The Presidency has vowed to take concrete steps to ensure Nigeria’s removal from the global Financial Action Task Force, FATF, grey list before the May 2025 deadline.

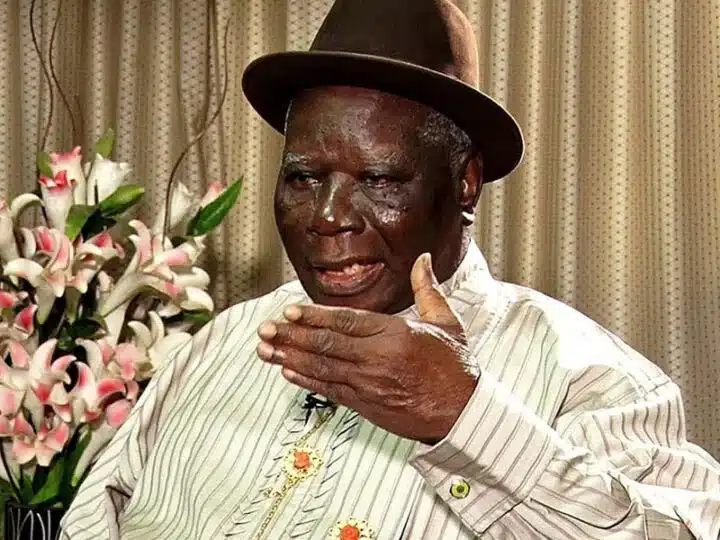

The Chief of Staff to the President, Femi Gbajabiamila, gave this assurance during a fact-finding visit to the office of the Nigerian Financial Intelligence Unit, NFIU, in Abuja on Tuesday.

Responding to a request from the Director and Chief Executive Officer of NFIU, Hafsat Bakari, who sought high-level intervention to meet the FATF action plan implementation deadline, Gbajabiamila pledged the federal government’s determination to address the deficiencies that led to Nigeria’s listing.

DAILY POST recalls that on February 24, 2023, Nigeria was placed on the FATF Grey List due to rising capital inflows and shortcomings in combating money laundering, terrorism, and arms financing.

FATF is an independent intergovernmental organisation that promotes policies to protect the global financial system by evaluating jurisdictions based on their Anti-Money Laundering/Counter Financing of Terrorism and Proliferation, AML/CFT/P standards.

Gbajabiamila, who acknowledged the progress made by NFIU, which has implemented 30 per cent of the action plan to address identified deficiencies, stressed the need for accelerated efforts to complete the remaining tasks.

“I am a firm believer that no matter how much you achieve, one thing can destroy everything you have achieved. One rotten egg can spoil the whole basket.

“We have nine months left to exit the Grey List, and even being on that list is bad enough—that is not what we want for our country.

”Therefore, we will do everything we need to do because May 2025 is around the corner. You must furnish us with the information and the boxes that we need to tick. We do not want a fire brigade approach because May is around the corner; this is a high priority,” he said.

Gbajabiamila also assured the management of NFIU, which operates under the supervision of the State House, of continued collaboration with his office to enable the organisation to fulfil its role in protecting Nigeria’s financial system from threats such as terrorism financing, money laundering, arms proliferation and other violent crimes.

“I know there’s much to be done and we are here to collaborate with you to ensure that, so that ultimately we can get to where we are supposed to be.

“I do understand the workings of NFIU from my time as the Speaker of the House of Representatives and the discussions of where to domicile you as an agency of government.

“I’m glad to see the agency’s independence, and we’ll continue to support it, as well as promote interagency cooperation,” he said.

The president’s chief of staff also commended NFIU for its commitment to implementing the recent Supreme Court interpretation regarding local government autonomy.

Highlighting NFIU’s achievements, the CEO, Bakari, noted that the agency has fostered inter-agency cooperation, connecting over 45 agencies to its intelligence-sharing platform.

She also disclosed that 18 state internal revenue services have been connected to boost domestic revenue mobilisation in sub-national governments, while collaborations with federal government agencies, including FIRS, NCC, NITDA, Oil and Gas Free Zones Authority, and other revenue agencies have been established.

“One of the key projects we have commenced is the implementation of a monetary network framework following the recent Supreme Court judgement on the fiscal autonomy of local governments,” Bakari said.

“This would enable the government to ensure that resources made available have an impact on the citizens.”

Addressing FATF-related challenges, she pointed out that NFIU has deployed significant human and financial resources to address identified deficiencies.

She added that the expanding use of technology by criminals, particularly in cybercrime and cryptocurrencies, requires continuous upgrades of new hardware and software to combat these evolving threats.

“Capacity building is essential to staying ahead of evolving methods and typologies of financial crime,” she said.

Gbajabiamila also visited the Nigeria Extractive Industries Transparency Initiative, NEITI, and the National Council on Climate Change, NATCCC, as part of his ongoing engagements with agencies under the supervision of the State House.

English (US) ·

English (US) ·