The Debt Management Office (DMO) said naira depreciation alone increased the total debt stock by N17.8 trillion in quarter one (Q1), dismissing the claim that the government has continued to pile up debts

In a statement, the DMO argued that weak currency increased the naira value of the external debt from N38.22 trillion to N56.02 trillion between end of last year and March 31, 2024 even though the dollar value remained stable.

The exchange rate effect explains the N24.33 trillion rise in the total debt stock for Q1 2024, DMO said.

Despite the perceived sharp increase in total debt stock, it clarified, the total external debt stock remained relatively stable, from $42.5 billion in Q4 2023 to $42.12 billion in Q1 2024.

It has explained that the sharp rise in Nigeria’s public debt stock is partly due to naira depreciation, new borrowing as well as securitisation of Ways and Means (W&M).

Current reforms, the DMO said, have been implemented to attract foreign exchange inflows, which are expected to bolster external reserves and support the value of naira.

The DMO addressed the wide gap in the total debt profile between the fourth quarter of 2023 (Q4 2023) and the first quarter of 2024 (Q1 2024), noting that the N24.33 trillion increase, in naira, terms has been misinterpreted as new borrowings.

The actual new borrowing comprises N2.81 trillion as part of the new domestic borrowing of N6.06 trillion provided for in the 2024 Appropriation Act and N4.9 trillion as part of the securitisation of the N7.3 trillion W&M advances approved by the National Assembly, it explained.

“Additionally, the official naira exchange rate depreciation from N899.39/$ in Q4 2023 to N1,330.26/$ in Q1 2024 significantly impacted the debt stock valuation in naira terms,” it noted.

It stressed: “In dollar terms, the total debt stock declined from $97.34 billion in Q4 2023 to $91.46 billion in Q1 2024, highlighting the impact of exchange rate changes on debt valuation.”

As of March 31, the total public debt in naira terms stood at N121.67 trillion, compared to N97.34 trillion as of December 31, 2023. The detailed debt data includes the domestic and external debt of the thirty-six states and the Federal Capital Territory.

The DMO emphasized that recent economic reforms have significantly impacted key economic indices, such as the naira-dollar exchange rate and interest rates. The change has directly influenced the debt stock and debt service obligations.

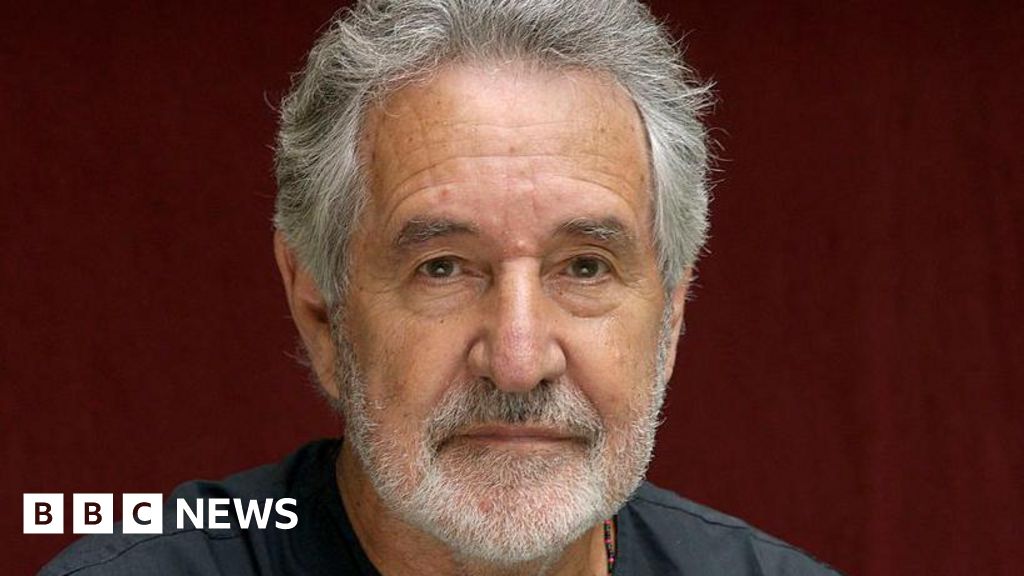

Director General of DMO, Patience Oniha, in a recent interview with NAN, said it is important to recognise that Nigeria has undergone some major reforms, which have impacted economic indices such as the dollar/naira exchange rate and interest rates.

“These two, in particular, affect the debt stock and debt service,” she said.

4 months ago

30

4 months ago

30

English (US) ·

English (US) ·