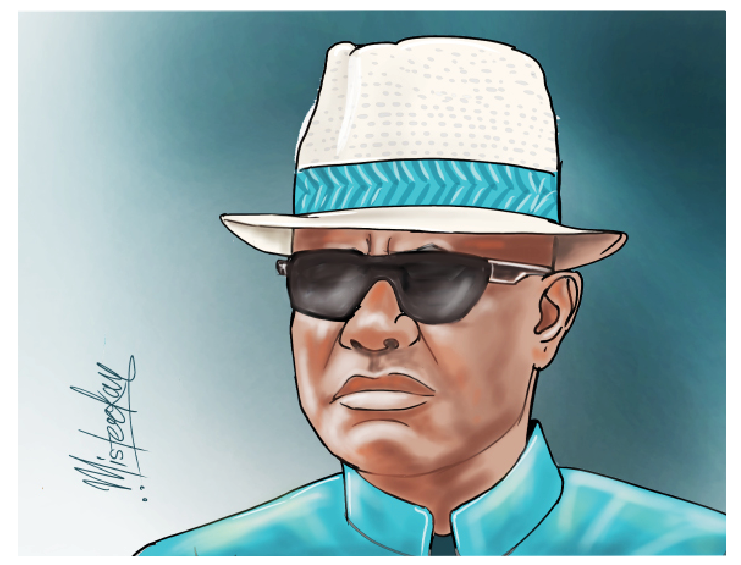

The Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has called for an urgent increase in oil production and a broader economic diversification strategy to stabilise the country’s volatile exchange rate.

He made this call on Tuesday while addressing journalists at the end of a two-day Monetary Policy Committee (MPC) meeting held in Abuja.

The bank chief emphasised that while efforts to boost foreign exchange inflows through various initiatives, including liberalising diaspora remittances, have shown promise, these measures cannot substitute for addressing the fundamental structural issues in the Nigerian economy.

“We must recognise that without resolving the underlying economic fundamentals, we will continue to sub-optimise.

“Oil production must be ramped up to levels that can support the economy, and we need to diversify beyond our current status as a monolithic economy reliant on oil. Until this happens, the strong exchange rate we all desire will remain out of reach,” he said.

The governor highlighted the constraints faced by Nigeria as an oil-dependent nation, noting that global fluctuations in oil prices and production levels leave the economy vulnerable.

He stressed the need for investment in non-oil exports and urged Nigerians to adopt a more sustainable approach by reducing the country’s heavy reliance on imports.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

Also, he pointed to import substitution as a critical area for development, alongside efforts to recalibrate the national appetite for foreign goods.

While the central bank has implemented measures to unlock diversified foreign exchange sources, including through remittance inflows and innovative financial products, Mr Cardoso made it clear that these efforts alone would not suffice.

“The central bank is committed to ensuring that markets operate efficiently and will hold accountable those who attempt to exploit the system, but this will not compensate for the broader need to fix the structural foundations of the economy,” he said.

According to the latest data published by the Organisation of Petroleum Exporting Countries (OPEC), Nigeria’s average daily crude oil production rose by 3.4 per cent to 1.352 million barrels in August.

The figure rose by 45,000 barrels, up from 1.307 million barrels in July. However, it still falls short of OPEC’s quota of 1.5 million barrels per day (bpd).

Dangote Refinery

Mr Cardoso expressed strong optimism about the positive impact of the Dangote refinery on Nigeria’s economy.

He pointed out that petroleum products currently account for between 10 per cent and 15 per cent of Nigeria’s total imports.

He emphasised that as the Dangote refinery comes online, reliance on foreign products will diminish significantly.

“To the extent that we can do away with that, I think that is a very, very good thing,” he said, describing it as a crucial step toward improving Nigeria’s balance of payments and overall economic health.

The apex bank chief also said that as Nigeria increases its domestic refining capacity and scales up production, the need for imports will drop, easing pressure on the naira.

The CBN governor was optimistic that as the refinery ramps up production and eventually begins exporting refined products, the resulting foreign exchange earnings will help stabilise the naira and support the central bank’s ongoing efforts to manage the foreign exchange rate.

He projected that in addition to reducing import costs, the refinery’s capacity to refine up to 2 million barrels per day would also boost Nigeria’s export potential.

“As production ramps up and we get to 2 million barrels and over, the export side will kick in, and foreign exchange starts to come in,” he said.

This, he explained, would have a significant and sustained impact on the strength of the naira in the long term.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·