- The Central Bank of Nigeria (CBN) has decided to reinstate Eyowo banking licence, months after revocation

- The fintech company faced setbacks in 2023 after the CBN revoked its license alongside that of 172 microfinance banks

- Having satisfied all CBN requirements, Eyowo will now be allowed to resume digital banking services

Legit.ng journalist Dave Ibemere has over a decade of business journalism experience with in-depth knowledge of the Nigerian economy, stocks, and general market trends.

Eyowo, a popular digital bank, a Nigerian fintech company, has had its license fully reinstated by the Central Bank of Nigeria (CBN).

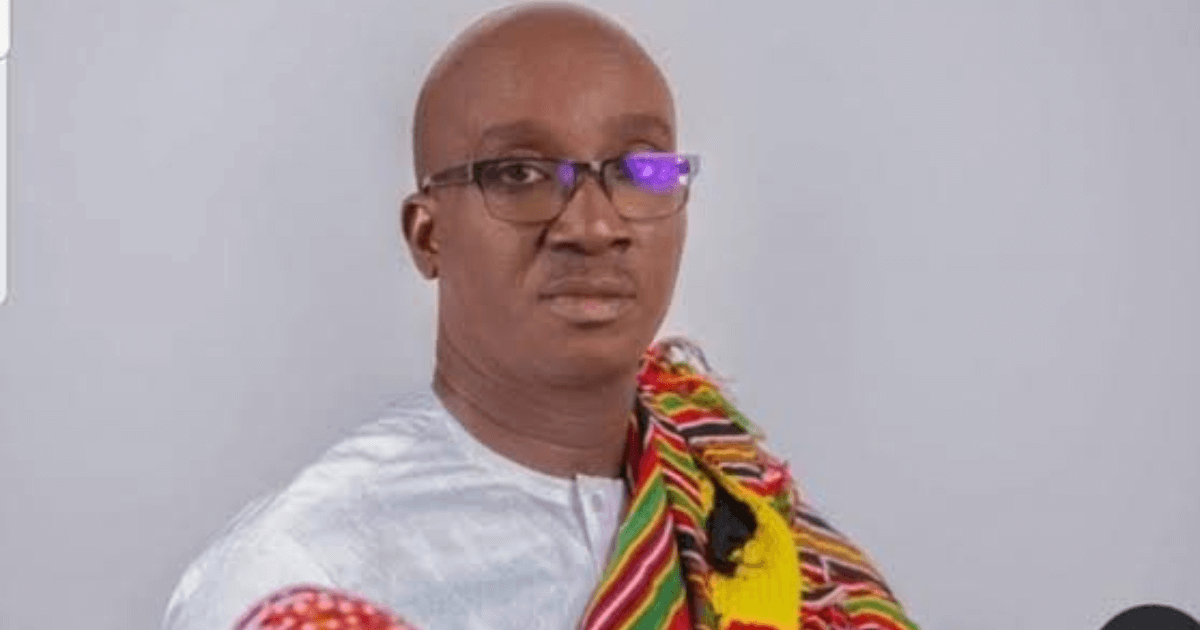

This was disclosed by the Yomi Adedeji, Co-Chief Executive Officer of Eyowo in a message posted on its X account.

Nigerian Bank to resume operation after months of suspension

Photo credit: Pius Utomi Ekpei

Nigerian Bank to resume operation after months of suspension

Photo credit: Pius Utomi EkpeiSource: Getty Images

Legit.ng had earlier reported that the CBN had, on March 23, 2023, withdrawn the microfinance licence of Eyowo and 46 other companies.

The apex bank followed with a list of another 132 microfinance banks, finance companies, and mortgage banks, whose licences were also revoked.

In a statement published, CBN explained the licences of the banks were revoked because they had either remained inactive, insolvent, failed to render returns, closed shop, or ceased to carry on the type of banking business for which they were licensed for more than six (6) months.

Eyowo makes a comeback

In March 2024, Eyowo announced that its Microfinance licence was restored by the CBN with approval in principle after meeting the regulatory requirements.

The company ensured customer access to funds through a partnership with ProvidusBank, enhancing safety, fraud prevention, and regulatory compliance.

The latest development is now a full license.

In his post Eyowo CEO, Yomi Adedeji' wrote:

"Hi Everyone, just to let you all know, we have our full and final license back for @eyowo from the @cenbank of Nigeria. "We will share details over the next few weeks. Impossible is nothing! Thank you, and cheers to it for us this weekend."This reinstatement now allows Eyowo to resume offering its products including digital banking, payment solutions, and financial management tools tailored for individuals and businesses

CBN revokes licenses of over 170 Microfinance Banks, finance companies

Legit.ng reported that the CBN had revoked the licenses of 179 microfinance banks, four primary mortgage banks, and three finance companies nationwide.

The announcement was made in the official gazette of the Federal Government, which was published on the CBN's website on Tuesday, May 23, 2023.

According to the gazette, these financial institutions had their licenses revoked due to several reasons.

Source: Legit.ng

English (US) ·

English (US) ·