•It will compromise compulsory insurance enforcement, ex-NAICOM kicks

Stakeholders in the insurance industry said granting operational licence to the Nigeria Police Force (NPF) will compromise enforcement of the six compulsory insurance products in the market.

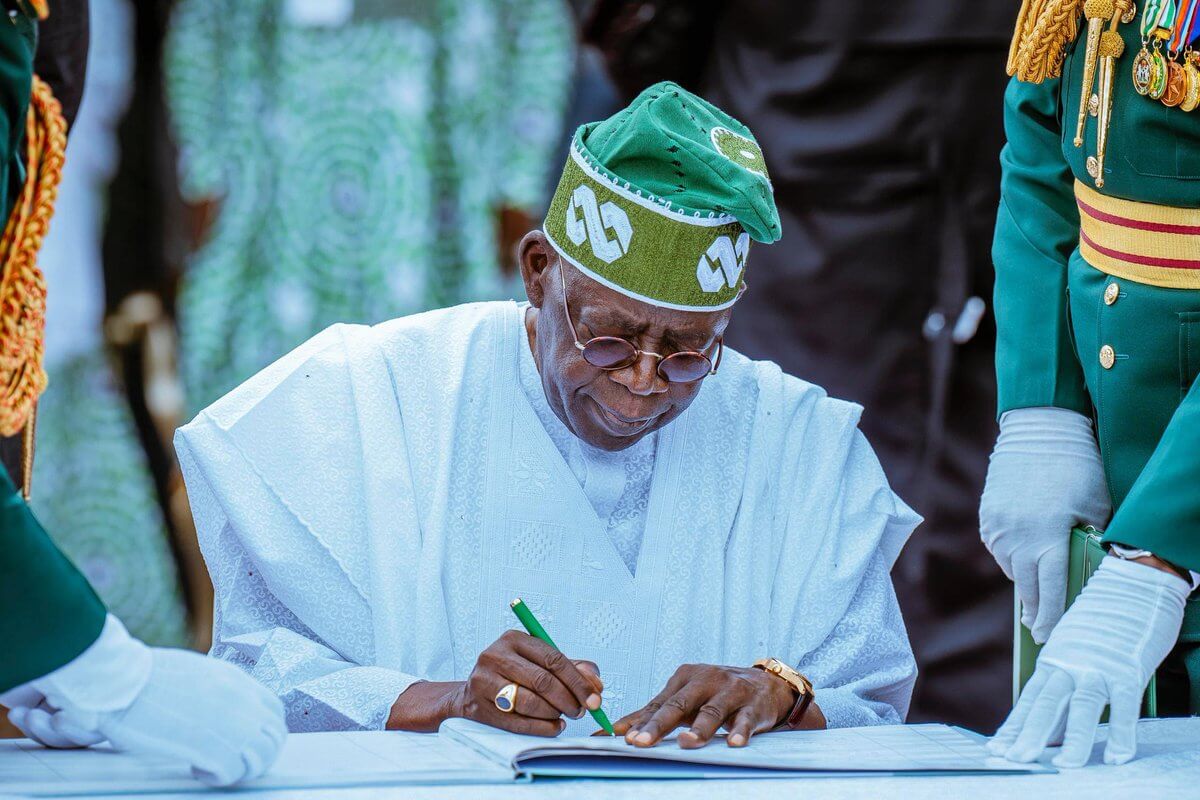

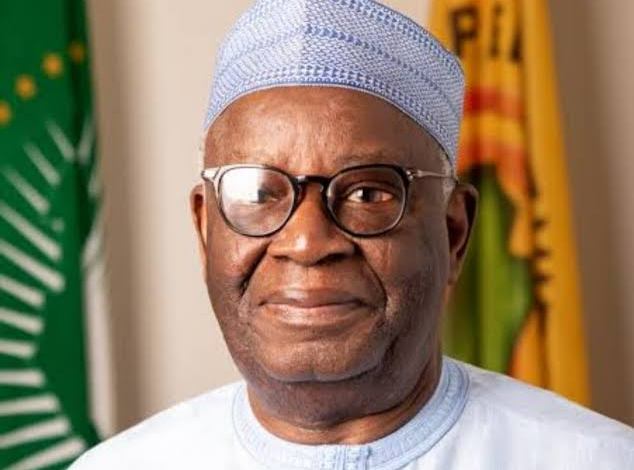

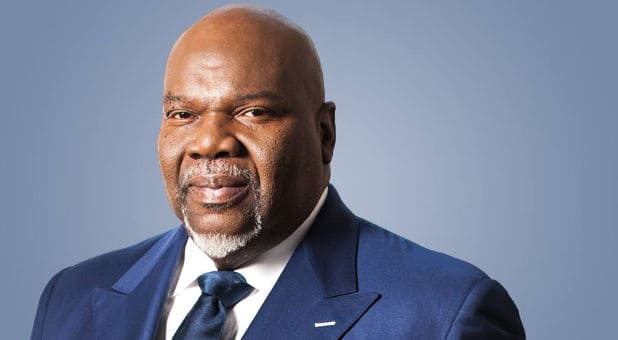

Speaking to this in a letter sent to the National Insurance Commission (NAICOM) and seen by The Guardian, a former Commissioner for Insurance, Mohammed Kari, who currently occupies a traditional stool as the Wazirin Bauchi, advised the commission that, if the NPF Insurance Company Limited is granted an operational licence, there could be a compromise in the management and enforcement of compulsory insurance policies.

Kari noted that the authoritative nature of the police and their potential representation on the Board of Directors of the insurance firm could lead to undue interference in the management of the insurance company, compromising its independence and effectiveness.

The ex-insurance practitioner said the core operations of the NPF are fundamentally at odds with commercial activities.

According to him, the primary mandate of the Police is to maintain law and order, not to engage in business ventures.

He said allowing the Police to operate an insurance firm could lead to conflicts of interest and distract from their essential duties.

“The Police are a regulator of sorts; they cannot enforce the law on compulsory insurance and be a provider of insurance. The temptation to force motorists to take their company’s policy will be irresistible,” he said.

The structure and ownership requirements stipulated by Nigerian insurance laws and the Financial Reporting Council (FRC), he said, necessitate a level of expertise that is currently lacking in the nominated Board of Directors of the proposed insurer.

