- When it's ready, the NNPC said it will announce that it is prepared to accept the $2 billion loan backed by crude oil

- The African Export-Import Bank provided NNPC with an emergency $3.3 billion credit for the repayment of crude oil in August 2023

- The amount of Nigeria’s crude-backed loans will increase to $5.3 billion when the $3.3 billion loan is added to the $2 billion newly proposed loan

Legit.ng journalist Zainab Iwayemi has over 3-year-experience covering the Economy, Technology, and Capital Market.

The Nigerian National Petroleum Company Limited declared that it will formally proclaim its readiness to accept the $2 billion loan secured by crude oil when it is ready.

Source: Getty Images

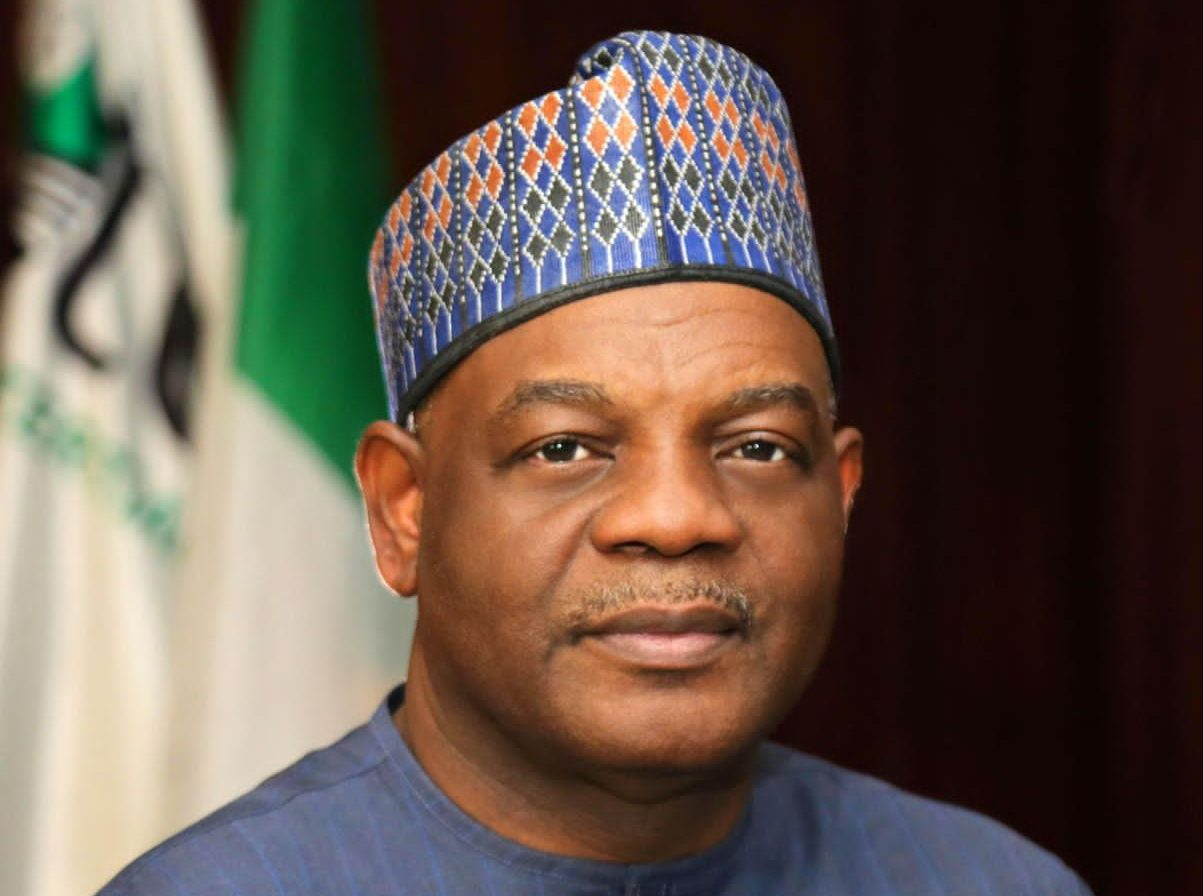

According to NNPC's Group Chief Executive Officer, Mele Kyari, the corporation was reportedly in talks for another oil-backed loan on Tuesday in order to strengthen its finances and enable investment in its operations.

The oil company wants to raise at least $2 billion with the proposed new loan, according to people familiar with the matter who spoke with Reuters.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

However, when our correspondent called Olufemi Soneye, the Chief Corporate Communications Officer of NNPC, on Wednesday to discuss the report, he informed us that the national oil corporation would make an official announcement as soon as the company is prepared to move forward with the agreement.

Even though the company will need cash to carry out its highly capital-intensive operations, he stated that it would reveal its financing arrangement in accordance with the established procedure.

Soneye stated in a brief response on the matter,

“When we are ready to proceed with any of the initiatives mentioned, we will make an official announcement. As a global energy company, we need funding to undertake aggressive drilling campaigns. Naturally, we will require financing for our high capital expenditure projects.“Our financing arrangements are typically announced through our financial advisers and arrangers. When the time comes, new financing transactions will be announced to the market.”In August 2023, NNPC announced that it had secured a $3.3bn emergency crude oil repayment loan from the African Export-Import Bank.

When the $3.3bn loan is added to the newly proposed loan of $2bn, it means the national oil company is about to raise its crude-backed loans to $5.3bn.

However, The Punch reported that it could not ascertain how much the oil company had repaid from the $3.3bn loan as of press time on Wednesday.

However, Kyari stated in the Reuters story on Tuesday that the company was seeking a new loan in relation to its daily output of between 30,000 and 35,000 barrels of crude oil, though he did not specify the amount.

According to Reuters, NNPC owes debt to petrol suppliers $6 billion, which is twice as much as it owed them in the previous four months. Soneye, however, refuted this.

Soneye said while responding to the Reuters report,

“False. Did they name the marketers they claim we supposedly owe? Let them name them."NNPC reports increase in oil production

Legit.ng reported that the Nigerian National Petroleum Company Limited (NNPCL) has announced an increase in Nigeria's oil production.

According to Mele Kyari, the NNPCL's group chief executive officer, Nigeria now produces 1.7 million barrels per day.

This represents a significant increase compared to the 1.28 million barrels per day reported in April.

Source: Legit.ng

English (US) ·

English (US) ·