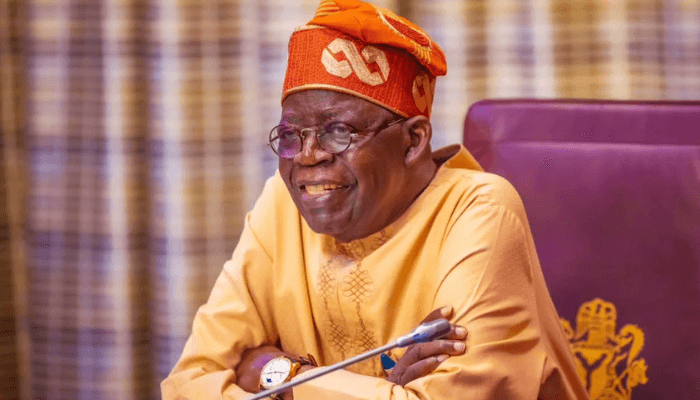

As the nation awaits the new minimum wage promised to be sent to the National Assembly by President Bola Tinubu, the burden of implementing the minimum wage may make many states bankrupt.

The Federal Executive Council, at its meeting last Tuesday, stepped down a memorandum on the report of the tripartite committee on the new minimum wage, to allow for more consultations among the federal and state governments on one part, the private sector and the labour unions on the other part.

Last Thursday, Tinubu met with the governors at the National Economic Council meeting chaired by Vice President Kashim Shettima. The meeting, which was expected to deliberate on the national minimum wage, was, however, silent on whether or not it considered the issue.

Also last Thursday, the Southern Governors’ Forum released the communiqué of its meeting held in Abeokuta, Ogun State, with the governors asking that each state should negotiate minimum wage with its workforce.

The labour unions have, however, reacted to the stance of the Ni¬geria Governors’ Forum over their overbearing influence on the minimum wage negotia¬tions.

In a document, titled, “Analysis of State FAAC inflows and state expenditure profile,” of the Nigeria Governors’ Forum Secretariat, the NGF report warned that implementing the new minimum wage could push states into bankruptcy due to increased recurrent expenditure.

According to the report, the burden of recurrent expenditure already left Abia, Ekiti, Gombe, Imo, Katsina, Kogi, Oyo, Plateau, Sokoto, Yobe, and Zamfara in deficit in 2022.

The report predicted that if the recurrent expenditure increased by 50 per cent, 13 states would fall into deficit, with only 10 remaining financially stable.

The tripartite committee’s recommendation of a N62,000 minimum wage would necessitate over a 100 per cent increase from the current N30,000, potentially leaving only a few states like Anambra, Bayelsa, Borno, Ebonyi, Gombe, Imo, Jigawa, Kaduna, Lagos, and Rivers with positive net revenues, based on the 2022 fiscal data.

A net revenue is the deduction of recurrent expenditure from the total revenue of the state. When it is positive, it means a surplus, but when negative, there is a deficit.

Also, the total revenue of states is calculated from the monthly revenue from the Federal Account Allocation Committee, internally generated revenue, aids and grants and constituency development funds.

According to the documents, sighted by The PUNCH, Abia, with an employment size of about 58,631 workers, pays N5,837,899,980.40 as wage monthly. Anambra has a 20,541 employment size and pays N1,824,851,308.96 monthly as wages, apart from N894,480,399.62 as pension obligation and N579,694,680.33 for debt servicing.

Bayelsa boasts of 48,213 workforce, paying N5,802,435,178.58 monthly, with N1,194,528,784.40 as pension obligation and N3,535,787,992.48 as debt servicing, totalling N10,532,751,955.46 as total recurrent expenditure monthly.

Benue has about 13,366 workers in its workforce and pays N2,040,184,471.85 as monthly wage, N76,838,634.62 for pension, and N64,685,126,826.08 for debt servicing, totalling N66,802,149,932.56 monthly.

Delta has about 50,871 workers, offering N8,973,081,853.50 as wages, N1,499,886,303.39 as pension, and N72,417,433,139.00 as debt servicing, accumulating to N82,890,401,295.89 in a month.

Jigawa has about 44,831 workers in its employ and pays N2,795,662,113.02 as wages, and N345,987,843.12 as a pension, totalling N3,141,649,956.14 monthly on recurrent expenditure.

