BY MOTOLANI OSENI

Nigerian banks’ payment partner, Network International, on Wednesday, disclosed that it handles more than $100 billion in electronic transactions (e-transactions) in Middle East and Africa (MEA) region, while reaffirming its dedication to strengthening the Nigerian financial ecosystem by utilising its Network One platform.

As the fourth-largest GDP in Africa with strong consumer spending, Nigeria is ripe for a digital payments boom. Total transaction value in the domestic digital payments market is projected to reach $21.32 billion in 2024, with an annual growth rate (CAGR 2024-2028) of 10.06 per cent projected to reach a total amount of $31.28 billion by 2028.

The group chief executive officer, Nandan Mer, at a media roundtable, organised by Network International, on Wednesday, in Lagos, said Nigeria can grow its economy through the digital payments market, adding that every one percent of money that is translated from cash to electronic payments can result in roughly a 0.4 percent increase in GDP over a five-year period.

READ ALSO: Defence minister urges ECOWAS Defence chiefs to tackle…

To boost the Nigerian digital payment ecosystem, Mer said, Network International has launched Network One, on soil in Nigeria, adding that the platform is now ready to onboard and empower banks, MNOs and fintechs in Nigeria and throughout the West African region.

By deploying its flagship Network One platform on soil, Network International aligns with the Central Bank of Nigeria’s directive for in-country transaction routing, enhancing its local processing capabilities. The integrated platform provides banks, FIs, and fintechs with a comprehensive range of payment products and services locally in Nigeria for both issuers and acquirers.

The suite is complemented by a variety of value-added services such as digital, loyalty, tokenization, enterprise fraud prevention, embedded finance and data and advisory solutions and many more. Network International is strategically investing in rolling out the platform in key markets to effectively serve its local and regional clients and partners across the MEA region.

Speaking on investment in Nigeria, the group CEO said Network International is strategically positioning its proprietary technology infrastructure in Nigeria, which is developed, hosted, and maintained on a local level, to cater to the needs of local and regional entities seeking market-relevant digital payment solutions for their consumers, adding that, “The company doled out over $100 million to build technologies and talents in the past four years and we spend about $40 million to $50 million to upgrade these technologies annually.

“Network International’s investments throughout Africa have led to substantial improvements in economies of scale. Consequently, the company can provide state-of-the-art technology at a lower cost than what companies might incur if developed internally. This affordability, coupled with the technology’s advanced features, appeals to a broad audience and furthers the company’s mission to expedite digital transformation across the continent. “Network One’s successful touchdown in Nigeria embodies our ambition to establish ourselves as a company that is authentically local in the African markets we serve.”

While 78 per cent Nigerians aged 15-17 are financially excluded, Mer, said the Nigerian government needs to play a strong role to ensure that they are included. “Government needs to put in place a financial inclusion target for all ecosystem participants. Financial inclusion has grown rapidly where there have been government sponsored domestic payment initiatives. I can tell you that Network International will be the first to embrace these programs, because we truly believe that the path to accelerated financial inclusion is government sponsored programs,” he affirmed.

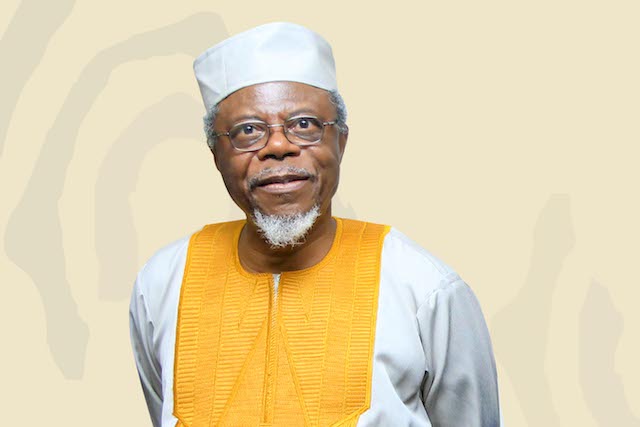

The managing director, processing, Africa and co-head group processing, Network International, Dr. Reda Helal added that, “We are partnering with telco operators, to bridge financial inclusion gap in the country. We believe telco operators have reach which is far beyond the conventional banks. So, our purpose today is not only to go to the formal banking channels, but also to hydrate the digital payment ecosystem in Nigeria to ensure those living in remote places are financially included.”

English (US) ·

English (US) ·