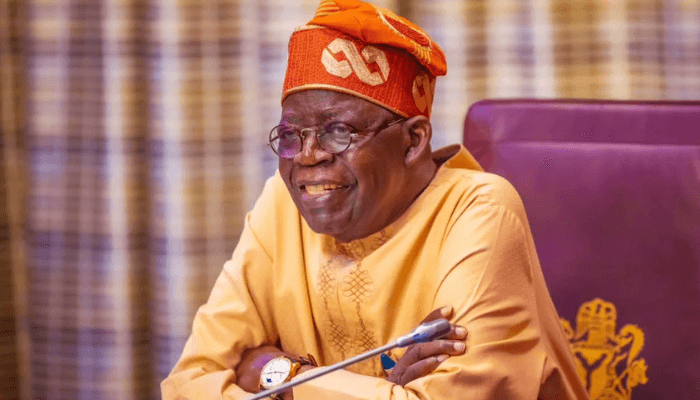

Chief Executive Officer, NGX, Temi Popoola

The Nigerian Exchange has introduced a digital platform to streamline the investment process.

The Group Managing Director of the Nigerian Exchange Group Plc, Temi Popoola, disclosed this at a press conference in Lagos on Wednesday.

He added that the platform would integrate several functionalities, including payment gateways, KYC processes, and brokerage account management, offering users a seamless and paperless experience.

“We are excited to introduce a new digital product that can distribute various services, emphasising the importance of quality UI/UX and collaboration. I want to appreciate the leadership and support from our regulator, acknowledging the evolution of our digital market and the contributions of those who came before us. Our regulator’s deep understanding of the market and digital assets is a significant advantage for us.

“Currently, investing in Nigeria involves filling out paper forms and dealing with various challenges. Our goal at the Nigerian Stock Exchange is to digitise the entire process, making it seamless and paperless. This digital transformation will bring numerous benefits, including improved efficiency and reduced reconciliation issues,” he remarked.

He added that the organisation collaborated with the Securities and Exchange Commission to ensure a seamless platform for new and existing investors.

“Our new digital platform integrates several functionalities like payment gateways, KYC processes, and brokerage account management. It is designed to be user-friendly and customisable, allowing banks to integrate their payment systems. The platform also facilitates real-time KYC verification and seamless brokerage account setup for both new and existing investors. It is not an app but a platform.

“We have been working closely with the Securities and Exchange Commission and other stakeholders to develop this platform. While we are still waiting for SEC approval, we are confident in their support and eventual approval. Our platform aims to ensure compliance with regulatory requirements while providing a simplified and efficient investment process for all users,” he noted.

Also, the Director-General of the SEC, Emomotimi Agama, underscored the organisation’s commitment to supporting initiatives that enhance transparency, fairness, and efficiency in the financial markets.

“Innovation means doing things that have not been done before. The challenge lies in creating a summary quickly, but it is essential to ensure the key details are communicated effectively.

“Stockbrokers play a crucial role in this process, ensuring that they read and understand the prospectus thoroughly before passing on the information to clients. It is their responsibility to engage and educate investors, making sure they understand what they are investing in,” he declared.

He reassured stakeholders that the SEC remained vigilant against any violations and would enforce strict adherence to regulatory standards, adding that the platform must be structured to meet the requirements of the younger generation.

“In Nigeria, 74 per cent of the population is under 24 years. This demographic requires us to digitise our processes and engage them through technology they understand, like apps and digital platforms. We must adapt to their world to bring them into the investment market.

“Our goal is to reach millions, not just a few hundred investors. Our mission is to achieve a $1tn economy, as mandated by President Bola Ahmed Tinubu. We all have a role to play in reaching this goal, and with this new platform, we’re on the right path,” he said.

Applauding the innovation, the Managing Director and Chief Executive Officer of the Central Securities Clearing System, Haruna Jalo-Waziri, stated, “We believe this platform will contribute significantly to the deepening of our market and anticipate a positive impact on the economy.

“The CSCS has consistently been at the forefront of innovation, and this mentorship alliance reinforces its position as a premier post-market infrastructure. We look forward to continued collaboration and progress in achieving our shared goals.”

The PUNCH reported that the Nigerian Exchange had collaborated with Meristem Securities to launch a USSD platform aimed at enhancing financial inclusion and expanding access to the capital market.

4 months ago

86

4 months ago

86

English (US) ·

English (US) ·