- Former Nigerian Vice President Atiku Abubakar has urged the immediate listing of the Nigerian National Petroleum Corporation Limited (NNPCL) on the stock exchange

- Atiku criticized the NNPCL for continuing to act as a financial tool for the Federal Government while pretending to be a private entity

- He also highlighted the failures of previous refinery management deals due to a lack of transparency and investor attraction

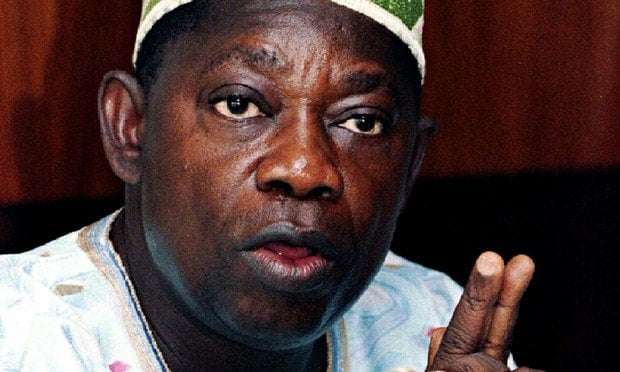

Former Nigerian Vice President Atiku Abubakar has called for the urgent listing of the Nigerian National Petroleum Corporation Limited (NNPCL) on the stock exchange, by the Petroleum Industry Act.

Atiku made this demand in response to the NNPCL's decision to transfer the management and operation of the Warri and Kaduna refineries to private entities.

Source: Twitter

He said:

“The NNPCL is supposed to have been listed on the stock exchange in line with the Petroleum Industry Act.PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

"This would make the company more profitable and enhance transparency and corporate governance.“Currently, the NNPCL claims to be private, but this is only a ruse to fool the feeble-minded because it remains the ATM of the Federal Government. "Anything short of listing the NNPCL on the stock exchange is nothing but a cosmetic development."He also argued that NNPC Limited is shielding the Tinubu administration’s inconsistent policies on subsidy payments, casting doubt on the independence that the Petroleum Industry Act mandates for NNPC Limited as a private entity.

The former Vice President and Peoples Democratic Party (PDP) Presidential candidate noted that previous arrangements and concessions had failed due to a lack of transparency in the contract award process and the government's inability to attract investors, The Punch reported.

He emphasized that for any such deal to be successful, the Bureau of Public Enterprises (BPE) and a reputable technical partner, such as Standard and Poor’s, must be involved in the process, Premium Times reported.

Group demands probe of Mele Kyari, other oil sector players

Earlier, Legit.ng reported that A rights organization, the Centre for Human Rights in Africa, has urged Adeola Ajayi, the newly appointed Director-General of the Department of State Services (DSS), to investigate the activities of Mele Kyari, Group Managing Director of the Nigerian National Petroleum Company Limited (NNPC), along with other senior officials in the oil sector.

In a letter signed by Princess Caroline Obi, the group alleged that Kyari, along with Gbenga Olu Komolafe, CEO of the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), and Farouk Ahmed, CEO of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), have engaged in activities detrimental to the growth and development of Nigeria's oil industry.

Source: Legit.ng

English (US) ·

English (US) ·