As the economy worsens, more Nigerians turn to banks and other financial institutions for soft loans.

In response, banks have created various loan products, making it easier for Nigerians to access household and business loans.

Legit.ng analysis of commercial banks financial reports released on the Nigerian Exchange, ten banks, as of the end of March 2024, have disbursed N57.73 trillion to their customers.

The amount represents a 28.25% or 1.27 trillion increase compared to N45.01 trillion reported in December 2023.

Source: Getty Images

The banks surveyed are First Bank Holding Company, Access Holding Company, Zenith Bank, Guaranty Trust Holding Company (GTCO), United Bank for Africa (UBA), First City Monument Bank (FCMB), Fidelity Bank, Stanbic IBTC Bank, Sterling Bank, and Ecobank

Breakdown of the loans

Access Bank, Zenith Bank, and FBN Holdings gave out the highest loans and advances among the banks surveyed.

Access Bank- (N9.62 trillion)

Access Bank Holding, the parent company of Access Bank, reports that its loan book stood at N9.62 trillion at the end of March 2024.

This represents a 19.74% increase within three months compared to the N8.03 trillion total loan and customer advances as of December 2023.

Zenith Bank- (N8.65 trillion)

Zenith Bank has the second-highest loan and advances to customers among the banks surveyed, with NN8.65 trillion at the end of March 2024.

This is a massive increase of 31.97% from the N6.55 trillion loans to customers stood in December 2023.

FBN Holdings- (N8.42 trillion)

FBN Holdings Plc, the parent company of First Bank Nigeria, revealed that its customer loan and advances stood at N8.42 trillion as of the end of March 2024, marking a 32.51% increase from N6.135 trillion reported in December 2023.

Other banks' total loans and advances to customers as of March 2024

- UBA: N7.29 trillion

- Fidelity Bank: N3.75 trillion

- Ecobank: N3.10 trillion

- Guaranty Trust Bank: N3.02 trillion

- FCMB: N2.22 trillion

- Stanbic: N2.16 trillion

- Sterling Bank: N1.06 trillion

Nigerian banks adjust rate for loan

Earlier, Legit.ng reported that after the CBN raised the benchmark interest rate, banks repriced their assets, meaning customers would have to pay more for borrowing money.

As a result, the cost of loans, mortgages, and other credit products has increased.

Source: Legit.ng

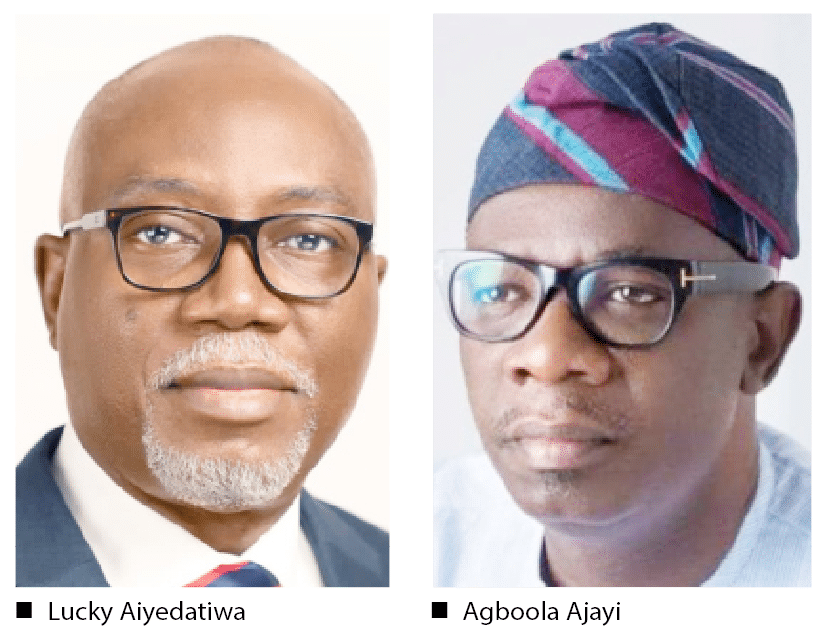

![[Live Updates] #OndoDecides2024: APC’s Aiyedatiwa Wins Ondo State Gubernatorial Election [Final Result]](https://www.naijanews.com/wp-content/uploads/2024/11/Ondo-Election-Results-1024x576.png)

English (US) ·

English (US) ·