Security and Exchange Commission (SEC)

The Security and Exchange Commission has granted an approval-in-principle to DreamCity Capital, a digital real estate investment platform in Nigeria.

“Approval in Principle” is a preliminary approval granted by a regulatory body, indicating that a proposal or application is acceptable in principle, subject to certain conditions or further requirements.

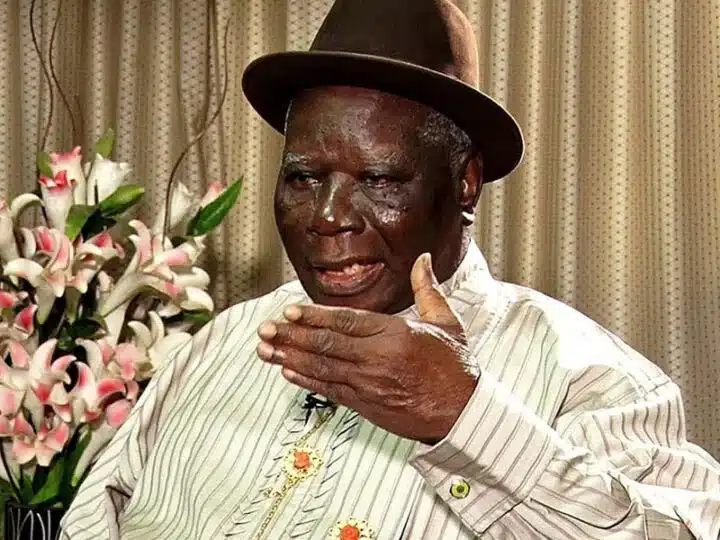

In a press statement on Friday, the Chief Executive Officer and Managing Director of DreamCity Group, Benjamin Akhamere, expressed his excitement about the approval.

According to Akhamere, the approval, granted under the Accelerated Regulatory Incubation Programme, marks a milestone for DreamCity Capital, solidifying its position as a key player in Nigeria’s emerging digital asset offering platform ecosystem.

“DreamCity Capital aims to revolutionise real estate investing by providing equity investment offerings for small and medium retail investors through digital technology,” he said.

He remarked that the innovative platform allowed investors to acquire equity ownership in pre-vetted, funded, and greenfield commercially driven real estate projects.

He explained the unique features of the platform, stating, “Our model individualises investment offerings, streamlines stake-ownership, and ensures transparent administration of the individual real estate asset.”

According to Akhamere, this is achieved through a special purpose company framework, which warehouses investor equity and assets.

“The platform offers a secure and efficient model for real estate investing,” he added.

The approval from the SEC is seen as part of the commission’s broader effort to foster innovation within Nigeria’s capital market while ensuring robust investor protection.

Akhamere mentioned, “DreamCity Capital’s inclusion in this programme underscores our commitment to adhering to regulatory standards while driving innovation in the real estate sector.”

3 months ago

32

3 months ago

32

English (US) ·

English (US) ·