- The Nigeria Deposit Insurance Corporation said it has carried out a nationwide assets valuation of the defunct Heritage Bank

- It stated that the exercise is a part of ongoing efforts to compensate depositors following the bank’s closure

- Its managing director emphasised NDIC’s commitment to safeguarding the stability of the banking sector, especially when a bank fails

Legit.ng journalist Zainab Iwayemi has 5-year-experience covering the Economy, Technology, and Capital Market.

As part of continuing attempts to reimburse depositors after the bank's liquidation, the Nigeria Deposit Insurance Corporation (NDIC) has stated that it has completed a nationwide assets appraisal of the now-defunct Heritage Bank.

Source: Getty Images

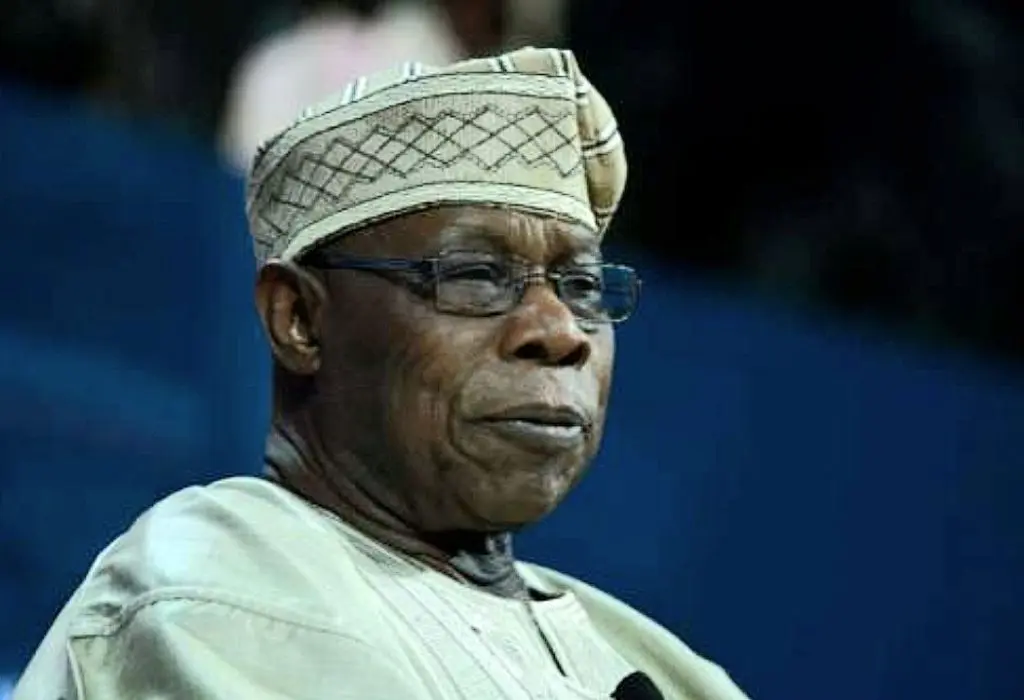

Bello Hassan, NDIC's managing director and CEO, made this announcement during the organization's special day at the Lagos International Trade Fair.

Hassan emphasized NDIC's dedication to preserving the banking industry's stability, particularly in the event of a bank failure, BusineDay reported.

Hassan noted that 86% of Heritage Bank's depositors have already received payouts, underscoring the NDIC's crucial involvement in the Central Bank of Nigeria's (CBN) recent termination of the bank's license on June 3, 2024.

Within four days following the closure, insured sums may be directly credited into depositors' alternative bank accounts thanks to NDIC's usage of the Bank Verification Number (BVN) as a unique identification to speed up these payments.

“This approach facilitated the swift disbursement of insured guaranteed sums to depositors,” Hassan noted.The NDIC recently increased the deposit insurance coverage for depositors of Deposit Money Banks from N500,000 to N5 million. He said this procedure is in line with recent regulatory changes.

Hassan claims that the enhanced coverage has significantly lessened the harm that bank failure has caused to impacted depositors.

Customers who have more than N5 million to be paid

Although insured deposits have been the NDIC's main priority, the organization is also trying to reimburse depositors whose balances surpass N5 million.

Hassan explained, “We have already initiated the process of realising the bank’s assets and recovering debts to facilitate the timely payment of uninsured depositors by way of liquidation dividends.”

He reassured depositors that NDIC is committed to a thorough and fair compensation process, ensuring that larger depositors receive a share of the recovered funds.

Hassan also discussed the NDIC's obligation to Heritage Bank's creditors in addition to depositors. He stated that payment to creditors would not be made until all depositors had been paid in full.

“This orderly process, based on asset realisation and prioritisation of claims, is essential in maintaining public confidence in the financial landscape,” he remarked, reinforcing NDIC’s dedication to a structured and transparent process.Hassan urged depositors who have not yet received their insured amounts to step forward. “We encourage any remaining depositors to come forward with their BVN, proof of account ownership, identification, and alternative account details.”NDIC lists steps to receive full payments

Legit.ng reported that the Nigeria Deposit Insurance Corporation (NDIC) said it reimbursed 82.36% of the customers of the liquidated Heritage Bank with deposits below N5 million maximum insured deposit.

The NDIC’s director of communications and public affairs, Bahir Nuhu, disclosed this on Sunday, August 11, 2024, and said that the corporation achieved this via the use of BVN-linked alternative accounts of customers of the liquidated bank.

According to Nuhu, the NDIC began paying insured deposits of a maximum of N5 million per depositor within four days of the bank’s closure.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Source: Legit.ng

English (US) ·

English (US) ·