The Chief Executive Officer of Economic Associates, Dr Ayo Teriba, and other economists have called for the securitisation of Nigeria’s N41tn assets to boost the financial resources available to the Federal Government.

Securitisation is a financial process that involves pooling assets into interest-bearing securities, which are then sold to investors. The investors receive the interest and principal payments from the assets.

The economists made the call at the 13th Annual Conference of the Institute of Capital Market Registrars in Lagos on Saturday under the theme, ‘Enhancing Financial Stability in the Nigerian Economy: Strategic Role of the Capital Market in Wealth Creation.’

The Central Bank of Nigeria statistical bulletin for Q2 2024, published recently, spotlighted the country’s fiscal position. According to the data from the report, FG’s fiscal deficit worsened to N4.3tn from N4.2tn in Q1 2024 (Q2 2023: N2.6tn) – marking the largest quarterly deficit on record.

For context, fiscal deficit defines the situation in which the government spends more than it generates in revenue. Cumulatively, the fiscal deficit grossed N8.4tn in H1 2024 compared to N6.9tn in FY 2023, and this translates to a 4.8 per cent outrun on the pro-rata N7.7tn estimated deficit for the period (2024 budgeted expenditure plus supplementary: N35tn, estimated revenue: N19.6tn, deficit: N15.4tn).

As of last year, the Managing Director/ Chief Executive Officer of the Ministry of Finance Incorporated, Dr Armstrong Takang, revealed that Nigeria’s assets were worth N18tn with a target of achieving a N100tn assets base in the next 10 years.

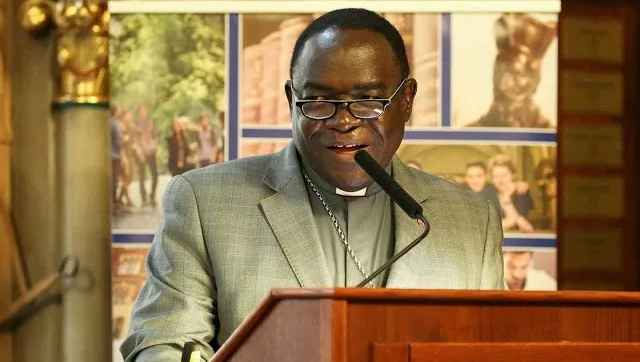

Speaking on the topic, ‘Balancing Innovation and Regulation for Financial Stability in an Era of Market Transformation,’ Teriba asserted that securitisation of national assets, which according to him had now grown to N41tn, would boost the fiscal position of the country and cited examples from across the globe.

He said, “The trouble with debt issue or income securitisation is that in periods of windfalls where your income is growing, it is good, but in a period of shortfalls as we have been for the past decade, it becomes a debt trap because debt security is a promissory note not attached to any asset but against expected income. When the income disappoints, then the debt burden rises, then you begin to struggle, and even say that the available revenue is not enough to pay interest. We have had that repeatedly in the fiscal conversation of the Federal Government.

“The way out is to look for assets that you can securitise and for one decade, the FG has yet to securitise any asset. It is a puzzle. Since 2016, I have been engaged with the then Vice President, with the president. Ultimately, the things we told them led to the reconstitution of MOFI. So, it wasn’t as if they didn’t buy the idea. It led to the creation of a national asset register and MOFI now has a list.

“The last time I met the MD of MOFI at a governance conference, he said the assets were worth N41tn. When is the first one of those going to be securitised? The biggest assets in Nigeria are collectively owned. The parallel example is that since 2015 and 2016, Saudi Arabia, Brazil, and India have bullishly gone to enact laws that enable them to refocus their national financial strategy on asset securitisation. Each of them has a digital portal where they have listed assets. The minimum assets listed by Saudi Arabia is 200 projects including Aramco which is now worth $2tn. Before 2016, I don’t think the Saudi government had any assets listed, it was this income shortfall that pushed them.”

Teriba noted that Aramco was not securitised abroad but in Saudi, stressing that “ours doesn’t have to be so big as to be mind-boggling. Even the Nigerian LNG project is not listed in any market. The aspect of it that FG has been trying to securitise is the dividend; the income statement. The Nigerian government can be financially comfortable like Saudi, Brazil, and India if we did just a fraction of what those countries have done over the past eight years that has attracted over $500bn in FDI between 2015 and now.

