Oando Plc completed the acquisition of Nigerian Agip Oil Company (NAOC), a unit of Italy’s oil supermajor Eni, the oil driller announced Thursday, barely eleven months after it struck a deal to buy the asset.

The transaction, worth $783 million, “comprised of consideration for the asset and reimbursement,” Oando said in a regulatory filing in mark of the latest divestment by an international oil company from offshore operations in Africa’s oil producer, which are seen to be increasingly fraught with risks.

Oando, which is listed in Lagos as well as in Johannesburg, considers the acquisition as a cornerstone of its long-term strategy to scale its upstream operations and beef up its position in the Nigerian oil & gas industry.

The purchase lifts the company’s stakes in oil mining leases (OMLs) 60, 61, 62 and 63 to 40 per cent from 20 per cent.

“It increases Oando’s ownership stake in all NEPL/NAOC/OOL joint venture assets and infrastructure which include forty discovered oil fandango gas fields, of which twenty-four are currently producing, approximately forty identified prospects and leads, twelve production stations, 1,490 km of pipelines,” the statement said.

The energy company will also take ownership of three gas-processing plants, the Brass River Oil Terminal, the Kwale-Okpai phases 1&2 power plants (with a total nameplate capacity of 960MW) and associated infrastructure.

Oando’s total reserves, by 2022 reserves estimates, equal 505.6MMboe, meaning the acquisition will raise the reserves by 98 per cent to 1.0Bnboe.

Nigerians need credible journalism. Help us report it.

PREMIUM TIMES delivers fact-based journalism for Nigerians, by Nigerians — and our community of supporters, the readers who donate, make our work possible. Help us bring you and millions of others in-depth, meticulously researched news and information.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Will you support our newsroom with a modest donation to help maintain our commitment to free, accessible news?

The company stated that the transaction is instantly cash-generative and is upbeat which would boost its cash flows considerably.

In July, the Nigerian Upstream Petroleum Regulatory Commission sanctioned the sale of 100 per cent of Eni’s shares in NAOC to Oando.

The deal extends the list of international oil companies in Nigeria that are selling off their offshore and shallow-water stakes to concentrate on onshore operations, citing constraints like oil theft and pipeline vandalism, which have tempered output.

Norway’s Equinor and China’s Addax have entered an agreement to sell their offshore assets in the country, while Shell has struck a pact to sell its local subsidiary to a consortium of five firms, most of them indigenous.

ExxonMobil is also on course to conclude the transaction of selling its shallow-water oil assets to Seplat, a deal in the neighbourhood of $1.3 billion.

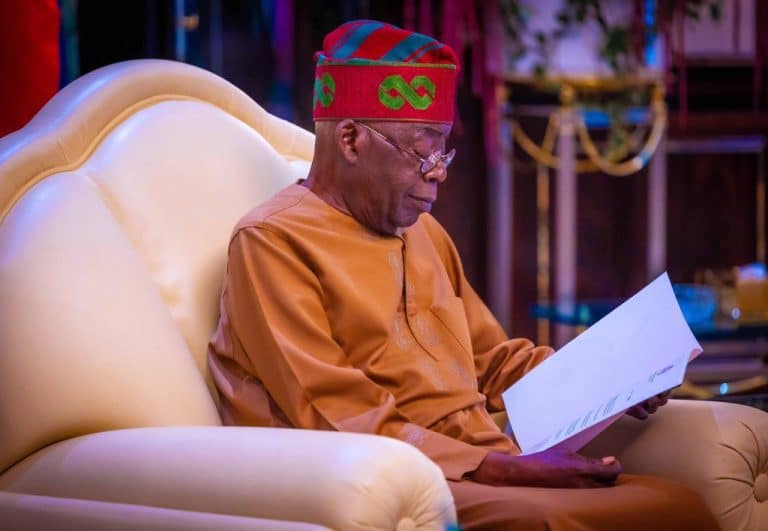

“It is a win for Oando and every indigenous energy player, as we take our destiny in our hands and play a pivotal role in this next phase of the nation’s upstream evolution,” said Wale Tinubu, Oando’s CEO.

READ ALSO: Oando denies ownership in Maltese oil storage, blending plant

“With our assumption of the role of operator, our immediate focus is on optimising the assets’ immense potential, advancing production, and contributing to our strategic objectives,” he added.

The deal excludes Eni’s 5 per cent participating interest in SPDC (Shell Production Development Company Joint Venture), Eni said in a website statement.

The Italian oil firm said it would continue to operate in Nigeria via investment in deep-water projects and Nigeria LNG while exploring fresh opportunities related to the agri-feedstock sector.

Oando has returned 314 per cent since the start of the year, making it Nigeria’s second-best-performing stock.

Support PREMIUM TIMES' journalism of integrity and credibility

At Premium Times, we firmly believe in the importance of high-quality journalism. Recognizing that not everyone can afford costly news subscriptions, we are dedicated to delivering meticulously researched, fact-checked news that remains freely accessible to all.

Whether you turn to Premium Times for daily updates, in-depth investigations into pressing national issues, or entertaining trending stories, we value your readership.

It’s essential to acknowledge that news production incurs expenses, and we take pride in never placing our stories behind a prohibitive paywall.

Would you consider supporting us with a modest contribution on a monthly basis to help maintain our commitment to free, accessible news?

TEXT AD: Call Willie - +2348098788999

English (US) ·

English (US) ·