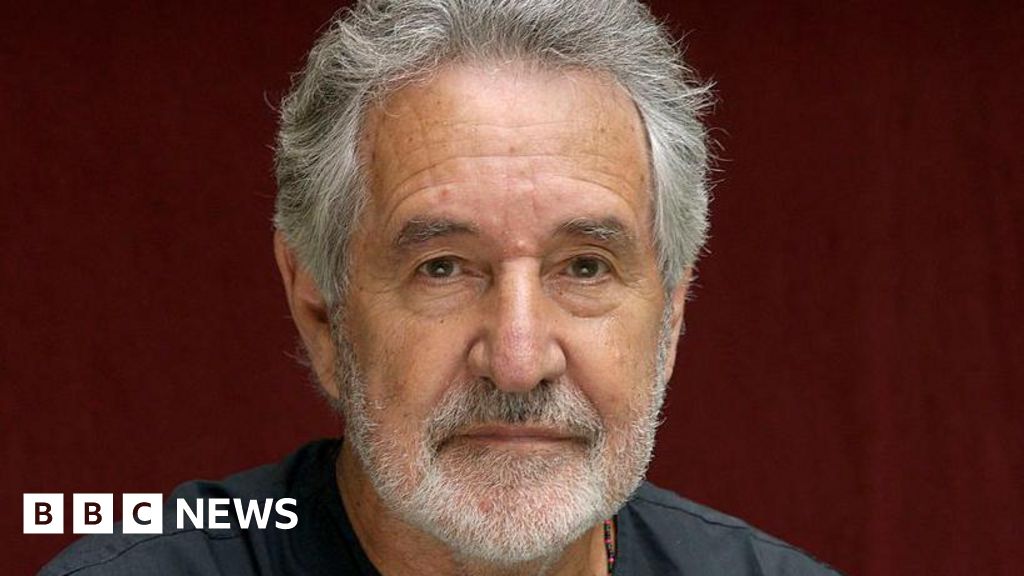

Former Deputy Senate Leader, Senator Abdul Ningi (PDP, Bauchi Central), has accused President Bola Tinubu‘s proposed tax reform bills of being discriminatory and favouring a few states, particularly Lagos, at the expense of others.

In an interview with Vanguard, Ningi alleged that the reforms, rather than addressing national issues, cater disproportionately to Lagos and two other states.

He described the bills as an attempt to exploit citizens’ silence and push through an inequitable fiscal agenda.

“The crux of the bill lies in its discriminatory nature,” Ningi emphasized.

He further criticized the President for disregarding the National Economic Council (NEC), chaired by Vice President Kashim Shettima, which had rejected the reforms.

Ningi expressed concerns that the bills were now being fast-tracked through the National Assembly despite NEC’s objections.

“It’s disturbing that, after failing to convince the NEC, the President is now attempting to push these bills through the National Assembly,” Ningi said.

The Senator highlighted the inequitable distribution of Value-Added Tax (VAT) revenues as a glaring example of the system’s flaws.

“This is not about North or South. The pains of Bauchi are no different from those of Anambra, Ebonyi, or Katsina. Lawmakers must stand united against these reforms for the sake of the country,” he said.

He explained that VAT collected in Lagos on goods sold in other states is retained in Lagos, leaving the producing states without a share of the revenue.

Ningi said, “You buy maize in Kaduna without VAT. When the maize is processed into Semovita in Lagos, VAT is collected when it is sold back in Kaduna. That VAT is returned to Lagos. Where is the fairness or ethics in this system?”

He also pointed to similar disparities in revenue allocation from petrol sales and airtime purchases, which benefit the locations of company headquarters rather than the states where the products are consumed.

Ningi called for a complete overhaul of Nigeria’s fiscal structure, proposing a system where resource-producing communities retain their earnings and pay taxes to the federal government.

“If these bills pass through the National Assembly, there will be consequences. Many will pay the price for their indifference, lack of patriotism, and outright unresponsiveness,” Ningi warned.

The bills, which include the Nigeria Tax Bill 2024 and the Tax Administration Bill, among others, were transmitted to the legislature following recommendations by the Presidential Committee on Fiscal and Tax Reforms, chaired by Taiwo Oyedele.

The Tax Reform Bills have faced pushback from some state governors, particularly from the northern region, who argue that the proposed derivation-based VAT distribution model would disproportionately disadvantage their states.

2 hours ago

25

2 hours ago

25

English (US) ·

English (US) ·