“Another requirement is a spread in ownership to avoid undue influence on the company by one shareholder. The NPF Investments have a history of mismanagement, as evidenced by the numerous issues surrounding the Nigeria Police Pension Scheme. This history raises significant doubts about the ability of the Police to effectively manage an insurance company, which requires a high level of expertise and know-how,” he added.

Kari said the entry of the Nigeria Police into the insurance market could disrupt the existing ecosystem, leading to inefficiencies and potential data loss that could harm the overall industry.

He noted: “In case they are floating the idea of a captive, I don’t believe the Force has enough business spread or expertise to support the survival of a captive company nor do they have the reputation to attract independent business. This would expose public funds to unwarranted loss.

“The command-and-control nature of the force would make them take offense of caution by a regulator. I don’t see how the Police can operate under someone’s regulation, for they would not accept commercial directives or observe regulatory control. It would compromise the authority of the regulator if one company is seen to ignore regulatory control or out rightly disregard them, the regulator would lose his authority to regulate the market.”

NAICOM, through an advertorial in some national dailies newspapers, disclosed that it had received an application from the NPF Insurance Company Limited for registration to transact insurance business in Nigeria. It requested the public to submit/report any objection or otherwise against the registration to it within 21 days from the date of the publication.

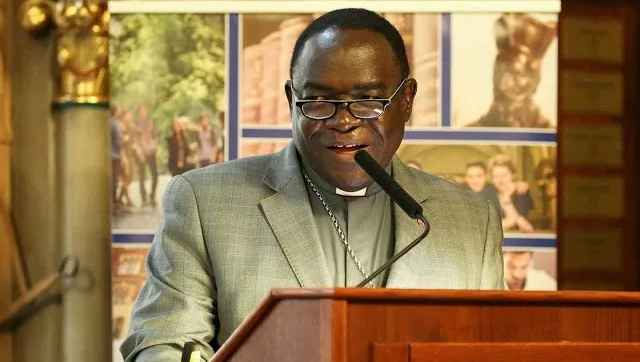

Also speaking on the development, a risk management expert and former president of RIMSON, Ray Akalonu, advised the Police to refrain from entering the insurance business.

Akalonu said that the Police’s failure to manage the Nigeria Police Microfinance Bank efficiently is an indication of their limited capacity for risk management.

3 months ago

40

3 months ago

40

English (US) ·

English (US) ·