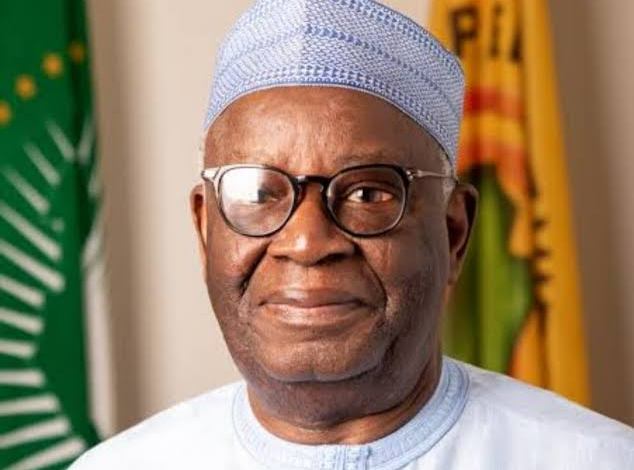

The exodus of multinational companies from the Nigerian market has underscored the need to strengthen the domestic market, Managing Director of Coronation Asset Management Limited, Aigboje Aig-Imoukhuede, has said.

According to him, while the exit of multinational companies portends a challenging investment climate, the country’s capital markets must be robust enough to attract and sustain both domestic and foreign investments.

Imoukhuede, who is also the chairman of Access Holdings Plc, also pointed out that achieving this necessitates macroeconomic stability, particularly in currency and inflation management.

He maintained that stability in the naira’s value against the dollar, and controlled inflation are essential for fostering an environment conducive to long-term business planning and investment.

“Nigeria’s economic landscape is characterised by a complex interplay of growth and stagnation. The National Bureau of Statistics (NBS) reports growth, which is promising. However, the true metric of economic vitality lies in long-term investment,” he said.

Recall that Nigeria is currently grappling with the issue of a significant exodus of multinational companies. Between 2020 and till date, close to 20 multinationals have closed their operations in Nigeria due to rising inflation, foreign exchange crisis, insecurity and other macroeconomic issues, a situation that has worsened the country’s unemployment crisis.

The chairman argued that inflation undermines business planning and investor confidence, noting that once inflation is stabilised, consensus on the naira/dollar exchange rate can be established to foster a more predictable and attractive investment environment.

Imoukhuede said although the Nigerian Treasury Bills’ yield of around 25 per cent for one-year T-bills and OMO bill auction yields reaching 29 per cent are high returns enticing foreign portfolio investors and bolstering the naira.

However, he argued that high interest rates impose a burden on borrowers. He noted that Nigeria’s financial outlook is at a crossroads, shaped by a dynamic interplay of internal and external factors.

Therefore, he stressed the need to strengthen the capital markets, stabilise the macroeconomic environment, and leverage technological innovations for sustainable growth.

In addition, he called for active collaboration among government at all levels, financial institutions, technology providers, and academia, stating that fostering partnerships would enable the country to unlock opportunities in technologies, spur innovation, improve financial services and stimulate economic growth.

3 months ago

69

3 months ago

69

![[ICYMI] No N500m missing from customer’s account, says Access Bank](https://cdn.punchng.com/wp-content/uploads/2018/09/14183604/20180707-DSC_0077new.jpg)

English (US) ·

English (US) ·