- The Small and Medium Enterprises Development Agency of Nigeria (SMEDA) has signed a deal to secure an N6 billion loan for SMEs

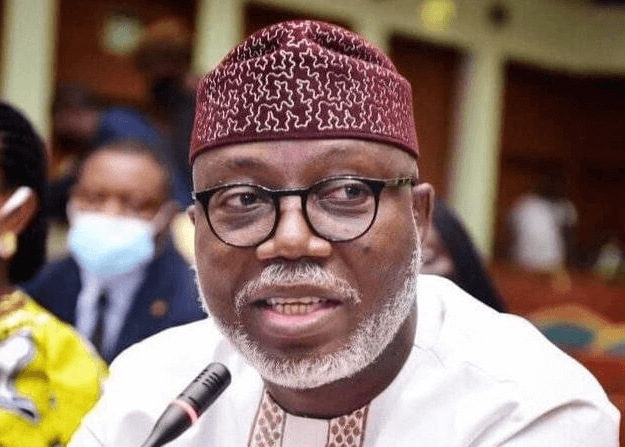

- The Director-General of SMEDAN, Charles Odi, disclosed that the deal would allow SMEs access a single-digit interest loans

- Odi explained the scarcity and the high cost of finance capital for small businesses in Nigeria

Legit.ng’s Pascal Oparada has reported on tech, energy, stocks, investment, and the economy for over a decade.

The Small and Medium Enterprises Development Agency of Nigeria (SMEDAN) has signed an MoU with the Bank of Industry and Sterling Bank to provide small businesses access to capital at single-digit interest rates.

The plan aims to support working capital, workplace procurement, and work equipment for small and medium enterprises (SMEs) with N6 billion.

SMEDAN announces new funding for small businesses at single-interest loans

Credit: Thomas Imo / Contributor

SMEDAN announces new funding for small businesses at single-interest loans

Credit: Thomas Imo / ContributorSource: Getty Images

UK agency lends support to Nigerian SMEs

The director-general of SMEDAN, Charles Odi, stated this during the launch of the Sustainable Systems for Research and Innovation Financing (SSRIF II) and the Nigeria Enterprise Support Organisations (ESO) project in Lagos.

PAY ATTENTION: Share your outstanding story with our editors! Please reach us through info@corp.legit.ng!

The project is funded by the UK’s Research and Innovation Systems in Africa (RISA).

Odi explained the scarcity and the high cost of finance capital for small businesses in Nigeria and stressed the agency’s efforts to open more access for SMEs to secure funding.

According to him, SMEDAN has signed an N5 billion loan deal with Sterling Bank and an N1 billion agreement with Bank of Industry (BoI), and extended efforts in different states such as Enugu, Anambra, Katsina, to support the efforts of SMEs.

FG launches Wholesale Impact Investment Fund

The SMEDAN boss expressed commitment to boosting the current government’s economic prosperity agenda by addressing challenges hindering SME growth and protecting them from inflationary pressures.

Leadership reports that the chief executive of the Impact Investors’s Foundation (IIF) Nigeria, Maria Etemore Glover, spoke about the government and private sector participation to boost the practice of Impact Investment.

She disclosed that the Nigerian government has provided 50% of the seed capital for establishing Wholesale Impact Investment Fund.

Sterling Bank unveils DataBanc

The development comes as Sterling Bank unveiled a platform for Nigerian business owners to access the SMEDAN loan at cheaper interest rates.

The Small and Medium Enterprises Development Agency of Nigeria (SMEDAN), in partnership with Sterling Bank, has introduced Databanc, a revolutionary new platform, Legit. ng reports.

The portal would act as the exclusive source of information about Nigerian enterprises, enabling decision-makers to provide tailored interventions and assistance to the MSME ecosystem. More benefit of Databanc.

The platform is expected to furnish SMEDAN with valuable insights that it may employ in carrying out its purpose regarding policy formation, intervention program implementation, and other activities, such as finance, that facilitate the expansion of small enterprises in Nigeria.

The Nation reported that the platform will offer a distinct identity for small businesses, their advocates, and the industries in which they operate.

CBN releases interest rates on customers' savings accounts

Legit.ng previously reported that Deposit Money banks (DMBs) have increased interest rates on deposits to reflect the latest Monetary Policy Rate announced by the Central Bank of Nigeria.

C CBN raised the Monetary Policy Rate (MPR) to 24.75% in May 2024 from 22.75% in February 2024.

Checks showed that 18 Nigerian banks now offer their customers at least 7.88% interest on their deposits as of June 28, 2024.

Source: Legit.ng

English (US) ·

English (US) ·