The Nigeria Extractive Industries Transparency Initiative (NEITI) has commended the Tax Reform Bill from the Presidential Committee on Fiscal and Tax Policy Reform.

Naija News reports that NEITI, however, noted that the Tax Reform Bill requires clarifications on some of its clauses to prevent poor implementation and administrative conflict.

Another concern raised by NEITI was the effect the bill could have on startups in some sectors of the economy if passed by the National Assembly as presently drafted.

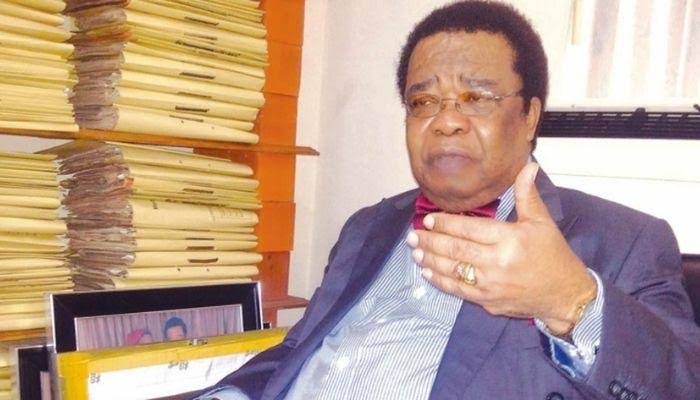

This was contained in a statement signed by its Executive Secretary, Dr Ogbonnaya Orji, and addressed to the leadership of the National Assembly and Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele.

The statement signed by NEITI’s spokesperson, Obiageli Onuorah, said, “The bills have the potential to modernize Nigeria’s tax system, streamline and broaden its administration and tax base to align with global best practices.

“A detailed review of the bill revealed that it has the potential to impact positively on revenue generation, household livelihoods, job creation, and overall economic opportunities.”

NEITI explained that its section-by-section review of the draft law revealed its strengths and weaknesses, particularly as they affected the extractive industries, which is the core of NEITI’s specific mandate.

“For instance, Sections 1 and 2 aimed to ensure a unified tax legislation across Nigeria for all individuals and legal entities. The sections did not have explicit guidelines to harmonize federal and state tax laws and clarify the roles of sub-national governments,” it said.

On unifying tax administration in the country, it noted that careful management of the transition process and robust public awareness campaigns were critical to avoid administrative confusion.

On tax law for the oil, gas and mining industries, including income, petroleum operations, VAT, and tax incentives, NEITI urged the introduction of clauses to address issues of alignment with state tax systems and provide guidance for resolving jurisdictional conflicts.

It stated that the provision on taxation of digital assets needed clear definitions of what are taxable assets and events, and valuation guidelines to ensure effective reporting mechanisms and implementation, allowing for exemptions or phased implementation for small businesses, to support growth.

NEITI called for the reassessment of tax rates for small-scale service providers, including the simplification of processes for compliance with Excise Duty on Services to ease their burden.

Among others, it recommended the streamlining of application procedures and the provision of technical support for applicants for Economic Development Tax Incentives; and the definition of eligible sectors exemptions from Stamp Duties and VAT transactions for greater transparency.

3 hours ago

1

3 hours ago

1

![BREAKING: UI Students Protest 3-Months Blackout At UCH [Photos]](https://www.naijanews.com/wp-content/uploads/2025/01/UI-Student-Protest-2.jpg)

English (US) ·

English (US) ·