Nigerian National Petroleum Company Limited (NNPC) says its quoted equity shares (at fair value) leapt to N11.9 billion in 2023 from N4.2 billion in 2022.

Details of its audited accounts released on Tuesday reflect the company’s stakes in First Bank Nigeria Limited, Nestle Plc, Cadbury Plc, Unilever Plc, Nigerian German Chemical Plc and Schlumberger.

Its unquoted equity shares (at fair value) climbed to N1.2 trillion from N467.2 billion, indicating its shareholding in Dangote Refinery and Afreximbank.

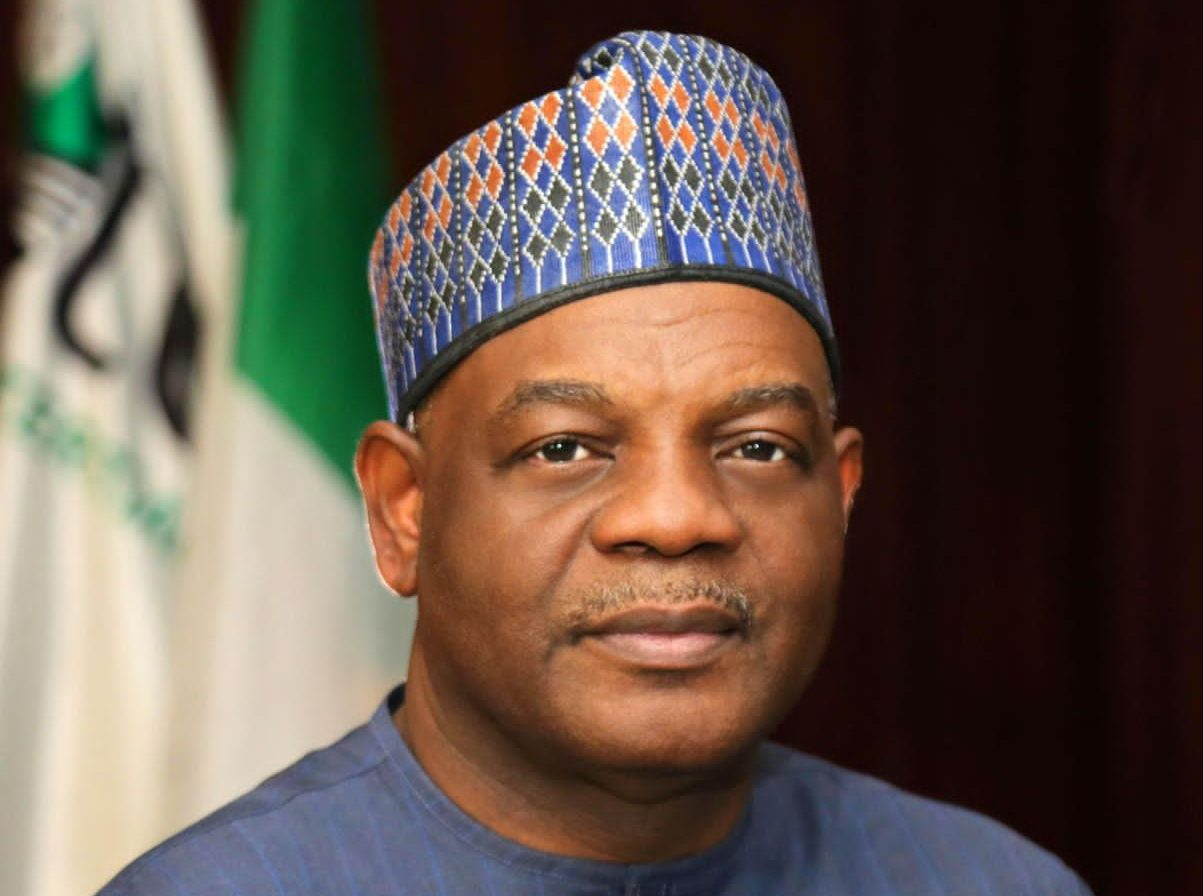

In July, Africa’s richest person Aliko Dangote said NNPC cut its stake in Dangote Refinery to 7.2 per cent from the planned 20 per cent. The development was later confirmed by Mele Kyari, NNPC boss, who said the state-owned oil company opted for a lower stake to enable it to invest in compressed natural gas.

The firm also posted a moderate increase (30.7 per cent) in net profit to N3.3 trillion last year, even though top line expanded by almost three times.

The state oil company reported a revenue of N24 trillion, which compares to N8.8 trillion a year earlier, on the back of a fourfold jump in revenue from crude oil sales, its chief source of income which alone contributed roughly 59 per cent of turnover.

Revenue derived strength from petroleum product sales and sales of natural gas.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

Selling and distribution expenses soared nearly six times to N132.6 billion, driven by marketing & distribution costs, which surged to N94 billion from N2.1 billion.

General and administrative expenses climbed 75.5 per cent to N3 trillion within the year, spurred by an exchange loss of approximately N900 billion. A notable pressure point here was employee benefit expenses, which more than doubled to N584 billion from a year ago.

NNPC spent N166.5 billion on repairs and maintenance within the review period relative to N124.3 billion in 2022. The four refineries operated by the company have been shut down for revamp and turn-around maintenance for years, and have missed a couple of restart schedules.

In July, CEO Mele Kyari told the Senate that the Port Harcourt Refining Company would resume operation early this month.

“Specific to NNPC refineries, we have spoken to a number of your committees, and it is impossible to have the Kaduna refinery come into operation before December, it will get to December, both Warri and Kaduna, but that of Port Harcourt will commence production early August this year,” he said.

Other income, for the period under review, rose to N2 trillion from N1.2 trillion, boosted by a 1,206 per cent improvement in management fees. NNPCL’s management fees represent 30 per cent of profit oil and profit gas from production sharing contracts.

Pre-tax profit accelerated 231.5 per cent to N6 trillion. A substantial tax liability of N2.7 trillion compared to a tax credit of N717.1 trillion in 2022 strained bottom line, causing net profit to moderately increase to N3.3 trillion from N2.5 trillion.

In 2022, NNPC announced plans to launch its initial public offer in the middle of 2023 after transforming from a government-run entity into a commercial company limited by shares. The proposal has been stalled ever since.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·