Security and Exchange Commission.

The Securities and Exchange Commission has revealed plans to make it easier for smaller firms to access funds.

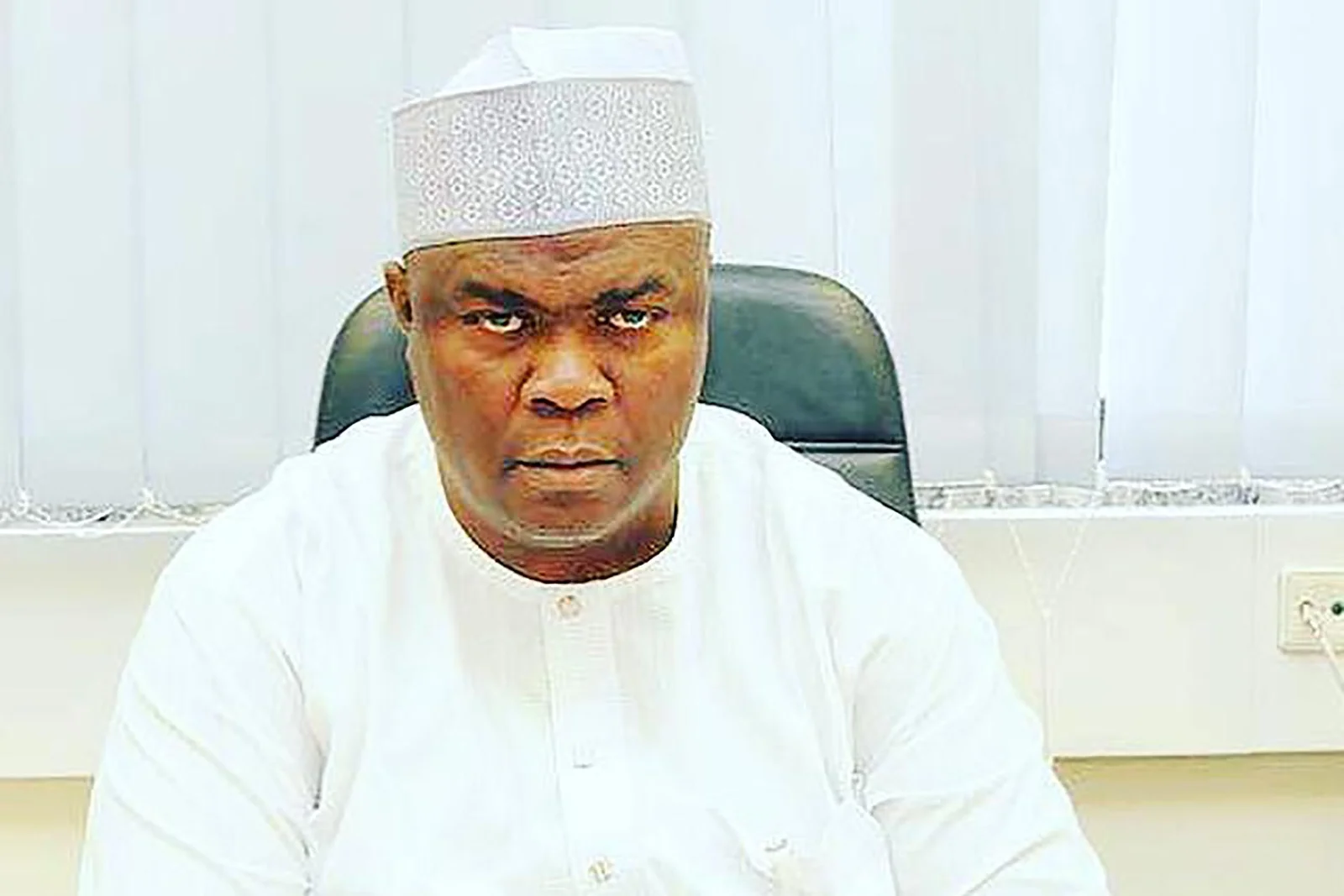

According to a Bloomberg report on Wednesday, the Director General of SEC, Dr Emomotimi Agama, said this in an interview.

The SEC boss described crowdfunding as an online money-raising strategy that began as a way for the public to donate small amounts of money, often through social networking websites, to help artists, musicians, filmmakers and other creative people finance their projects.

According to Agama, the concept has recently been promoted as a way of assisting small businesses and start-ups looking for investment capital to help get their business ventures off the ground.

The regulations for the registration and operation of crowdfunding platforms and intermediaries released in 2021 by the regulator detail the regulatory framework by which companies could raise debt or equity capital through crowdfunding, as well as the eligibility criteria and obligations of issuers, crowdfunding portals and crowdfunding intermediaries.

Under the regulation, all MSMEs incorporated as a company in Nigeria with a minimum of two years’ operating track record are eligible to raise funds through a crowdfunding portal registered by the commission, in exchange for the issuance of shares, bonds/debentures, simple investment contracts or such other investment instrument as the SEC may determine from time to time.

In addition to detailing the crowdfunding process, the rules provide for the major participants/channels in the crowdfunding space, as follows: the Crowdfunding Portal, the Crowdfunding Intermediary, the Issuer and the Investor.

Also, the rules said that “the aggregate amount of investment instruments that can be

offered and sold by the fundraiser within 12 months shall comply with the following limits: i. The maximum amount which may be raised by a medium enterprise shall not exceed N100m; ii. the maximum amount which may be raised by a small enterprise shall not exceed N70m; iii. the maximum amount which may be raised by a micro-enterprise shall not exceed N50m”.

Agama said limits on the amount that could be raised were also seen as a constraint.

He said, “We are actually taking a new look to make it a little bit easier for people to come in.”

He added that the ceiling may be raised for firms “on a case-by-case basis”.

This move is coming amid a high interest rate environment, with the benchmark interest rate currently at 27.25 per cent.

The SEC DG hinted that the move would lead to new draft rules, which might be released as early as the first quarter of 2025.

2 hours ago

24

2 hours ago

24

English (US) ·

English (US) ·