“India listed 15,000 assets on its India investment creed and Brazil lists more than 10,000 assets on its partnership for private investment. India was celebrating recently when the stock market hit a milestone. It is similar to the way MOFI has started but they (India, S’Arabia, Brazil) are consummating the deals.”

Adding to the point raised, the Director-General of the Securities and Exchange Commission, Dr Emomotimi Agama, posited that “Securitisation of assets frees debt capital. Once you can raise money from the assets that you have, then the assets come alive. It is a matter of using what we have to get what we want.”

Agama, who was the keynote speaker at the event added, “We are saying the Federal Government has a lot of assets, how do we use those assets to get money to do more things? For me, securitisation is perfect in dealing with the debt capital that we have in this country to increase the amount of money that is available for production and other infrastructure.”

Also supporting the argument was the Chief Executive Director of the Nigerian Exchange Limited, Jude Chiemeka, who said, “I think the capital market has done very well in the last couple of years in the Nigerian economy. I couldn’t, but I agree with Dr Ayo Teriba that what the country needs to do now is to begin to securitise assets.

“We’ve been doing a lot of borrowing, and the argument has always been that the debt to GDP ratio is within the manageable essence, the servicing or the debt is well set out. But for us to really achieve that level of financial stability, we need a lot more collaboration with the international community. One of the easiest ways is the securitisation of assets.”

In his welcome address, the President/Chairman of Council of ICMR, Seyi Owoturo, highlighted the challenges facing the Nigerian economy and the need for economic stability.

He said, “This year, the Nigerian economy is expected to gradually pick up and deliver approximately three per cent real growth. Inflation is expected to remain elevated in the medium term, whilst forex exchange volatility remains a major pain point given the FX supply bottlenecks. In the year 2023, the new administration in Nigeria implemented some pro-market reforms which appear to be tilting the balance of the economy in the direction of a private sector- growth model.

“Specifically, the twin reforms of fuel subsidy removal and exchange rate unification caused a sharp depreciation of the naira. The depreciation in naira provoked inflationary pressures and led to a more restrictive interest rate environment that weighed on growth. Furthermore, the country also experienced problems of FX illiquidity and loss of investor confidence. Consequently, Nigeria needs financial stability, economic growth and restoration of confidence in our economy. Based on the above, the key objectives of this conference are to assess the current national economic landscape; identify key challenges facing financial stability, propose policy recommendations and suggest actionable policy measures to enhance financial stability.”

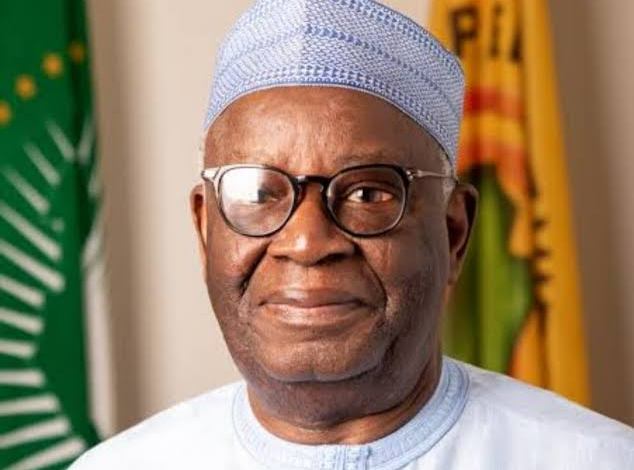

The event also saw honorary fellowship of the institute being bestowed on the SEC DG, NGX Group chairman, Umaru Kwairanga, Senate Committee Chairman on Capital Markets, Osita Izunaso and Ariyo Olushekun.

Other fellows included the Chairman/CEO of the Investment and Securities Commission, Amos Azi, the Managing Director/Chief Executive Officer of Central Securities Clearing System Plc, Haruna Jalo-Waziri, professor of the capital market, Uche Uwaleke, veteran journalist, Olusola Oni, among others.

2 weeks ago

31

2 weeks ago

31

English (US) ·

English (US) ·