The Socio-Economic Rights and Accountability Project (SERAP) has called on Nigeria’s 36 state governors and the Minister of the Federal Capital Territory (FCT), Mr. Nyesom Wike, to provide comprehensive details regarding their debts and liabilities.

In a recent appeal, SERAP urged the governors and the FCT minister to disclose information about any Chinese loans and other external borrowings guaranteed by the Federal Government. Specifically, they are requested to reveal the terms and conditions of such borrowings, including collateral provisions, repayment obligations, interest rates, and any defaults or debt restructurings.

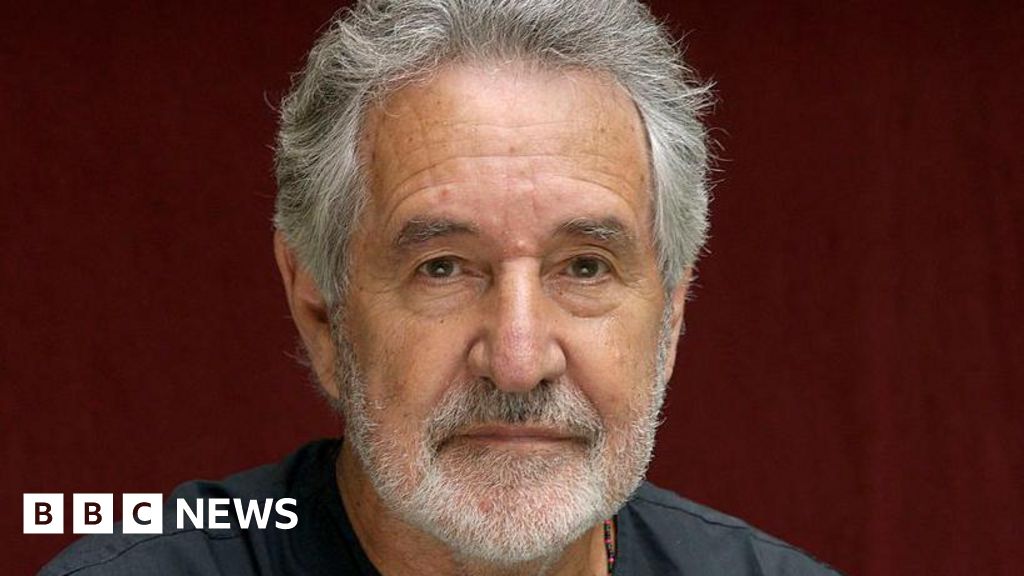

SERAP’s letter, dated August 24, 2024, and signed by Deputy Director Kolawole Oluwadare, noted concerns over the potential mismanagement of debt obligations. The organisation is particularly focused on the efficiency of debt management, especially in relation to external debt and investment obligations.

The letter stated: “We are concerned that your state and the FCT may have failed to efficiently manage your debt obligations, especially your external debt and investment obligations, as guaranteed by the Federal Government. The failure to uphold your obligations is contrary to Section 6 of the Debt Management Office Establishment (etc.) Act and creates financial risks and other exposures to Nigeria regarding these Chinese loans, liabilities, and other external borrowings.”

SERAP also requested clarity on any investment agreements with Chinese companies and the repayment histories of loans and facilities obtained from China and other external creditors. The organisation expressed concern over the significant risks of defaults and potential asset confiscations by foreign creditors due to alleged non-compliance with borrowing terms.

The letters further stressed the urgency of addressing these issues, stating: “We would be grateful if the recommended measures are taken within 7 days of the receipt and/or publication of this letter. If we have not heard from you by then, SERAP shall consider appropriate legal actions to compel your government and the FCT to comply with our request in the public interest.”

SERAP also referenced a recent National Bureau of Statistics (NBS) report indicating that over 133 million Nigerians are living in various forms of poverty, with a majority being women and children. The organisation expressed deep concern over the alleged mismanagement of public funds by state and FCT authorities.

Additionally, SERAP requested the disclosure of spending details for the Chinese loans, investment obligations, and external borrowings, including project details, implementation status, and completion reports.

The organisation pointed out that Nigeria’s total public debt, including external and domestic debts, rose significantly from ₦97.34 trillion ($108.23 billion) in December 2023 to ₦121.67 trillion ($91.46 billion) by March 31, 2024. This debt encompasses loans obtained by the Federal Government, the 36 state governments, and the FCT.

SERAP also noted that the World Bank has approved several loans for Nigeria’s states, including a recent $750 million credit line for state reforms and job creation, and a $1.5 billion loan for social protection and COVID-19 response.

The letter read in part: “It said, “We urge you to disclose the spending details of these Chinese loans, investment obligations and external borrowing, including details of and locations of projects as well as the implementation status and completion reports, if any, on the projects.

“According to Nigeria’s Debt Management Office, the total external debt for Ogun State is N168,833,006.66 as at December 31, 2023. The total public debt portfolio for the country’s 36 states and the Federal Capital Territory is N9.17 trillion.

“Nigeria’s total public debt stock, including external and domestic debts, increased by ₦24.33 trillion in three months alone, from ₦97.34 trillion ($108.23 billion) in December 2023 to ₦121.67 trillion ($91.46 billion) as of March 31, 2024. The debt represents external and domestic loans obtained by the Federal Government, the 36 state governments and the FCT.

“SERAP notes that the World Bank has approved several loans and other funding facilities to the country’s 36 states including the recent $750 million credit line meant to the states to carry out reforms to attract investment and create jobs.

“The World Bank on 15 December 2020 approved a $1.5 billion loan for Nigeria’s 36 states and the FCT for social protection and strengthened state-level COVID-19 response. The loan aims to help the states build a resilient recovery post-COVID19 and to reduce poverty.”

3 months ago

54

3 months ago

54

English (US) ·

English (US) ·