The federal government has offered one FGN bond valued at $500 million for subscription to interested investors.

According to the Debt Management Office (DMO), in a statement on Monday, it is a five-year domestic FGN dollar bond due in 2029, at an interest rate of 9.75 per cent per annum.

The opening date for the offer is 18 August, closing date is 30 August, while the settlement date is 6 September.

“It is offered at 1,000 dollars per unit subject to a minimum subscription of 10,000 dollars (10 units), and in multiples of 1,000 dollars thereafter.

“Coupon payment is semi-annually, while bullet repayment (principal sum) is on maturity date.,” DMO said.

It listed eligible investors as Nigerian residents, Nigerians with savings abroad, Nigerian diaspora, and qualified institutional investors.

“Payment shall only be made through the banking system and electronic transfers into the designated accounts.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

“No cash deposits will be accepted under this transition, except where such cash deposits have been made into the domiciliary accounts for not less than 30 days prior to the date of offer,” it said.

The DMO said that the dollar-denominated FGN bond was backed by the full faith and credit of the Federal Government of Nigeria, and granted liquid asset status by the Central Bank of Nigeria. (CBN).

“It qualifies as securities in which trustees can invest under the Trustee Investment Act.

“Qualifies as securities in which the Pension Fund Administrators can invest under the Pension Act.

“Qualifies as government securities within the meaning of Company Income Tax Act and Personal Income Tax Act for tax exemption for pension funds among other investors,” it said.

It said that the dollar-denominated FGN bond would be listed in the Nigerian Exchange Limited and FMDQ OTC Securities Exchange Limited.

The News Agency of Nigeria (NAN) reports that the federal government through the Debt Management Office (DMO) on Thursday announced plans to issue the $500 million local bond to boost dollar liquidity.

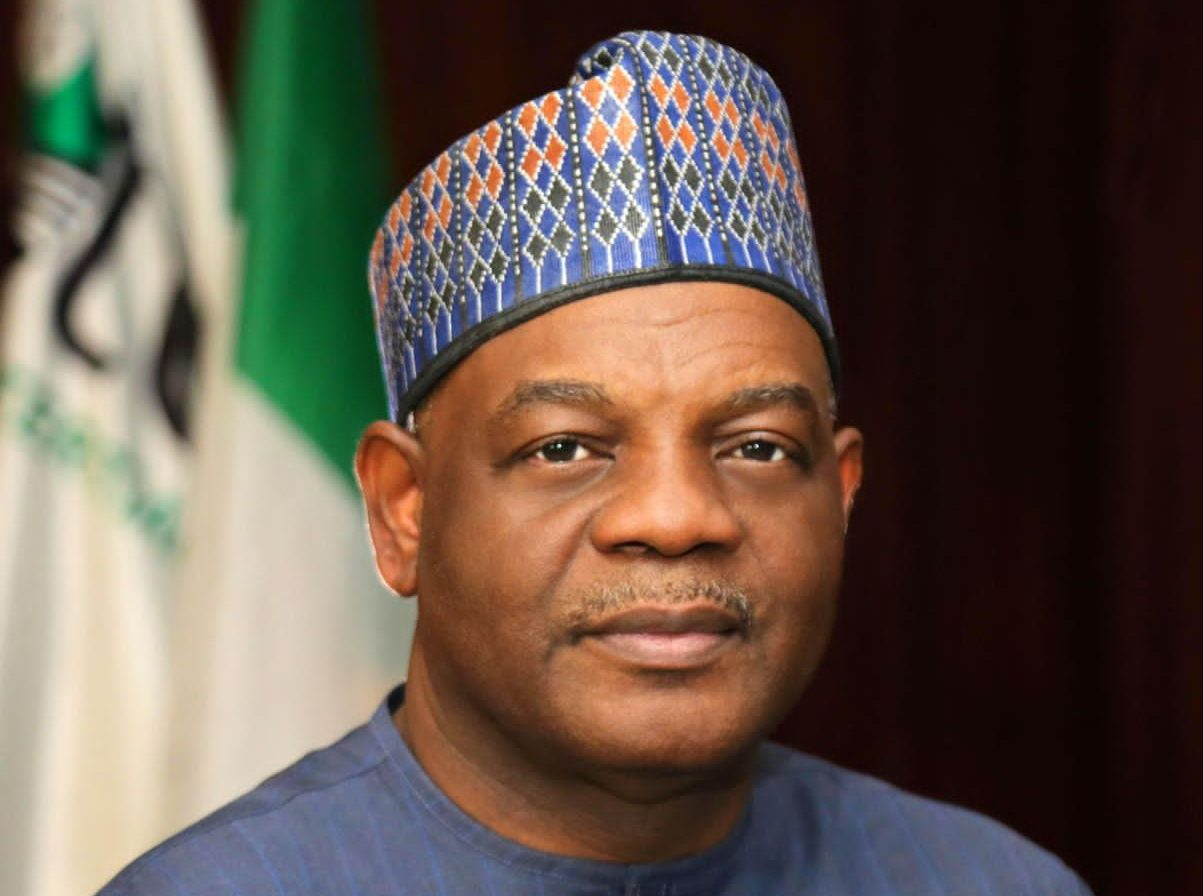

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, said that dollar funding was critical for the exchange rate to stabilise.

(NAN)

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·