The Commissioner for Insurance/Chief Executive Officer of the National Insurance Commission, Olusegun Omosehin, has revealed that there are some ailing entities in the sector that the regulator is managing.

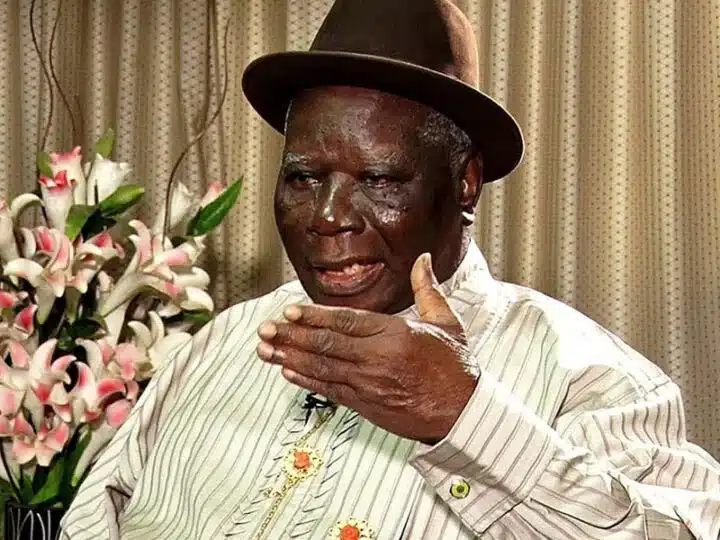

He said this on Wednesday at an interactive session with journalists in Lagos.

There have been reports recently about the policyholders not being settled as of when they were due.

He said, “Most of you have reported instances of some consumers going to some entities you know, not being able to get their claims paid. These are some of the issues we are dealing with. We have some ailing entities that we are trying to manage in order not to disappoint the public.

“This is our job, but also the desire moving forward is to reduce this incident so we don’t have too many entities falling into that category. That involves a lot of work and all of that we are doing currently. But the reality of the situation is that, yes, we have a few that we are managing, and we are hoping to get out of this.”

Omosehin noted, “I am not going to mention how many, but the impact is what we are trying to manage. We don’t want it to rub off on the people who are doing so much. We have entities in this market that are doing a whole lot to change the face of insurance, but the efforts are not coming through.

“The ones people talk about are the negative ones. Honestly, if there are 1,005 claims, 1,003 were settled properly, and two were bad. Nobody talks about the 1,003; it is those two that were not settled that people remember.”

The CFI added that they were working on the legal framework that would enable the commission to take action and not be challenged in court.

“The second aspect deals with us as the commission. You know, strengthen our internal capacity to regulate, which will give us the level of effectiveness required to properly regulate the industry. So, it is strengthening our capacity, and this has to do with several parts, including the right legal and regulatory framework. That will allow us to take certain steps without being challenged at every second in law courts.

“When the CBN took over a bank a couple of months ago, it was a seamless exercise. It is not like those banks don’t know where the court is, or they don’t have lawyers that will help them file, but because the legal framework for taking such actions is clear, you need no challenge the very clear provision,” he explained.

On the issue of recapitalisation, which has been a topical issue in the industry, the CFI disclosed that the commission was still engaging stakeholders to arrive at the minimum capital requirements.

The Insurance Reform Bill 2024 has passed a second reading in the Senate, and it seeks to increase the capital base for operators in the industry.

Meanwhile, the Deputy Commissioner for Insurance (Technical), Ekerete Gam-Ikon, highlighted the role of technology in boosting the sector.

He said, “We shouldn’t fail to recognise what we are doing in respect of using technology to drive penetration; we are looking at that as probably the best opportunity we have to transform the insurance industry in Nigeria.

“Check and you see the number of devices that we have in Nigeria, and you begin to wonder why we don’t have device insurance commonly in place. Beyond that, we have a population that relies on technology for their lifestyle and everything. So we are also making a lot of efforts in that respect.”

4 months ago

49

4 months ago

49

English (US) ·

English (US) ·