Katsina, Kwara and Niger have 19,062, 36,048 and 22,225 workers, with accumulated N139,294,944,565.27, N4,457,268,675.54 and N2,653,614,213.35 monthly recurrent expenditure respectively.

According to the document, Abia has a total recurrent expenditure of N111,983,979,958.62, against a total revenue of N147,637,730,867.73.

For Adamawa, the recurrent expenditure stands at N70,369,399,885.57, against a total revenue of N109,722,949,684.65, while Akwa Ibom boasts of a high revenue of N444,288,683,000, with recurrent expenditure of N235,144,539,000.

Of the states, Lagos has the highest total revenue, amassing N1,243,778,878,170 in 2022, with a recurrent expenditure of N621,043,036,000, followed by Delta, with N702,020,717,460.08 and a recurrent expenditure of N377,905,100,451.83.

Rivers amassed N525,588,159,714.88 in 2022, with recurrent expenditure of N186,974,715,774.87; Kaduna had a total revenue of N222,349,875,000 and expenditure of N95,987,999,472.10; Ogun, N297,249,009,626.83, recurrent expenditure of N178,519,010,628.42 and Oyo, with total revenue of N247,156,776,739.70 and recurrent expenditure of N152,077,804,384.65.

Kebbi State had the lowest total revenue in 2022, raking in N92,132,444,588.16 and spent N57,601,464,374.96 on recurrent expenditure, followed by Taraba, with a total revenue of N101,177,283,069.87 and recurrent expenditure of N75,055,201,412.62.

Aside from FAAC allocation, some states recorded poor IGR in the 2022 data compiled by the NGF Secretariat.

Zamfara State generated N6,513,960,477.20; followed by Kebbi, with N8,630,767,122.96; Taraba, N9,744,331,840.01 and Yobe State, with N9,940,554,642.00.

The IGR of Katsina (N12,821,119,042.64), Adamawa (N13,175,774,969.53), Niger (N14,427,373,136.00), Benue (N15,021,223,729.38), Plateau (N15,927,001,739.90) and Imo (N16,711,346,111.18) also showed a poor revenue standing.

The PUNCH reported on October 19, 2023, that 15 states have yet to implement the N30,000 minimum wage for their workers since it was signed into law in 2019.

According to BudgiT, though the 15 states were yet to implement the minimum wage of N30,000, the 36 states of the federation grew their cumulative personnel cost by 13.44 per cent to N1.75tn in 2022 from N1.54tn in 2021.

The civil society organization, in a release, ‘The States of States Report 2023,’ highlighted that the 36 states of the federation grew their revenue by 28.95 per cent from N5.12tn in 2021 to N6.6tn in 2022.

“Put together, the IGR of the 36 states appreciated by 12.98 per cent from N1.61tn in 2021 to N1.82tn in 2022, denoting a strengthened domestic revenue mobilisation capability.

“Nonetheless, the IGR to GDP ratio remained very low at 1.01 per cent. The increase in IGR did not reflect across the board as 17 states experienced a decline in their IGR from the previous year, while 19 states recorded positive growth,” BudgIT said.

The Assistant General Secretary of the NLC, Chris Onyeka, in an interview with the News Agency of Nigeria on minimum wage and its implementation, claimed that many state governors were flouting the Minimum Wage Act and listed the states of Abia, Enugu, Bayelsa, Delta, Nasarawa, Gombe, Adamawa, Niger, Sokoto, Imo, Anambra, Taraba, Benue, and Zamfara as defaulting.

Reacting, the Enugu State chairman of TUC, Ben Asogwa, said the state commenced payment of N30,000 minimum wage and its consequential adjustment in February 2020 for state government workers, while local government workers and primary school teachers were paid 25 per cent consequential adjustment.

He, however, said Governor Peter Mbah, on assumption of office, approved the full implementation of the N30,000 minimum wage for both the LG workers and primary school teachers in the state.

The PUNCH reports that the Zamfara State Governor, Dauda Lawal, announced during a meeting with the leadership of the labour unions that the state would begin payment of N30,000 minimum wage effective June 2024.

4 months ago

40

4 months ago

40

English (US) ·

English (US) ·