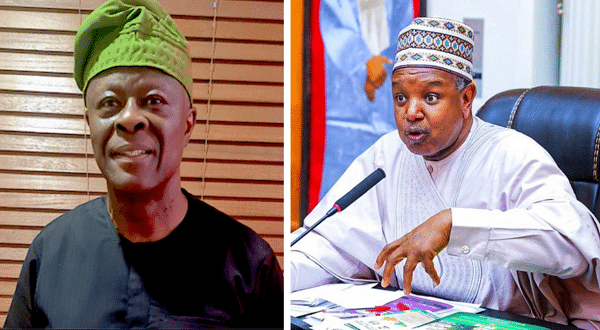

- The governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has disclosed that Nigeria’s reserves have risen

- Cardoso said that the country’s reserves now stand at $40.2 billion from $38 billion recorded in September

- The Minister of Finance, Wale Edun, attributed the rise to the government’s policies, saying the growth was organic.

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment and the economy for over a decade.

Nigeria’s foreign reserves rose to $40.2 billion in October 2024, up from $38 billion recorded in September.

The governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, disclosed this during an investors’ meeting in Washington, DC, on Wednesday, October 23, 2024.

Source: Getty Images

FG explains why CBN does not intervene in naira

At the meeting, Nigeria’s minister of finance, Wale Edun, said the inflows were organic due to the government’s decision not to defend the naira.

The minister stressed the government’s commitment to maintaining transparency in the country’s FX reserves.

He reassured investors that the government is committed to regularly updating Nigeria’s reserve position.

According to reports, the minister explained that the decision to let the market determine the exchange rate for the naira rather than the Central Bank of Nigeria (CBN) defending it led to the organic growth in the nation’s reserves.

He said that by allowing the market to determine the exchange rate, the government is boosting investor confidence and building cushions to stabilise the economy.

Reserves growth is organic

He disclosed that the government aims to improve its forex supply organically without CBN intervention, stating that the apex bank may still intervene in the market periodically.

However, he said the ultimate aim is to achieve a stable FX rate without relying on the CBN’s interventions.

The minister highlighted the positive impact of foreign portfolio investment on the economy.

Experts ask FG to stabilise the naira

The finance minister said Nigeria has witnessed improved investor confidence, with many ready to commit more resources to the Nigerian market.

Kelechi Mgboji, a financial analyst, stated that the development will lead to further appreciation of the naira.

He said investors typically look at a nation’s reserves before deciding on investment.

“It is a positive development that will positively affect the naira. However, I disagree with the decision of the CBN and the government not regularly intervene in the forex market.“The naira is in a fragile position at the moment and will require constant nurturing until it achieves stability,” he said.CBN Explains Sources of $2.33bn into economy

Information from the CBN disclosed that foreign exchange inflows via International Money Transfer Operators (IMTOs) rose by 47% to $2.33 billion in the first six months of this year relative to the $1.58 billion recorded in 2023.

The development comes amid CBN policies allowing eligible IMTOs to access naira liquidity at the official forex window.

Recently, the apex bank released some measures to boost the FX markets and increase remittance inflows via formal channels.

Access, UBA, GTB, others adjust exchange rates

Legit.ng earlier reported that the Nigerian naira extended its fall against the dollar in the foreign exchange market.

According to data from the FMDQ Securities Exchange, the naira dropped in value for the second day in the Nigerian Autonomous Foreign Exchange Market (NAFEM) to exchange at N1,654.09/$1 on Wednesday, October 23.

Wednesday’s exchange rate represents a 0.06%, or N1.07, depreciation compared with N1,653.02/$1, traded on Tuesday.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

English (US) ·

English (US) ·