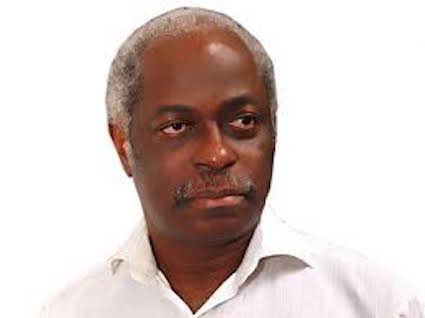

The Nigerian Education Loan Fund (NELFUND) has, so far, disbursed about N10 billion to 40,000 students since the commencement of the student loan programme, the managing director of the agency, Akintunde Sawyerr, has said.

Speaking on Channels Television’s prime time programme, Politics Today, on Tuesday, Mr Sawyerr said about 370,000 students have registered on NELFUND’s portal, though only 280,000 of them have gone further to apply for the loan.

According to him, this leaves a number of students “who have not decided as to whether or not they want to proceed and apply, which is fair enough”.

“It’s a loan, people need to think about it. About 89,000 of those exist,” Mr Sawyer said.

He continued, “About 40,000 of them have been approved and we’ve actually disbursed to them…I think that’s probably in the region of N9 to N10 billion.”

He said many of the 89,000 students who have yet to apply for the loan may still be holding back their decision while waiting for parental consent or seeking further clarification on the loan programme.

Mr Sawyerr said funds disbursed to students under the loan programme cover sessional institutional fees and a monthly upkeep of N20,000 for each of the students.

Nigerians need credible journalism. Help us report it.

Support journalism driven by facts, created by Nigerians for Nigerians. Our thorough, researched reporting relies on the support of readers like you.

Help us maintain free and accessible news for all with a small donation.

Every contribution guarantees that we can keep delivering important stories —no paywalls, just quality journalism.

“The way we disburse the loan is that we pay the fees, and so far, we have a commitment of paying fees of about N30 billion and about N 60 billion in upkeep loan. So, the second tranche of this is that we pay directly to the students for upkeep – pocket money if you like,” he said.

Persons eligible for the loan

Speaking further, Mr Sawyerr said to be eligible for the student loan, the student must have gained admission or be under continuous enrollment at a tertiary institution owned by the government, and is faced with financial constraints.

He explained that the requirement of enrollment in government-owned institutions was put in place because the institutions provide a reliable pool of eligible candidates.

“Our objective is to look, seek out and find these students and put this opportunity before them so that they know that the option of dropping out, which often isn’t an option in itself, is not one that we never want them to put up with,” he said.

Background

President Bola Tinubu signed the Access to Higher Education Act in June 2023, about a month after his inauguration, creating a legal framework to support fee payments for low-income Nigerians.

In July this year, the president launched the digital NELFUND disbursement exercise at the State House in Abuja.

In August, NELFUND confirmed receiving N50 billion from the Economic and Financial Crimes Commission (EFCC) to boost the student loan scheme, following a directive from President Tinubu in his 4 August speech addressing the nationwide #EndBadGovernance protest.

READ ALSO: Sanwo-Olu insists Lagos ready to establish medical university

To expand the NELFUND’s reach, Mr Sawyerr, revealed that the agency will collaborate with private institutions like banks to increase accessibility for those without internet access.

Speaking further, he explained that the agency refused to use manual processes to curtail corruption.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·