NLPC Pension Fund Administrator (NLPC PFA)’s Assets Under Management (AUM) rose to N470 billion as of June 2024 even as it is working to position itself for greater pension market share.

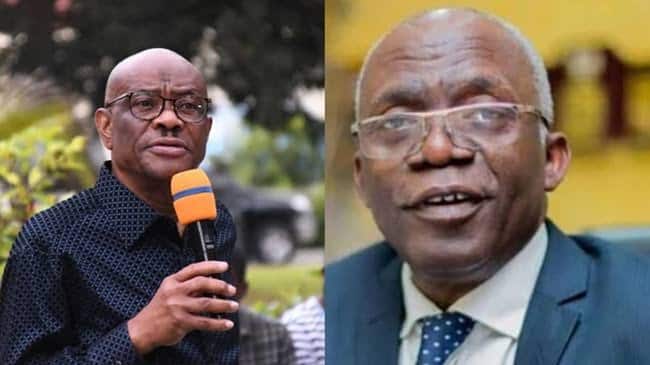

Speaking at a media briefing in Lagos recently,, the managing director/CEO, Samuel Abolarin, said, the PFA will continue to leverage technology to achieve sustainable returns and improved service delivery to pension contributors.

He reaffirmed the PFA’s commitment to the safety of funds and brings returns on investment to pension contributors in the industry.

According to him, the pension manager has started to achieve stability, moving on the table from 21st position to 10th, with returns on investment coming back stronger again.

On his part, Abolarin said, the company has three core principles – integrity, expertise, and experience – emphasising that the company is one of the largest PFAs in Nigeria with a strong branch network.

“Our operational base is about 400,000 customers cut across the public and private sectors. On a good note, we have also recapitalised in line with the National Pension Commission (PenCom) guidelines,” he said.

Also speaking on the investment of the PFA, the acting executive director, of finance, Dipo Taiwo, explained that, the Contribution Pension Scheme (CPS) offers a more resilient framework, where pension funds are managed prudently, invested wisely, and insulated from the vagaries of political and economic instability.

The PFA, he said, is committed to securing a brighter future for workers by ensuring a steady stream of income at retirement through efficient and safe management of their pension savings, employing and motivating the right people using appropriate technology for excellent service delivery in the country

3 months ago

55

3 months ago

55

![Just In: Tinubu Departs Aso Villa For Late COAS Lagbaja’s Burial [Video]](https://www.naijanews.com/wp-content/uploads/2023/06/20230622_180721.jpg)

English (US) ·

English (US) ·